One of the most eyecatching political reports of the weekend was squirrelled away on page 16 (£) of the Sunday Times. It’s worth clipping out for the scrapbook, even now. In

it, Marie Woolf reveals some of the fiscal sweeteners that Osborne might sprinkle into the Budget. There are two particularly noteworthy passages:

One of the most eyecatching political reports of the weekend was squirrelled away on page 16 (£) of the Sunday Times. It’s worth clipping out for the scrapbook, even now. In

it, Marie Woolf reveals some of the fiscal sweeteners that Osborne might sprinkle into the Budget. There are two particularly noteworthy passages:

i) Raising the personal allowance. “The income tax threshold is already set to increase by £1,000 to £7,457 from April 1. However, Osborne is expected to raise

it by about a further £500. Details of the additional concession are still being worked on, but it marks a victory for the Liberal Democrats, who have been arguing within government for tax

cuts for the poor.”

ii) Holding off on 50p. “The Treasury admits that in addition to carrying out modelling on the effects of tax cuts for the lowest earners, it has looked at the effect of cutting

the 50p tax rate. A senior government source said: ‘Cutting the 50p rate of tax would be “toxic”. People are talking about it in the long term, of course they are. But if there is going

to be a tax cut [in the budget] it will be in the low and medium incomes.'”

The second of these needs little extra context. It’s no surprise that the Treasury is modelling the effects of cutting the 50p rate, and no more surprising that it’s unlikely to be cut this time around. Although in light of Boris’s recent exhortations, and last week’s growth figures, 50p does seem to have become a more totemic issue ahead of this Budget. More Tories seem to be wondering, out loud, whether it’s worth sticking with a measure that was always more political than economic – and what the costs are from doing so. The Taxpayers’ Alliance, in conjunction with The Spectator, has already come up with a number: that the 50p rate will lose the Exchequer £4.5 billion. I wonder whether the Treasury analysis is similar.

But the first passage has been cast into a new context by today’s news. The IFS report has drawn attention to an effect that the Resolution Foundation explained on Coffee House a few weeks ago: that the increase in the personal allowance is being offset by lowering the threshold for the higher 40p rate. So, if Osborne were to raise the personal allowance by another £500, that could mean several thousand more higher rate taxpayers, who would then face the prospect of losing their child benefits, etc. A worthwhile trade-off, perhaps – but not one without political implications, as this morning’s newspapers show.

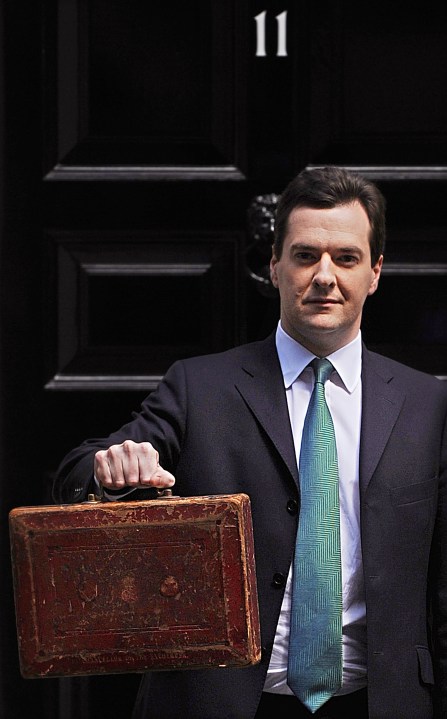

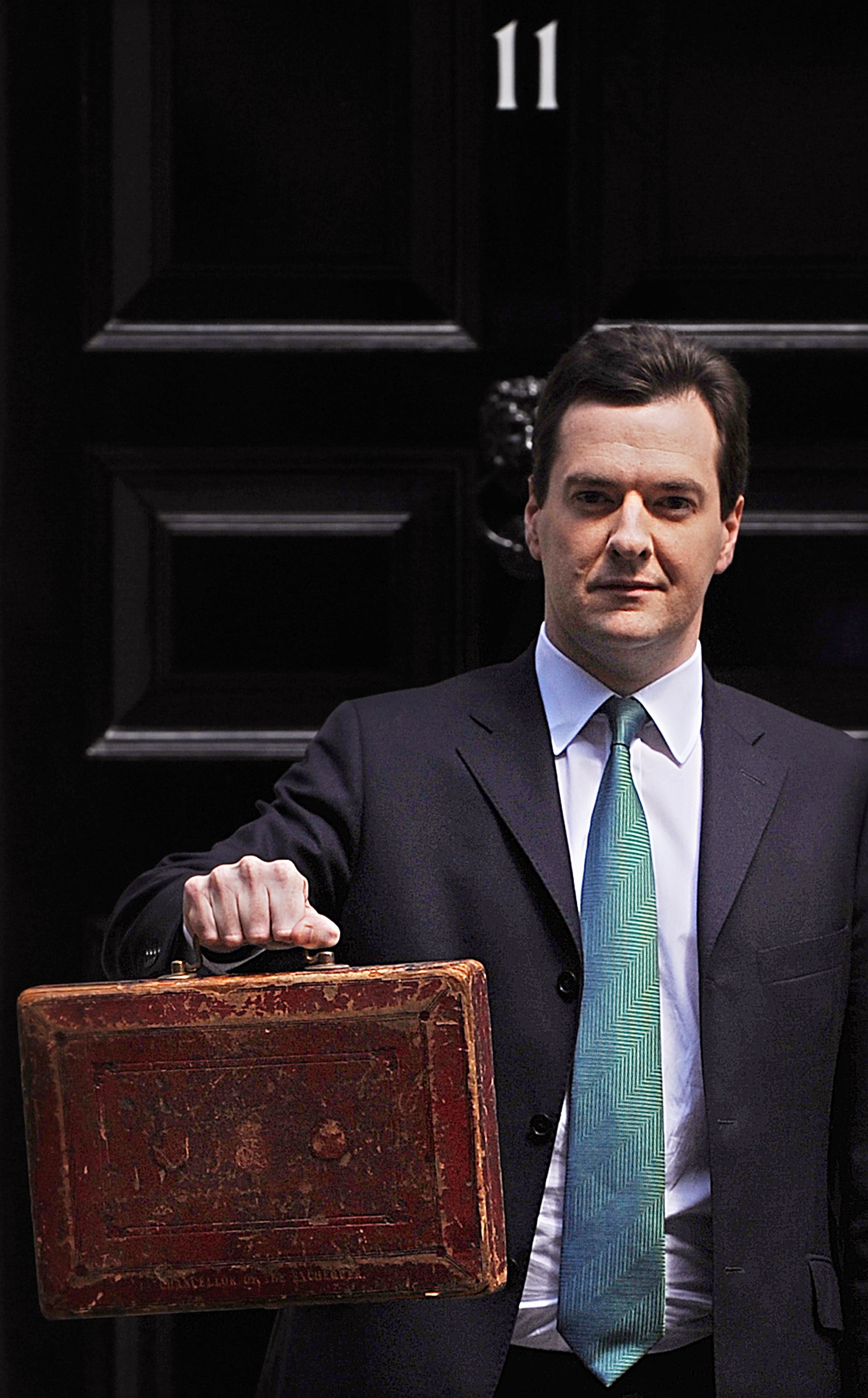

All of which captures the task that George Osborne faces ahead of March’s Budget. Very few of the obvious measures are uncomplicated, either from a fiscal or political standpoint. And those that remain won’t do much to revive our faltering economy. Hence the question: what are Osborne’s options? CoffeeHousers, your suggestions, please.

Comments