The homepage of the Washington Post has a

clock ticking down to America’s debt-ceiling deadline: four days, 14 hours, and a fast-declining number of minutes and seconds. It also has details of the events, last

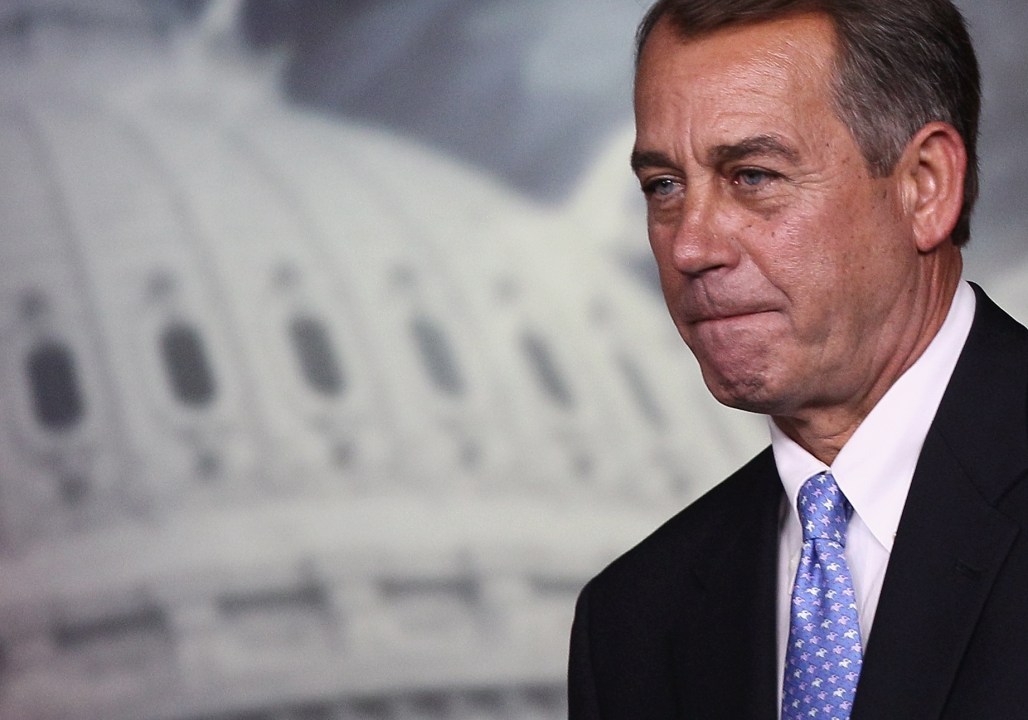

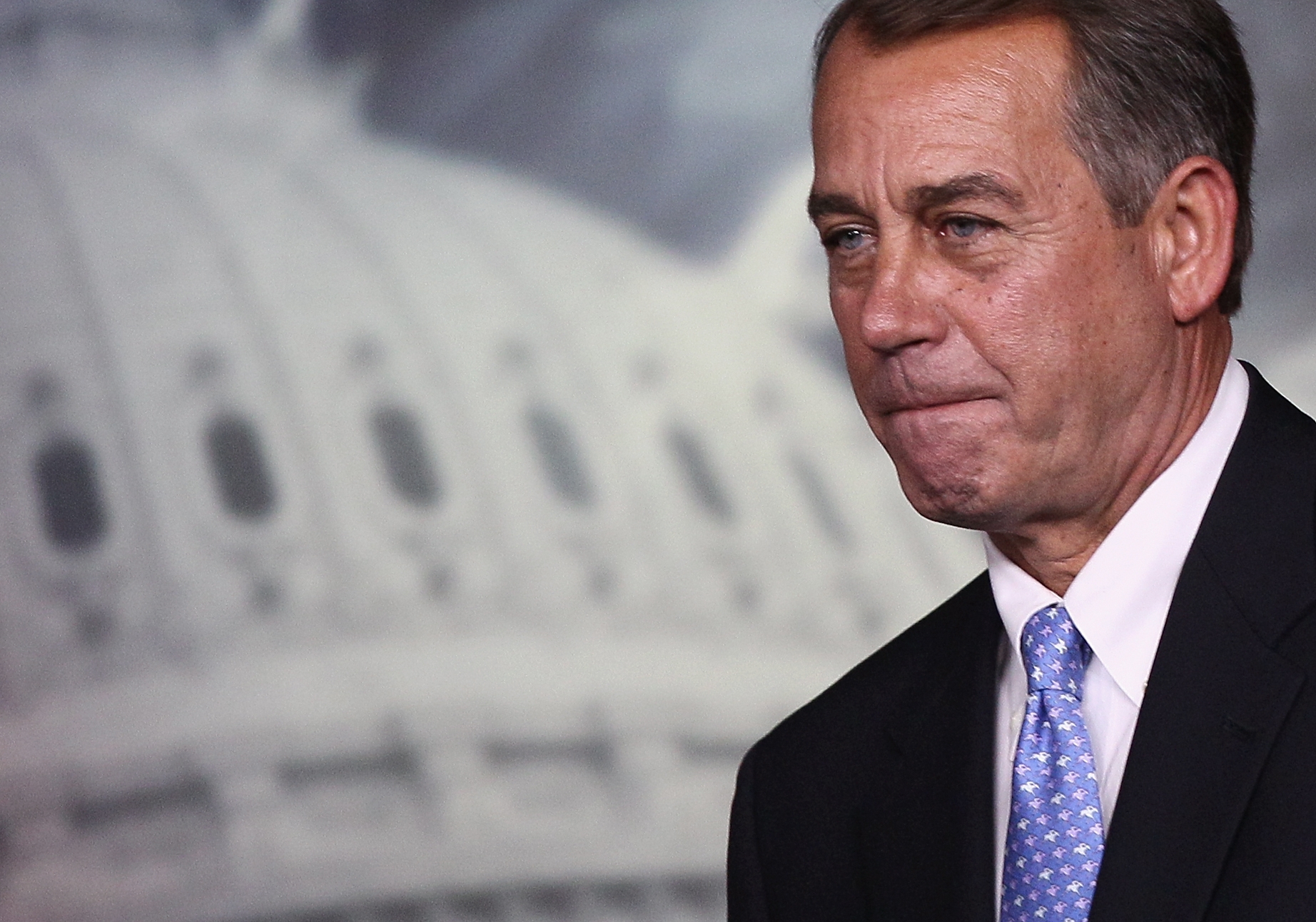

night, that upset the prospect of a deal being reached yet again. The Republican Speaker of the House of Representatives, John Boehner, had been frantically trying to corral support for a bill that

would raise the ceiling in exchange for $billions of extra spending cuts. He only needed 216 of the House’s 240 Republicans to vote with him. But it wasn’t to be. The vote was called off, postponed

until at least later today, as it became clear that Boehner couldn’t immediately persuade those in his party who want further cuts still. Even if a tweaked version of his bill passes today, it’s

likely that the Democrat majority in the Senate will kill it off anyway.

The homepage of the Washington Post has a

clock ticking down to America’s debt-ceiling deadline: four days, 14 hours, and a fast-declining number of minutes and seconds. It also has details of the events, last

night, that upset the prospect of a deal being reached yet again. The Republican Speaker of the House of Representatives, John Boehner, had been frantically trying to corral support for a bill that

would raise the ceiling in exchange for $billions of extra spending cuts. He only needed 216 of the House’s 240 Republicans to vote with him. But it wasn’t to be. The vote was called off, postponed

until at least later today, as it became clear that Boehner couldn’t immediately persuade those in his party who want further cuts still. Even if a tweaked version of his bill passes today, it’s

likely that the Democrat majority in the Senate will kill it off anyway.

The Asian markets have already quivered at the developments, and others will surely follow today. Although some are suggesting that last night’s muddle was caused less by hardline opposition to Boehner’s bill and more by Republican Representatives wanting to sleep on their decision, there is clearly more uncertainty now that a deal will be reached in time. And uncertainty, too, that any deal will have the necessary heft to persuade the credit rating agencies. Indeed, a report released by Citi yesterday suggested that there is an 83 per cent likelihood that both a deal will be reached and the US sovereign long-term rating is still downgraded to AA.

But what if there is a default? That same Citi report puts it at 5 per cent likelihood — and also describes the possible outcome. Their analysis lapses into some dry technicalities, but I

thought CoffeeHousers might care to see it anyway. I’ve put some of the most striking points in bold:

“Under this scenario, there is no bipartisan agreement for any fiscal package, large or small. The Federal debt ceiling is not raised in time and the US Federal government defaults by missing interest payments or other spending obligations. Currently, the US Treasury foresees this event to materialise on August 2 in the absence of a rise in the debt ceiling. It is possible that the US Treasury can still find some workaround to delay the date of default by a few more weeks, but it ultimately matters little if default happens in the beginning of August or a few weeks later. ‘Payments’ default would be accompanied by ‘default’ ratings of the US government or some of its debt issues by the major credit rating agencies. A downgrade of the short-term rating of the US government to ‘default’ would be highly likely, while the nature of the downgrade for the long-term debt looks more uncertain. Even if the default is cured forthwith and any missing interest payments (if any) are made good quickly, the effects on the US sovereign, the US economy and the rest of the world are likely to be severe. Money market funds may have to sell their holdings of short-term US government securities in the case of a default rating. Even in the absence of a default rating, the fear of an increase in net redemptions from the very conservative investor base of money market funds would lead to a large increase in cash positions and a corresponding reduction in the provision of short-term funding. Several press reports have indicated that many money market funds have in fact already increased their cash positions in preparation for a potential increase in redemptions. Both with and without a default rating, some money market funds may ‘break the buck’. The potential for widespread near-term disruption in funding markets following even a technical default is all the more worrying given the fragility in Eurozone funding markets and the fragile nature of the economic recovery in advanced economies around the globe. The experience of the 1979 technical default in the US shows that even such a small and short-lived aberration can have long-lasting consequences, increasing both short-term rates and long-rates for an extended period (see Zivney and Marcus (1989)). Increases in US rates at all points of the curve are likely to be relatively large and to persist for years. The dollar could drop sharply and major disruption in the US and global financial system could cause private lending and borrowing rates to rise even more rapidly than the sovereign rates. Financial conditions could worsen sharply and interbank, credit and other funding markets are likely to ‘freeze’. As a result of the financial turmoil, the negative wealth effects, the increases in costs of capital and the substantial hit to sentiment, the US dives into a deep recession, taking the rest of the world with it. The IMF, in its recent Spillovers Report for the US, has provided several estimates of the potential impact a sovereign debt crisis in the US could have on US growth and growth in the rest of the world, with some of the estimates implying that US growth could fall by over 5%, while growth in the rest of the world could fall by as much as 3.7% in the event of a sovereign debt crisis in the US with an associated loss in confidence globally (IMF(2011)). The effects of the default are likely to persist, and it may be years before the US regains its triple A status. A front-loaded and severe package of fiscal tightening measures may well, following a default, be part of any realistic strategy to restore credibility, but would further reduce domestic demand and US growth. Given the fragile nature of the recovery in many other advanced economies (AEs), the shock to the world economy even from a technical US default may set the world economy back by years.”

Comments