Labour market figures are among the most widely watched economic data in financial publications Fisher Investments UK’s analysts follow. However, jobs are lagging economic indicators – limiting their use for investors, in our view.

In our experience, many investors care about labour market data because of their implications at a personal level. Jobs represent people’s livelihoods and ability to take care of themselves and loved ones financially, and there are important sociological impacts from unemployment. But more relevant to investors, we have found many can’t imagine how an economy can grow when unemployment is high and rising – after all, consumer spending is vital in most developed economies.

Fisher Investments UK agrees labour market trends are meaningful and can have political and sociological consequences. But from an economic perspective, jobs follow growth – they don’t drive it. Consider this from a hypothetical business owner’s perspective. An employee represents an investment of both time (think of recruiting, training and ongoing professional development) and money. Because of that commitment, the owner will typically refrain from making this high investment until it is necessary to meet consumer demand. Likewise, when a recession (an extended economic downturn) occurs and pressures businesses to reduce costs, business owners will usually wait to cut jobs until they have to, based on our research – employees are amongst a company’s most valuable assets. There is also an emotional aspect. Most employers have a relationship with their workers and don’t wish to sever that.

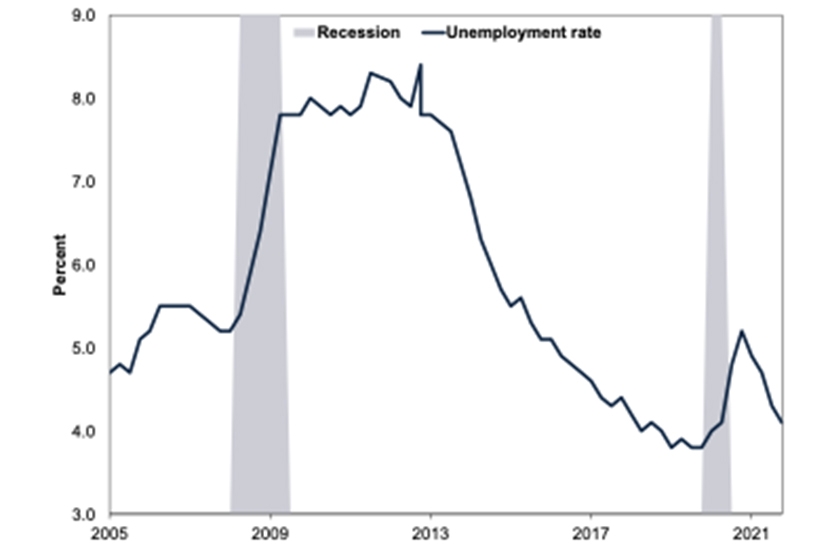

Historical gross domestic product (GDP, a government-calculated measure of economic output) and labour market data from the eurozone and the UK illustrate how jobs trail growth. In both cases, recessions began when unemployment was at a relative low – and joblessness started rising sharply after contraction had begun. Similarly, unemployment crested either very late in a recession – or after it ended. (Exhibits 1 – 2)

Exhibit 1: Jobs Trail Growth, Eurozone Edition

Source: FactSet and Euro Area Business Cycle Dating Committee, as of 08/04/2022. Harmonised unemployment rate for eurozone, monthly, January 2005 – February 2022. Recession dating based on Euro Area Business Cycle Dating Committee’s “Chronology of Euro Area Business Cycles”.

Exhibit 2: Jobs Trail Growth, UK Edition

Source: Office for National Statistics, as of 08/04/2022. UK unemployment rate (aged 16 and over, seasonally adjusted) and change in UK GDP, quarterly, Q1 2005 – Q4 2021. Since the UK doesn’t have an official recession arbiter, we define recession here as two or more consecutive quarters of GDP contraction.

Now, as the charts show, there can be instances in which unemployment starts rising shortly before recession begins. But, more broadly, low unemployment didn’t keep spending high and recession at bay before downturns – and high unemployment didn’t prevent recovery from starting.

In Fisher Investments UK’s view, recognising the information jobs data do – and do not – reveal is important because many economic experts argue labour market trends signal an economy’s direction. Currently, we have observed commentators in several financial publications we follow argue ongoing labour shortages may crimp economic recoveries in the UK and eurozone nations. But we think this is fallacious since jobs confirm what the economy did, not what it is about to do. Furthermore, the argument doesn’t account for businesses’ adaptability in finding ways to maintain productivity with a lean staff – or growth and rising wages’ ability to lure early retirees or others who left the workforce back to jobs.

For investors, we don’t think backward-looking economic information is helpful when making portfolio decisions. Based on our research, equities are leading economic indicators. As efficient discounters of widely known information, we think equities have already priced in – and moved on from – the economic growth jobs confirm. However, that doesn’t mean we think ignoring jobs data is wise. For example, we think how widely watched market commentators, economists and politicians discuss jobs – and what they do and don’t focus on – can shed light on the broader prevalent mood amongst investors. But using jobs data as a basis for a portfolio decision seems unwise to us. Instead, we think investors benefit more from consulting data that indicate which direction the economy is heading, which is what equities care more about.

Get exclusive stock market knowledge in your Markets Commentary guide as the first of our ongoing insights.

Follow the latest market news and updates from Fisher Investments UK:

Facebook: https://facebook.com/FisherInvestmentsUK/

Twitter: https://twitter.com/FisherInvestUK

LinkedIn: https://www.linkedin.com/company/fisher-investments-uk

Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

Investing in equity markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance is no guarantee of future returns. International currency fluctuations may result in a higher or lower investment return. This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or as a representation of its performance or that of its clients. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. In addition, no assurances are made regarding the accuracy of any forecast made herein. Not all past forecasts have been, nor future forecasts will be, as accurate as any contained herein.

Comments