A great article by Martin Wolf in today’s FT, analysing what the upwards-revised borrowing figures in the PBR mean for the public finances. Here are his key observations:

A great article by Martin Wolf in today’s FT, analysing what the upwards-revised borrowing figures in the PBR mean for the public finances. Here are his key observations:

“First, the Treasury’s view that the last cycle ended in 2006 seems quite ridiculous. The correct view is that the UK has been caught in an unsustainable supercycle, with a once-in-a-lifetime bubble in global finance and domestic housing. It is only now in the downswing. The cyclically adjusted fiscal deficit, properly measured, was far larger than believed for at least a decade. So fiscal policy should have been much tighter. If it had been, the UK would be in far better shape today.

Second, the UK cannot afford the spending it once hoped for. The government recognises this: current spending is forecast to grow at only 1.2 per cent in real terms from 2011-12 and net investment to fall by 0.9 per cent of GDP. As a result, spending is forecast to fall from 44.2 per cent of GDP next year to 41.5 per cent in 2013-14. Even so, tax shares must also rise: the PBR forecasts a rise of 2.4 percentage points between 2009-10 and 2013-14. Misery lies ahead for years.

Third, even so, the Treasury surely remains too optimistic: despite the scale of the shock to the world economy and the financial system, it assumes an annual peak to trough decline in GDP of a mere 1 per cent; an economic recovery in the second half of next year; and then a return to trend growth at 2¾ per cent a year, despite the need to shift output into capital-intensive, export-oriented manufactures. This is not plausible.

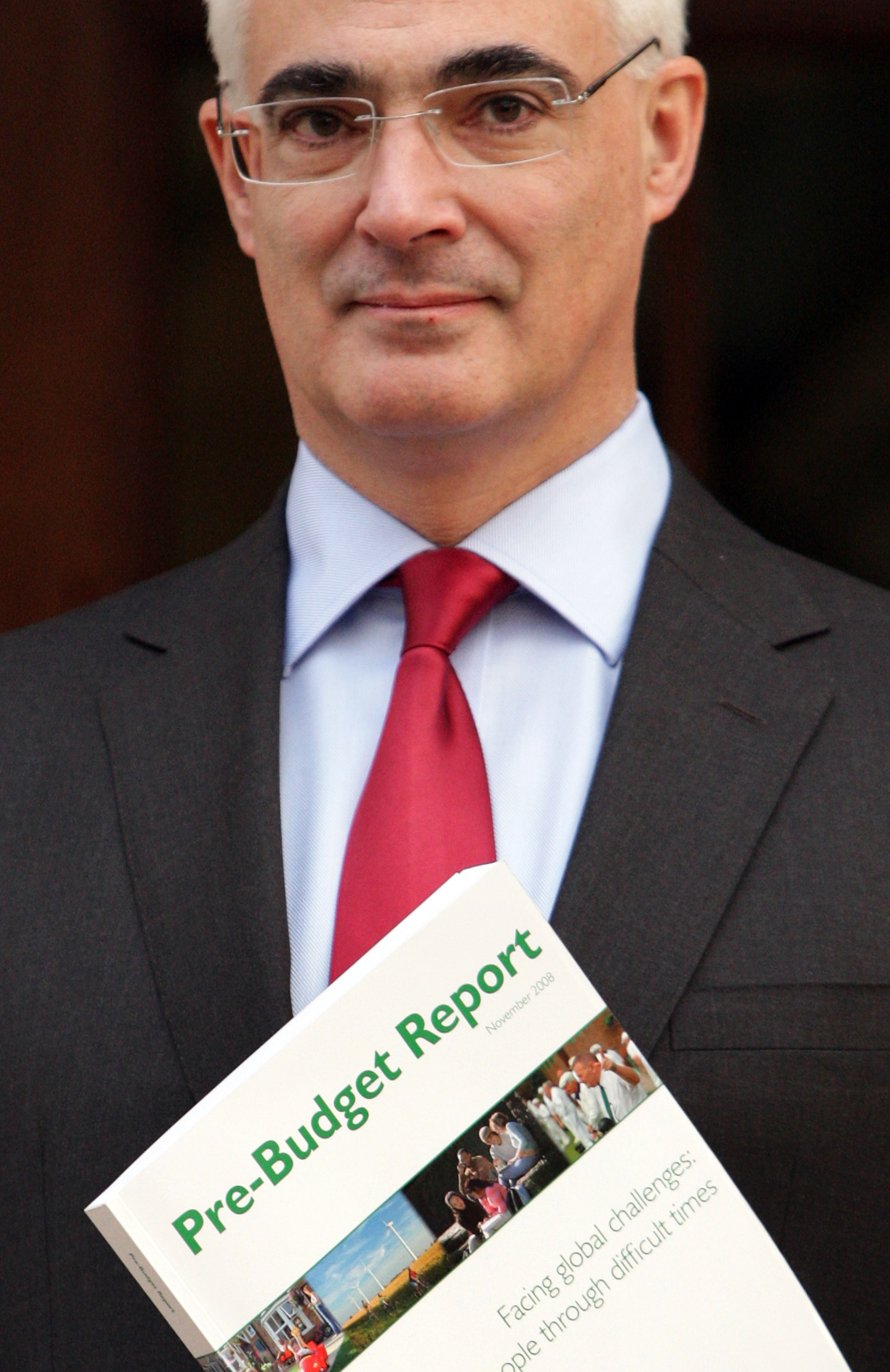

Finally, assume, instead, that GDP shrinks by 2 per cent in 2010 and 2011, before expanding by 1.75 per cent in 2012. It would then be 11 per cent lower in 2012 than forecast in the Budget. The fiscal accounts would be drowning in red ink.”The point about Darling’s growth figures has been taken up by much of the commentariat this week. The vast majority of them – along with most of the people I’ve spoken to – believe that the Chancellor’s prognosis is far too optimistic. As we’ve said before, the Government may reap the political implications of that. But the financial burden – the accounts “drowning in red ink” – will be left for future taxpayers.

Comments