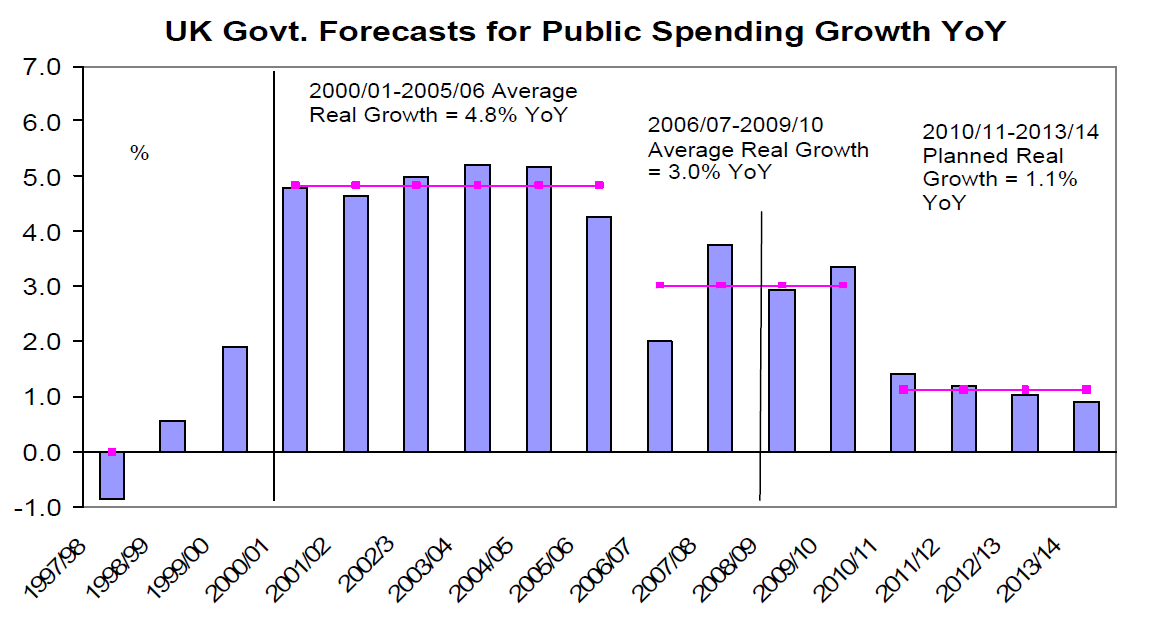

Much as I applaud David Cameron’s warnings about debt, and his bravery for doing so at a time when the borrowed penny hasn’t quite dropped over Westminster, would he actually do anything about it? I asked him at his press conference this morning. My point: that from April 2010 Gordon Brown intends to increase state spending at an average of 1.1 per cent (see graph, below). Cameron has ruled out real-term cuts, so would therefore have a range is between 0 per cent and 1.1 per cent – ie, between nothing and almost nothing. So where’s this great difference on the economy between the two parties?

I have, of course, fallen into Brown’s trap here. He doubtless has no intention of meeting the tight spending round outlined in the PBR just as Ken Clarke had no intention of meeting the “eye-wateringly tight” spending limits that Brown did actually observe until 2000-01. Since then, Brown has always overspent his limits. The PBR was a fairytale of healthy projections, and government parsimony – a document written to reassure our international creditors. The real UK debt will likely be far greater than the horrific, £1 trillion picture outlined.

Cameron has his language and positioning precisely right on the economy: the public are worried about saddling their children with billions of debt and would seek another path. But as Cameron was the first to point out, Brown isn’t taking on this debt to fund a splurge. He needs it to fund day-to-day government expenditure – and unless Cameron is going to cut that, he can’t plausibly promise to cut debt by very much.

As others pointed out, he has pledged to increase real-terms NHS spending and increase international aid as share of GDP. So what will he cut? And is his plan to save Britain from “Italian levels of debt” anything more than an unfunded aspiration? If there will indeed by an election in the new year, he’d best have his answers ready.

P.S. If the UK economy goes through a second, violent convulsion – perhaps caused by a secondary banking crisis that some in the City are talking about – then all the above becomes academic. Harsh cuts will be the only option open to any British government that wants to stay solvent.

Comments