The idea of ‘squeezing the rich’ may be politically attractive. But, says Arthur B. Laffer, it means less tax revenue — as the coalition may be about to learn the hard way

Britain’s new coalition government has a simple mission: to walk the thin line separating huge deficits and political correctness. Just how can a government patched together from former political adversaries raise the revenues needed — and still be fair to the poor, the various minorities and the disenfranchised? The answer they seem to have alighted on is the old saw of ‘tax the rich’. The first salvo in this new class warfare skirmish is to raise the capital gains tax rate, with new upper rates of 40 per cent and even 50 per cent being discussed. And thus the coalition falls for one of the greatest fallacies in economics.

The underlying premise is that the rich, because they own so much of the country’s wealth, can easily afford to pay higher taxes. Also, because they constitute such a small portion of the body politic, their screams won’t be heard. It would be sound logic — if it were true. But it’s not! When these new taxes are fully effective, then the private sector’s counter-offensive will begin. The new Lib-Con government will come to understand what Sir Robert Peel meant when he warned politicians against increasing taxes on the great articles of consumption, because they will be thwarted in their expectations of greater revenue.

People and businesses respond to incentives, and government policies change incentives. It’s really fairly simple. People, especially the rich, can change how much work they do, where they earn money, how they earn money, and when they earn money.

Just compare the UK’s economic growth before and after the tax-reducing Thatcher government. Or look at the USA before and after President Reagan took office. Reducing the burden which government places on the economy, through tax, is the surest way to promote growth. I have never heard of a country that taxed itself into prosperity. And for a simple reason. If Britain raises capital gains and other taxes, people and businesses will be less inclined to locate their assets in the UK and as a result, jobs, profits and taxes will move offshore.

In the United States, we have 50 states, each of which has its own tax system. The lessons to be learned on how easily people, jobs and businesses can move are profound. Over the past decade, those nine states with no state income tax grew 36 per cent faster than did those nine states with the highest state income tax rates. The nine states with no income tax also had population growth almost 10 per cent greater than the nine states with the highest income tax rate. But even more to the point, the nine states with no state income tax had total tax receipts growth a full 22 per cent greater than those nine states with the highest income tax rates.

This is all common sense, rather than complex economics. Businesses don’t locate their plant facilities as a matter of social conscience. They locate plant facilities to produce an after-tax return to shareholders. All things being the same, high tax countries lose businesses and jobs. This lesson is borne out time and time again, the world over. Between 1980 and 2007, the US dropped tax rates on every form of income, the highest, the lowest and all those in the middle. The result was that the rich paid more — even if their tax levels were reduced.

Let’s take the top 1 per cent of earners. Over this 27-year period, their contribution to the income tax collected in America doubled — from 19.5 per cent to 40 per cent. The same dynamics worked in Britain: when the top rate of income tax was lowered to 40 per cent in 1988, the share of income tax collected from the richest 1 per cent rose from 14 per cent then to 24 per cent now. For the rich, a simple formula applies: higher tax rates yield lower tax revenues. For all other income categories the reverse is true.

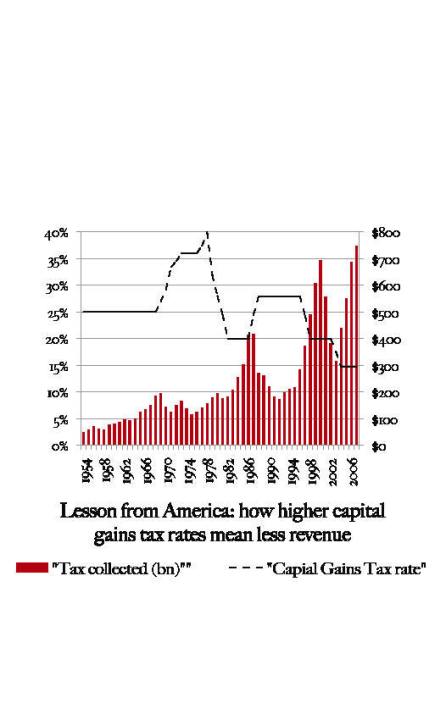

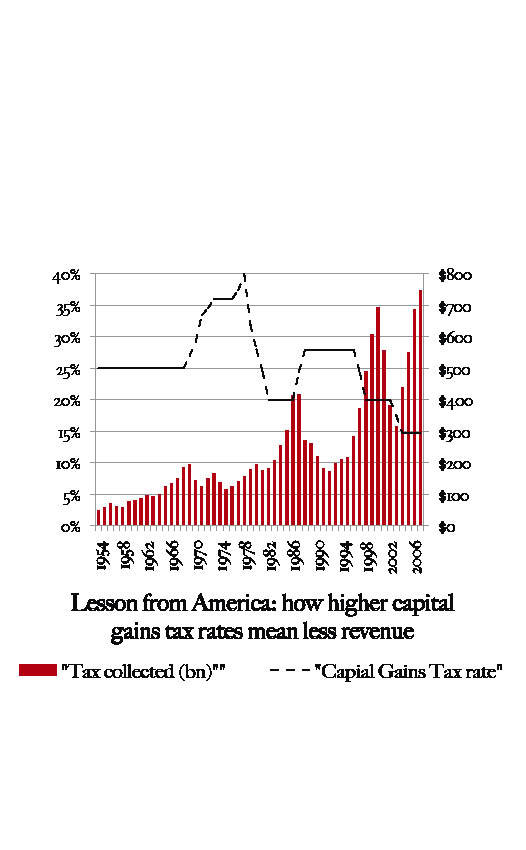

And with capital gains as a sub-category of income for the rich, capital gains tax revenues are perhaps the most sensitive income category to tax rates. Between the years 1976 and 2006 a consistent pattern has emerged in the US: when the capital gains tax rate has been cut, capital gains tax revenues have risen — both in cash terms, and as a share of economic output. When the capital gains tax rate has been raised (as it looks set to be in Britain), the tax generated by capital gains tax has fallen — both in absolute terms and as a share of economic output. All this is shown by the graph above. The lesson for British policymakers could hardly be clearer.

But there is a wider principle at stake. Raising the capital gains tax rate does an inordinate amount of damage to an economy, in spite of its relatively minor significance to government tax receipts. Raising capital gains tax rates will reduce total capital gains; it will lower total profits; it will lower total investments; it will reduce wages and total employment. As a result, it will also lower other income tax receipts, payroll taxes, profits taxes, sales taxes, property taxes.

And in the same breath, it will increase the need for more welfare payments to the poor, the unemployed and the underemployed. Raising tax rates on the rich and especially on capital gains is about as bad an idea for the UK as I could imagine. If you want poor people to do better, create jobs, not welfare. ‘The best form of welfare,’ in the words of John F. Kennedy, ‘is still a good high-paying job.’

Arthur B. Laffer is founder and chairman of Laffer Associates; he invented the Laffer Curve in the 1980s.

Comments