Today’s stock market plunge is interesting for two main reasons. First, for those of us who have never traded on the Japanese stock exchange, comes the revelation that the colours used to denote changes in stock prices are the inverse of those used on western markets: red means a share has gone up, green means it has gone down. The same, apparently, is true in China. Fortunately, for the sake of foreign drivers neither country inverts the colour of its traffic lights, although ‘go’ in Japan is denoted by something closer to blue than green…

Second, UK markets seem to have been dragged down in sympathy with others even though the economic news here might suggests they should be rising. It is easy to understand why Japan’s strong bull run should have been sent into reverse by a decision by the country’s central bank to raise interest rates. Yet the Bank of England’s base rate yesterday was cut to 5 per cent. Moreover, you might understand why the German stock market might be weak, given that GDP declined again unexpectedly by 0.1 per cent in the second quarter. But growth in the UK has surprised on the upside in recent weeks. That, however, has not saved the FTSE from plunging by 1 per cent soon after US markets opened this afternoon. The FTSE250 was down by more than 2 per cent by mid-afternoon.

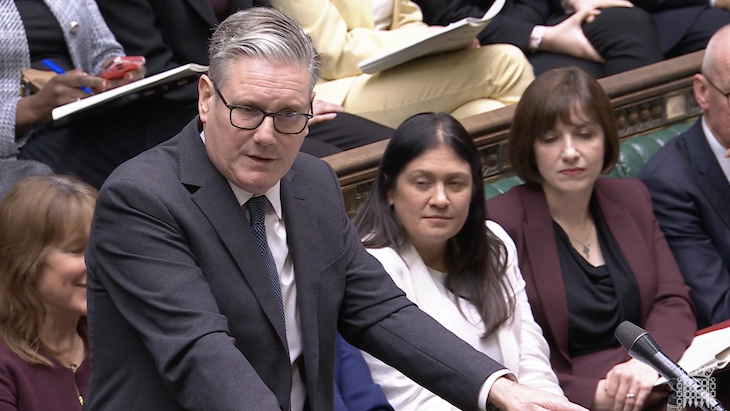

It is easy to see this as just another case of global investors acting as a mindless herd, storming into one thing after another, and selling stocks across the board, regardless of the fundamentals, when they see others selling. On the other hand, could the FTSE’s performance be a reaction the gradual realisation that Sir Keir Starmer and his chief economic lieutenant Rachel Reeves are unlikely to be precipitating an economic miracle? The reversal seems to confirm it: that, no, the coming of the Starmer government is not going to be accompanied by a stock market boom such as the one which helped create a sense of wellbeing in the early months of Tony Blair’s administration. Since the election, the FTSE100 hasn’t gone anywhere, in spite of a few days of initial enthusiasm for the new government. It is lower now than it was when Rishi Sunak called the election in May.

This week does seem to have changed the tone of the Starmer government. In the early days it was all going to be about growth, growth, growth. Yet this week Reeves has announced a big switch from capital investment – with road and rail schemes axed and new hospital projects being reviewed, as well as government cash withdrawn from IT projects – and towards higher current spending on public sector salaries. Moreover, the pay increases have not been made dependent on improvements to the lamentable productivity in the public sector. Unions have been granted greater powers to go on strike, which will put yet more pressure on government budgets. It should be little surprise if markets react by worrying about the future path for economic growth and fiscal discipline in the UK.

Having made so much of the plunge in bond markets in 2022 following Kwasi Kwarteng’s mini budget, Labour can hardly now turn around and say negative market sentiment has nothing to do with them. No matter what the international perspective, if the FTSE plunge continues next week, Reeves is going to find herself at the centre of it.

Comments