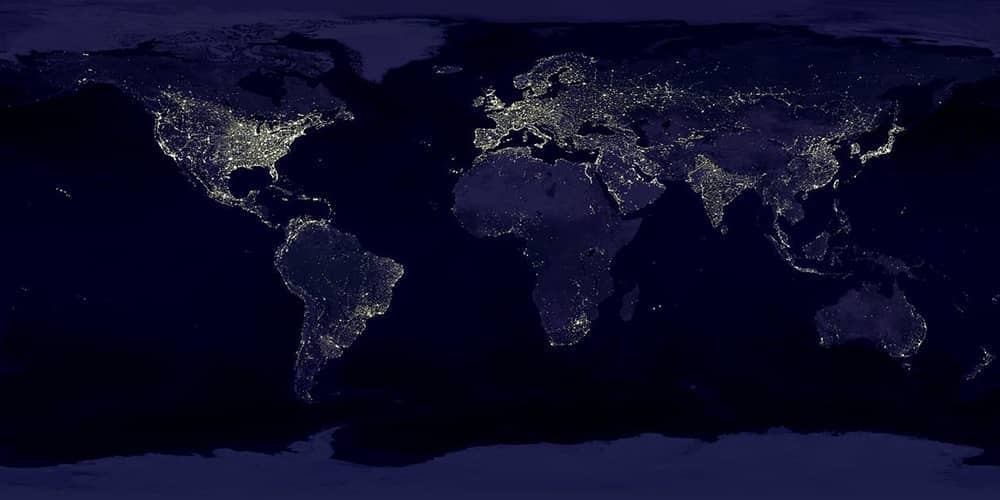

What will the world look like in 2050? Some trends are easy to forecast – like demographics. Based on birth-rate trends and life expectancies, the UN projects the Earth’s population will top 9.7 billion by then.[i] Sociologists who write in publications we follow foresee the vast majority of that population living in urban areas, theoretically requiring a massive increase in electricity generation and other infrastructure. Many demographers we read also see most of that population increase happening in the Southern Hemisphere, with ageing (and eventually shrinking) populations in the north. These predictions all may be interesting from an academic perspective, but, for investors, Fisher Investments UK thinks they are of little use. For markets, our research shows demographics aren’t destiny – they don’t predict stock returns or which countries, industries or companies will be the biggest winners as these shifts play out.

Like all prices, we think stocks move on supply and demand. In Fisher Investments UK’s experience, the latter gets most attention, as it typically drives short-term moves. Stocks trade in an auction marketplace and are technically always worth whatever investors are willing to bid for them at a given time. Demand can change on a dime, but supply moves much more slowly. Initial public offerings (IPOs), in which a company lists on public exchanges for the first time, take months to play out. So do stock buybacks, in which a company repurchases its own shares, taking them off the market, and which reduce supply. Bear markets (typically deep, lasting, broad market declines of -20% or worse with a fundamental cause) can begin when runaway supply increases outstrip demand – we think the dot-com bubble is a prominent example – but more often than not, our research finds demand is the swing factor in the short term.[ii]

In our view, overemphasising demand as a market driver is likely what often leads financial commentators we follow to argue that if and when populations in the Northern Hemisphere age and decline, it will lead to weaker stock returns – fewer working-age people means fewer buyers of stocks, they argue. Fisher Investments UK thinks this logic doesn’t withstand scrutiny. One, if you presume the Southern Hemisphere will develop rapidly over the same period, it would stand to reason that growing demand for stocks emanating from there would offset a potential decline in the north. Two, we think that decline in demand is far from a given. As life expectancies lengthen, retirees need to make their savings provide for them for many more years.[iii] Owning stocks is key to that, in Fisher Investments UK’s view. Three, in studying demographic projections, we have found they rest on birth-rate projections whilst largely ignoring the potential for higher immigration, which we think defies prediction since immigration policies depend on politicians’ whims.

Most importantly, though, we think forecasting markets based on demographic effects on demand ignores supply, which we think is impossible to forecast in the long run. Consider: The Wilshire 5000 Index, which includes every publicly traded US company, doesn’t presently include 5,000 stocks – that is simply how many it included when it launched in 1974. Did people know then that it would mushroom to over 7,500 constituents by the late 1990s?[iv] At the heights of the dot-com boom, did people know that the IPO frenzy would cease and the Wilshire 5000 would decline to just 3,641 constituent companies as of 30 September 2021?[v] All the factors that our research shows influence supply – including regulations, tax policy, private takeover activity and more – are impossible to predict, in our view, as they depend on a host of human variables. We aren’t aware of anyone who even tries. If they did, anyone claiming they can predict supply in the long run is just pretending, in our view.

We think picking long-term winners and losers amongst companies, industries or sectors from population trends is similar guesswork. Take electricity. Extrapolating present trends forward would likely lead people to presume wind turbines and solar panels will dot every spare inch of open space in 30 years. (We exaggerate for dramatic effect.) But what if wind and solar are just fads? What if scientists have a massive nuclear fusion breakthrough? What if hydrogen power takes centre stage, both in electricity generation and auto fuel? Or what if there is some crazy new technology that no one has dreamt of yet? We think you can apply the same thought exercise to infrastructure and food production, not to mention pretty much every good and service in existence today. When massive mainframes dominated the computer world in the mid-20th century, even science fiction television couldn’t conceive of smartphones. In the original Star Trek, the Enterprise’s bridge controls looked like an old telephone switchboard – no touchscreens in sight. If even creative futurists can’t predict how technology will evolve, what hope do mere mortals have?

Ultimately, economic theory holds that human capital is just one economic input, along with financial capital, technology and productivity – which we think are unpredictable wildcards. This is why Fisher Investments UK thinks stocks don’t look more than about 3–30 months out. Any impact from demographic shifts is likely beyond that range, if not far beyond it, and out that far we think there are just too many unknown variables on all fronts. Longer-term innovation and technological changes aren’t predictable. If they were, we would all have jet packs and flying cars by now, as that is what many envisaged in the mid- to late-20th century, judging from pop culture at the time. Our research shows stock supply isn’t predictable beyond the next couple of years, either. So we suggest not letting far future projections, whether sunny or sour, influence your investment decisions today. Concentrate on where we think stocks look – the foreseeable future – and supply and demand within that window.

Interested in other topics by Fisher Investments UK? Get our ongoing insights, starting with a copy of Markets Commentary.

Follow the latest market news and updates from Fisher Investments UK:

Facebook: https://facebook.com/FisherInvestmentsUK/

Twitter: https://twitter.com/FisherInvestUK

LinkedIn: https://www.linkedin.com/company/fisher-investments-uk

Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[i] Source: United Nations, as of 30/11/2021.

[ii] Source: FactSet, as of 07/01/2022. Statement based on MSCI World Index returns with net dividends in pounds, 31/12/1969–31/12/2021.

[iii] Source: World Bank, as of 07/01/2022. Statement based on life expectancy at birth for the world.

[iv] Source: Investopedia, as of 30/11/2021.

[v] Source: FT Wilshire 5000 Index Fact Sheet, 30/09/2021.

Comments