How, I wonder, did a shortlist of candidates to succeed Sir Mark Tucker as chairman of HSBC come into the public domain? The three names ‘exclusively’ revealed by Sky News, if they really are the final contenders, ought to be a secret kept between a board committee led by senior independent director Ann Godbehere and the headhunters on the job, named as MWM Consulting. Two of the three – Kevin Sneader from Goldman Sachs and Naguib Kheraj, formerly of Barclays and Standard Chartered – might feature in a round-up of usual suspects. But the third is the former chancellor George Osborne, who has no public-company chairmanship experience and is, to say the least, a Marmite figure.

Hence we might suspect a judicious leak – HSBC says it won’t comment on ‘speculation’ – to test what investors, corporate customers and mischievous columnists might think. The best precedent, by the way, is century-old: Reginald McKenna, who was Asquith’s chancellor, went on to chair the then world-leading Midland Bank from 1919 to 1943. And let’s not forget Nigel Lawson, reportedly disappointed not to have been offered the chair of NatWest before he found a lesser billet at Barclays.

But what’s to be said for or against Osborne? The public never warmed to him as a politician. Mervyn King, as governor of the Bank of England, expressed a (leaked) view that Osborne and David Cameron were ‘out of their depth’ on economic issues before they came to power in 2010. More recently, the media looked askance at Osborne’s role (as a partner of the investment bank Robey Warshaw) advising the UAE-backed RedBird IMI bid for the Telegraph.

On the other hand, he’s a formidable high-level operator and HSBC is one business where his past willingness to glad-hand Beijing might stand him in good stead. So long as he’s surrounded by people who actually understand banking risks, he could be a very smart appointment. And as an aside, we might also wonder whether advice on the HSBC job prospect was sought from Lord Mandelson, who had the misfortune to be snapped relieving himself in the street after dining chez Osborne last week. A tale, as it were, of one leak after another.

Stratford vision

I spent the weekend in a conference at Stratford in east London. The £9 billion regeneration of post-industrial semi-wasteland into what was the 2012 Olympics site and is now the Stratford City complex, is remarkable for its ambition and energy – even if most of it isn’t beautiful, its homes are almost as expensive as central London and its displaced communities still resent the whole transformation.

The vast Westfield shopping mall, rammed with pre-Black Friday bargain-hunters, ‘might as well be in Omaha’, as one American visitor observed to me. No Eurostar train has ever halted at the white elephant that is ‘Stratford International’. And it was a relief also to discover the more familiar urban scruffiness of old Stratford on the far side of the station.

But this new Stratford has green spaces and waterfronts, colleges and studios, Sadler’s Wells and the V&A East Storehouse. Overall, it filled me with unexpected optimism. So much of our society, infrastructure and economy seems to be falling apart. But with imagination and stamina, there’s always the possibility of change for the better.

Into the freezer

Here’s another indicator that the AI bubble is about to burst. The Silicon Valley investor Peter Thiel sold his hedge fund’s entire $100 million stake in the AI chipmaker Nvidia during the third quarter, despite its continuing rise towards a $5 trillion valuation. The fund also sold three-quarters of its stake in Tesla and reduced its overall equity holding by two-thirds, while adding to safer bets in Apple and Microsoft.

Is Thiel someone whom smaller market players would be wise to follow? A co-founder of PayPal and Palantir and an early backer of Facebook (the sort of patient investor that barely exists in the UK), he has a $25 billion fortune and is highly influential in right-wing libertarian circles. More weirdly, he’s also keen on the idea of life-extension by cryogenic preservation. If he’s packing his share portfolio into the deep freeze, I’d say that’s a strong signal to sell.

Old haunt reformed

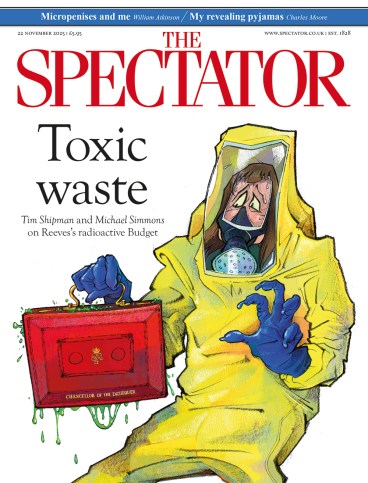

The FTSE 100’s recent all-time closing high of 9911 reflected a positive global response to moves in Washington to end the extended US government shutdown. You might think it odd, in the otherwise dismal times I allude to above, that London investors were so swept along by this surge of international sentiment as to overlook the all-but-shutdown of our own government, as Downing Street descended into civil war and the Chancellor fed her umpteenth Budget draft into the shredder while the Office for Budget Responsibility made her task worse by preparing to downgrade its productivity forecast. But perhaps the Square Mile was also buoyed by another reopening – that of the 268-year-old former Simpson’s Tavern in Ball Court, off Cornhill.

This chop-and-sausage hangout for City traditionalists closed overnight in 2022 after a rent dispute between the then management and the building’s Bermuda-registered landlord, provoking a public campaign to preserve it as a ‘community asset’. It will be reborn early next year as Cloth Cornhill, sister of an eaterie called Cloth on Cloth Fair in Farringdon. Not everyone is happy that the old Simpson’s name and team are not returning, but the PR blurb promises a revival of the ‘debaucherous’ lunching that was once a daily habit of commodity traders, Lloyd’s brokers and money market men.

One habitué quick to welcome the news was Nigel Farage, formerly of the London Metal Exchange, whose path to power can now be plotted over pints of Bass in his old haunt’s dark-panelled booths.

Comments