It gives me no pleasure to say I told you so. ‘If [Donald Trump] is prepared to cause mayhem in global trade as his first move, he’s even more dangerous than his detractors thought,’ I wrote in February. ‘British commentators of the “Why can’t we have visionary maverick musclemen like Trump?” persuasion should be careful what they wish for.’ And in November, ahead of the presidential election, I wrote that gold could have ‘more upside ahead’ while bitcoin holders would be wise to take profits – advice that looked wildly wrong in December but finally came right with gold at an all-time high and the cryptocurrency suffering its worst first quarter for a decade.

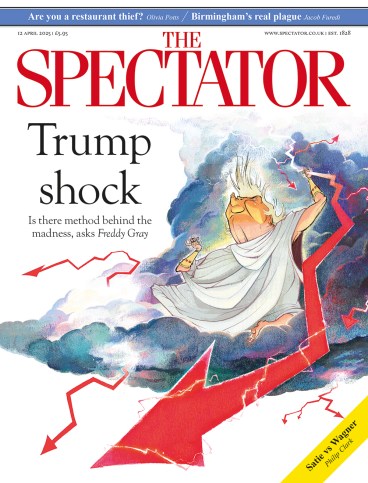

All of which (you’ll think, if you’ve taken refuge in Casablanca for the umpteenth time) ‘don’t amount to a hill of beans’ beside the $10 trillion wiped off global share values since Trump’s so-called Liberation Day. Let’s face it, all market predictions are ephemeral; new ones amid a strengthening tempest would be peculiarly pointless. But what’s perverse about the present imbroglio is that it might actually be better for US stock markets to go on falling, because the ruin of crony fortunes and voters’ pension plans may be the only thing that will persuade the President to reverse his catastrophic course.

Safe-haven gold

‘Sit tight unless you have urgent cash calls’ must be the only advice worth offering any investor today. But I’m grateful to a City reader for this nugget: on the 12 occasions since 1945 when the S&P500 US share index fell by 20 per cent from its peak, it delivered positive returns over the subsequent year in eight of those cases – and in all of them over five years, with an average return of just over 50 per cent. And my source adds that the political impetus behind this week’s market plunge makes it more susceptible to a quick rebound than a sell-off driven by pure economics.

But would you also be wise to add some safe-haven gold to your portfolio? It’s the classic store of value for those uncertain where else to park cash, with buyers currently ranging from Chinese retail punters to central banks, and it’s usually quick to bounce from wider market dips. What’s more, this column’s veteran investment guru Robin Andrews sees an opportunity to buy shares in gold and silver producing companies that have declined sharply along with other asset classes: ‘Hochschild and Fresnillo are outstanding longer-term opportunities – for the brave.’

Cold shower

This column comes from France, where President Emmanuel Macron has called for ‘collective solidarity’ in the form of a suspension of new investment by French companies in the US until the tariff standoff is ‘clarified’. His targets included CMA CGM, the shipping group, which has $20 billion worth of US expansion plans, and Schneider Electric, which is investing $700 million in energy projects over there. It may also have been aimed at Bernard Arnault, the LVMH luxury -goods tycoon, who recently declared in response to French corporate tax hikes that he felt ‘the wind of optimism’ in the US, but ‘when you come back to France, it’s a bit of a cold shower’.

Arnault’s attitude is an indication that Macron’s appeal to corporate patriotism is unlikely to land well: a Le Figaro editorial summed it up as ‘Punish yourselves to punish Trump’. Rational businesspeople every-where, accountable to shareholders, concerned for their workers, concerned for their own pensions, watch in despair as vain politicians turn their livelihoods to dust.

I must be mad

I’m here to build my own coalition of the willing around the idea of converting a redundant barn in my Dordogne village into a theatre and concert venue. A majority of those to whom I’ve shown sketches have responded: ‘What a wonderful idea, go for it!’ But the one person I know who has actually battled with French planning and licensing bureaucrats to complete a similar scheme said simply: ‘You must be mad.’

Maybe. But as world leaders (except our prudent or pusillanimous Prime Minister, that is) trade blows with Trump while he wrecks the trade in goods that has done so much for prosperity and peace, what can we citizens do but form ‘small platoons’ to promote benign co-operation on a local scale? That phrase belongs to Edmund Burke, writing, as it happens, in Reflections on the Revolution in France (1790). It originally referred to the need for aristocrats to resist revolutionary vandalism of traditional institutions, but it came to be applied to civil society in all its forms as a positive counterweight to overbearing government.

That’s not entirely why I conceived a pipe dream which another of my doubters compares to Fitzcarraldo’s opera house. But I’ve certainly found a distraction from the horrors of the greater world.

A cortege passes

Returning north via the drab railway town of Brive-la-Gaillarde, I have a couple of hours before my departure for Paris. But the station brasserie has closed down and the hotel opposite is shuttered, as are most of the shops towards the town centre. There’s only a Turkish barber, a tabac doing desultory trade in scratchcards and a funeral cortege. Dispirited by this vision of the near future, I pause to read the rest of Le Figaro’s rant about Trumpian protectionnisme suicidaire.

Then a door opens – Le Comptoir St Sernin, which serves a pleasant lunch ahead of a contemplative journey to Gare d’Austerlitz in time for a stroll at dusk along the banks of the Seine among thousands of young Parisians chattering, drinking and flirting without a care. Onwards a day later to Épernay, to join The Spectator Champagne tour at Pol Roger and Taittinger. As darkness descends, we must find comfort wherever we can.

Comments