Messy deals and fudged compromises: an inevitable feature of coalition politics.

But that doesn’t necessarily mean that the resulting policy will always be bad. As a result of grubby negotiations in Downing Street, it looks as if we might just end up with a change in

direction of tax policy which should have been made years ago.

Messy deals and fudged compromises: an inevitable feature of coalition politics.

But that doesn’t necessarily mean that the resulting policy will always be bad. As a result of grubby negotiations in Downing Street, it looks as if we might just end up with a change in

direction of tax policy which should have been made years ago.

The battle over the 50 pence tax rate seems to be settling into an uneasy compromise: the Chancellor gets to abolish it possibly in 2013 and in return the Lib Dems get some form of mansion tax, the levy proposed by Vince Cable on homes costing more than two million pounds. Ever the party of the land, many on the Conservative side are still bitterly objecting to any higher property tax. But they should grab the deal while they can. Not only that, they should go further and bring about a permanent shift in the tax burden from income to property. It is the only way to mitigate yet another hugely damaging cycle of property speculation.

Property - particularly of the residential type – is prone to speculation partly because it is so lightly-taxed. Buy a house and live it and, when you come to sell up, you will not owe the taxman a penny, regardless of how big the profits you have made. Moreover, the exemption on capital gains tax on a main home lasts for three years after you have moved out, so you can in fact earn capital gains tax-free profits on two homes at once. True, buyers pay stamp duty, but once you have covered that the only tax you will pay is the highly-regressive council tax. The highest band for council tax is levied on properties which were worth £320,000 in April 1991 which averaged across the country equates to a property worth approximately £950,000 today. If you own a £1 million house you pay three times the tax paid by the owner of a £100,000 house. If you own a £10 million house you still pay only three times the tax paid by someone living in a £100,000 property. While owners of £100,000 properties will be paying around one per cent of the value of their homes in tax every year, the council tax burden rapidly tapers off as you go up the house price scale. Second homes are charged at between 50 and 90 per cent of full council tax.

Compared with property speculation, going out to work looks a mug’s game. It isn’t just the 50 per cent rate which is excessive. Earn £10,000 a year and you are already on a marginal tax rate of 32 per cent: 20 per cent income tax and 12 per cent National Insurance contributions. No wonder during times of property boom millions of homeowners are able to reflect that their homes are earning more than they are. Low taxes make for inefficient use of property. Those who own it have a tendency to cling onto it even when they are under-using it or not using it at all, for fear of missing out on tax-free profits. Belgravia has become a network of ghost streets thanks to foreign speculators buying London property as what they see as a safe and tax-efficient investment. Property speculation has not just given us high property prices, putting home-ownership out of reach for many; it has also sucked money out of investment in wealth-creating industries.

You don¹t have to be a communist to see the attraction of higher property taxes. British homes are worth a total of £4 trillion. An annual tax of one per cent on the value of all residential property would raise £40 billion, a revenue stream which would enable 16 pence to be cut from the basic rate of income tax or, better still, allow employee National Insurance (NI) contributions to be abolished altogether, bringing a change which would reward work at the expense of speculation. Place a similar annual tax on commercial property and the government could take a huge step towards abolishing employer NI contributions, too.

True, there would be losers who don¹t quite fit the popular image of a property speculator: the fabled widows living in mansions who were cited as a reason to replace the old domestic rates with the poll tax in the 1980s. But then why should the tax system support the interests of elderly people who are living in houses too large for them and which are rotting around them? If you cannot afford to pay a tax of one per cent of the value of your home you almost certainly cannot afford to maintain it properly, either.

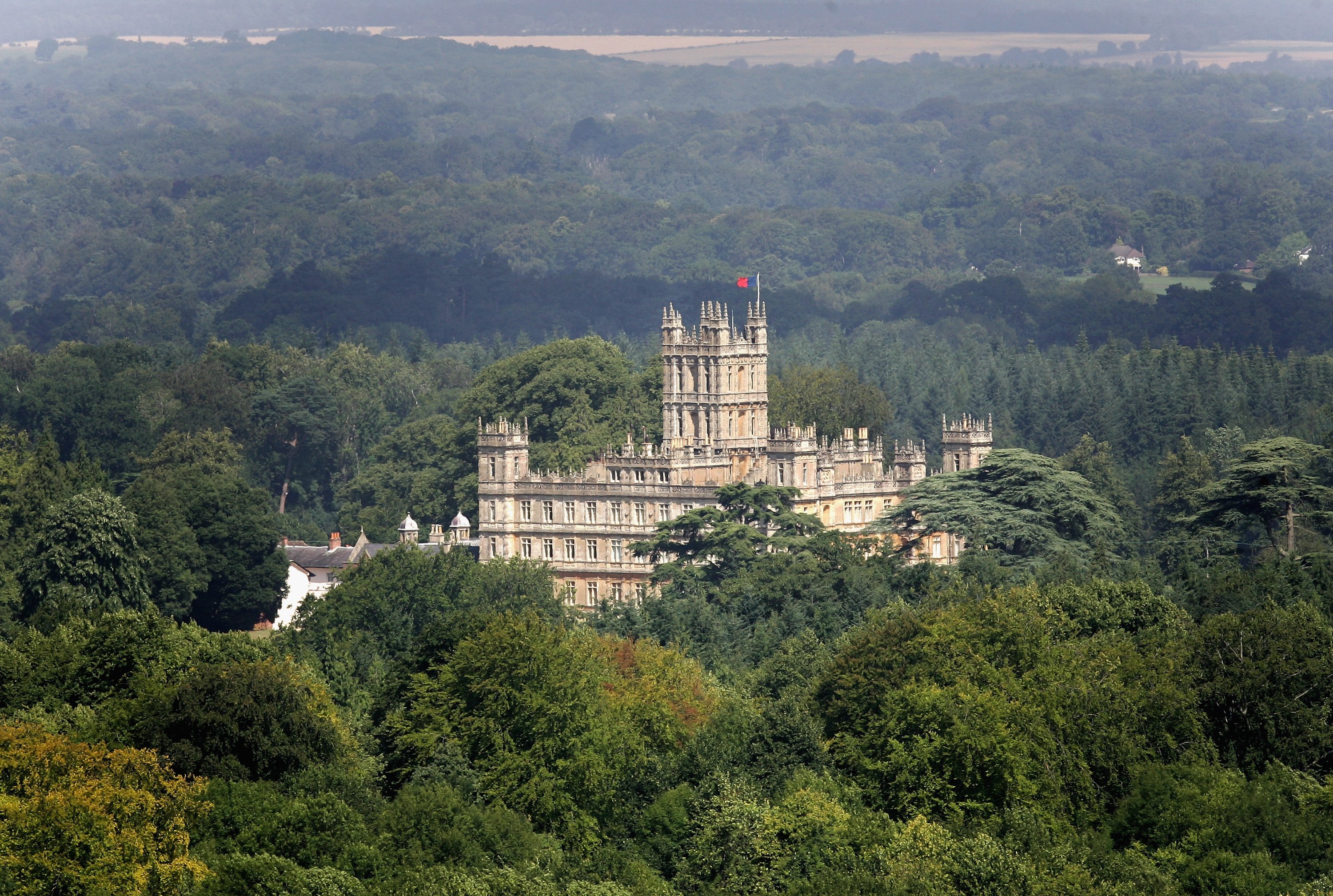

Would it be any bad thing if the over-housed were persuaded to cash in their profits and move somewhere smaller and if under-used second homes and abandoned houses were encouraged onto the market? On the contrary, it would take pressure off our housing stock and reduce the need for the mass house-building which so upsets Conservative voters in the shires. Far from being a hated policy to buy off the Lib Dems, a mansion tax - assuming it was balanced by a dramatic cut on taxes on income – could prove this government’s lasting legacy.

Comments