Most forecasts for the economy are pretty grim: bankruptcies, bad debts, job losses and a massive debt hangover leave little room for optimism. But I’m going to try. I think there is a wodge of money burning a hole in UK consumers’ pockets. And once they can, households will go out and spend it.

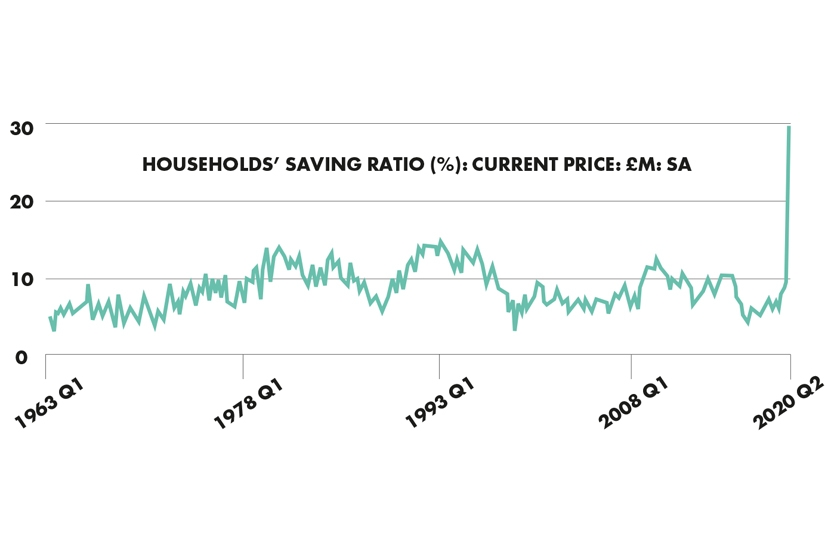

This wall of money can be seen in the savings ratio — the amount of income that households save. For decades it has wobbled around 10 per cent. But the latest figures from the Office for National Statistics (ONS) show that households are now saving an astonishing 30 per cent of their income. It’s never been so high. In a pandemic, there are fewer opportunities to splurge, and so many households have become big savers by default.

So when the health crisis is under control, will households spend this wall of money? My experience has taught me never to underestimate the average Briton’s desire to spend. Or as the Institute for Fiscal Studies puts it: ‘Backing the UK consumer has historically proven a sound bet.’ This savings glut could set the scene for a 1980s-style consumption spree.

There is some evidence this might be starting already. Firstly, ONS retail sales results for August, September and October have been surprisingly strong, with the latest figure showing retail sales up almost 6 per cent on last year’s levels. That’s amazing given hundreds of thousands have lost their jobs.

Secondly, budget airline easyJet noted in its recent results that once travel restrictions had been lifted to the Canary Islands, it saw huge demand for flights. There is a hidden demand to get away and have fun again.

House prices are at record highs and home sales booming (albeit helped by a stamp duty cut from the Chancellor). Car registrations for October were flat on last year’s levels but private sales to households were actually marginally higher.

And another expensive item — furniture — has seen a massive increase in sales, according to the most recent Bank of England report. Purchases of big-ticket items such as homes, cars and furniture require some degree of consumer confidence.

A spending spree would be fabulous for GDP as so much of the economy is dependent on consumer spending — about 70 per cent.

Of course, for many households, the past eight months have been catastrophic financially. But for those in safe and secure jobs, still earning a wage, their finances may have never looked so good.

Of course, much depends on the coming months: if we get a vaccine in the next half year; if the extension of the furlough limits job losses to below a million; if businesses can reopen and trade profitably by spring; if the government and banking industry continue to support businesses — then it may be that spending booms.

And emotionally it feels right. Who doesn’t want to get away on holiday and forget what a rubbish year this has been? Who doesn’t want to go out for a meal with their loved ones? Take their kids to the swimming pool? Who doesn’t want to treat themselves to a pair of fantastic shoes? (OK, you may not agree with me there.)

This wall of money is being seen elsewhere, too. The savings ratio has soared in Germany, France, Italy and Spain. If the households in these countries decide to splurge their savings too, this could mean a boost to exports (although of course we have Brexit lurking in the shadows).

This crisis has clearly done catastrophic damage to the nation’s finances. It has pulled the rug from underneath many small business owners. It has pushed the just-about-managing to struggling. But people want to live again. The ‘eat out to help out’ boom showed that.

We are not quite back to ‘loadsamoney’, but you get the idea.

Comments