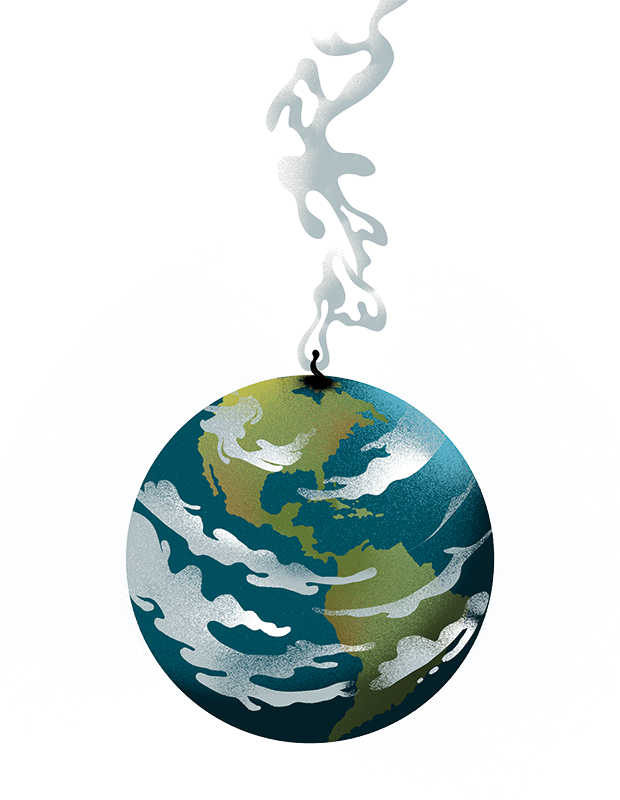

The seizure of enemy treasure, formerly known as plunder and pillage, is an ancient tool of war. Though still practised in the world’s nastiest conflict zones, it’s a tricky business within a rules-based international order. The G7’s agreement to lend $50 billion to Ukraine – using income from $300 billion of frozen Russian assets to cover interest and repayments on the loan – is a vivid case in point. And some would say, a lily-livered half-measure.

The key feature of the deal is that it does not actually claim ownership of Russian loot – which however ill-gotten is mostly held in EU banks in the form of western government bonds. It merely diverts interest payments due on the bonds from the issuing governments. But why not confiscate the capital itself, given that the Putin regime clearly has no respect for any order other than its own and has in recent times plundered the Russia-based investments of numerous foreign energy companies as well as the likes of Danone, the French dairy group, and Carlsberg, the Danish brewer?

According to the Kennan Institute, a US thinktank, ‘no western company’s property is safe from effective nationalisation in Russia’, while the Washington Post argues for the ‘elegant justice’ of transferring frozen Russian assets direct to Ukraine. In that mode, the US government has separately decided, under the Repo Act signed by President Biden in April, to ‘repurpose’ the smaller holding of Russian capital, around $5 billion, that lurks in the US banking system.

So why such caution at the G7? Evidently because Christine Lagarde of the European Central Bank and her peers in Germany and elsewhere fear confiscation would provoke a flight of Chinese and other countries’ reserve holdings from western government bonds and currencies. But a $50 billion loan will fund the Ukrainian war effort for less than a year (in 2023 the military bill was $65 billion), while a Russian victory would have far worse consequences for the world than a burst of money market turmoil. On the other hand, what a difference $300 billion might make – and why, morally, should Putin be allowed to keep it? If realpolitik says an orderly plunder of Russian treasure might save Ukraine, then shouldn’t the rules change to allow it?

Pillar of wisdom

Sir Martin Jacomb was the wisest City gent of his generation, and an emollient chairman of the snakepit that was BZW, the fledgling investment banking arm of Barclays where I was once a junior director. Over the decades since, I disagreed with him only on one issue, which was the merits of ‘Big Bang’, the 1986 reform that gave birth to BZW by allowing Barclays and others to buy stock exchange firms and create trading combines in imitation of Wall Street. It was a revolution that rebooted the Square Mile as a global finance centre but, in my opinion, launched the era of greed-driven risk-delusion that culminated in the 2008 crash.

For Jacomb, writing here before that fall, Big Bang was ‘a resounding success’. When I visited him not long ago, bright-eyed as ever at his Oxfordshire home, I asked whether that was still his view. ‘Oh yes, and we can now also see Big Bang as a necessary step in a much larger process of globalisation.’

But he added a postscript: how he regretted ‘the guilt part’ of the story, which was that the more sophisticated financial markets became, the easier it was for participants to ‘make money out of money and cash out while the going’s good’, eroding the more benign model of capitalism based on long-term productive investment. We parted in perfect agreement. He died a fortnight ago, aged 94: how I’ll miss our conversations.

Masterclass

When I travelled with Jacomb in Asia, his guru-like eloquence never failed to captivate local big shots. One such was Yoshihisa Tabuchi, who as president of Nomura Securities from 1985 to 1991 was the capo di tutti capi of the red-hot but rackety Tokyo stock market in which BZW was an aspiring small player. Tabuchi eventually resigned after a scandal in which his firm was found to have lent money to a yakuza boss and reimbursed trading losses for favoured clients.

His taciturn manner signalled he was seeing us as a bare courtesy on a busy day. But Jacomb’s opening gambit was a masterclass in manners which gave our host ‘face’, in the Japanese sense of showing proper respect, while scoring a subtle point for the gaijin (foreigner) side. Gesturing behind the president’s chair to a painting at which I’d bet Tabuchi himself had rarely glanced, he said: ‘Oh, I do like your Chagall.’ From then on it was a meeting of equals.

Big date for entrepreneurs

Labour’s plan to ‘pull up the shutters for Britain’s entrepreneurs’ had me very confused, since the Collins definition of ‘putting up the shutters’ – a slim semantic difference – is ‘to close business at the end of the day or permanently’. Increased workforce costs plus a capital gains tax sting and closure of the private-equity ‘carried interest’ tax loophole could indeed do just that, wiping out a swath of entrepreneur-led ventures that might otherwise contribute to the party’s manifesto goals of growth and ‘wealth creation’.

But the detail of Labour’s small-business policy gallops breathlessly in the opposite direction: better access to finance; fairer business rates; higher skills; more help for exporters; and the flourishing of Britain as a ‘clean energy superpower’ with glorious opportunities for innovators. If Sir Keir Starmer and Rachel Reeves can make all that happen, with no tax raids on business founders, I’ll hold top-table seats for both at our Economic Innovator of the Year Awards gala dinner in November.

Meanwhile, the best UK entrepreneurs will sail with whatever political weather lies ahead – and will be busy polishing their Awards entries. Details are here and the closing date has been extended to Friday 28 June.

Comments