The nation owes the former Labour leader Neil Kinnock an eternal debt for losing the 1992 general election when he was clear favourite to win it, thereby sparing us whatever socialist folly he might have brought to Downing Street. I salute him again for popping up to propose a 2 per cent wealth tax on fortunes above £10 million that might raise a supposed £11 billion for the hard-pressed Chancellor – thereby bringing into sharp focus the vague threat that several cabinet ministers have studiously refused to rule out.

Pressure is building on Rachel Reeves from backbenchers, unions and anti-poverty campaign groups to mount a raid on the rich in her autumn Budget. But Kinnock of all people, a firebrand backbencher at the time, should remember that Labour’s 1974 manifesto included the promise of ‘an annual Wealth Tax on the Rich [and] a new tax on major transfers of personal wealth’ – which was dead within two years.

Why? Because of concerns in the Treasury, and among worldly Labour voices such as the (millionaire) cabinet fixer Harold Lever, that at a time of dire UK economic performance, such a confiscatory measure would provoke an exodus of capital and a crisis of business confidence. Sound familiar?

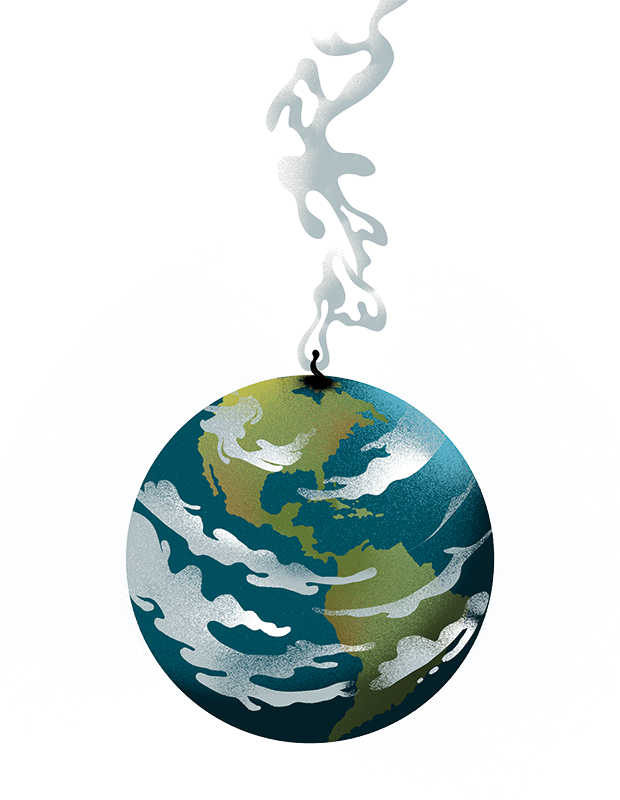

Once upon a time, wealth taxes were in fashion in a dozen OECD countries, as bien pensants bought Thomas Piketty’s thesis, in his absurdly bestselling tome Capital, that a global levy was the moral solution to the fact that the rich were getting richer even while ordinary folks’ real incomes were squeezed. But one by one, most of those taxes were scrapped as being difficult to collect, economically counter-productive and an incentive to entrepreneur flight. In Europe, only Norway, Spain and Switzerland still have them – and further afield, Colombia, presumably in pursuit of cocaine loot. Spain is reckoned to have lost 10,000 of its richest since the higher rate was raised to 3.5 per cent in 2022. In short, the tired old wealth tax concept is a classic red flag of envy politics – and we must thank Lord Kinnock for waving it.

Not with a bang

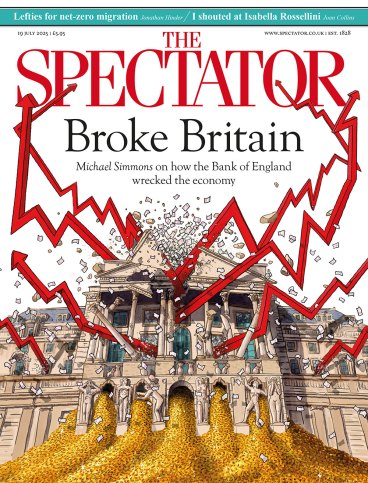

Meanwhile, Reeves’s ‘Leeds reforms’ ahead of her Mansion House speech on Tuesday made great play of slashing City red tape. But after a backlash from the sector she has U-turned on her well-advertised plan to cut the £20,000 tax-free cash Isa limit in the hope of pushing savings towards UK equities.

Spin ahead of the day’s speeches talked of a new ‘Big Bang’. But until there’s a tidal shift of capital towards high-growth UK companies – and valuations rise accordingly, driven by a revival of international confidence in UK prospects generally – all other City reforms risk being dismissed (to misquote T.S. Eliot) not as bangs but as whimpers.

Rose among clowns

Congratulations and an overdue apology to Cindy Rose, the senior London-based Microsoft executive who has been headhunted to revive WPP, the advertising and PR conglomerate that has never fully recovered from the acrimonious departure of its creator Sir Martin Sorrell in 2018. One of the few world-scale businesses built in Britain in the past 40 years and a long-time constituent of the FTSE 100 index, WPP stands accused of running adrift in the era of social media marketing. Torn by internal strife, it has lost clients and seen its shares plunge; another sharp fall followed the resignation of the current chief executive Mark Read and a profits warning last week. Some analysts say the best hope is a break-up into its constituent agencies, while Sorrell himself declares unhelpfully that WPP may be ‘too far gone’ to be turned around, even by Rose.

Who is she? A New York-trained lawyer, she has also worked for Vodafone and Virgin and been called ‘the most powerful woman in UK tech’. And I’d guess she’s well skilled at deflating the overblown male egos that tend to disrupt ‘talent-led’ firms such as WPP – which takes me neatly to my apology, for an episode long ago when Rose, newly arrived to work for a top London law firm, found herself among Englishmen behaving riotously at a dinner party that might have been a rejected scene from Laura Wade’s play Posh. This being the pre-internet age, an exchange of barbed letters followed, mine on crudely faked US Supreme Court letterhead purporting to offer consoling advice from Justice Clarence Thomas.

While I guffawed at my own ungallant wit, she evidently concluded that if this drunken ‘peanut gallery’ (I think that was her phrase) was the best an expensive British education could produce, she’d have no difficulty overtaking us to build a top-level corporate career on this side of the pond. As indeed she has: so not only is moral victory hers but I suspect our buffoonery hardened her ambition. And I’ll happily offer her tea at the Ritz to celebrate that positive outcome.

Korea from here?

How do we achieve a revaluation not just of London-listed stocks but of the UK as a whole in the eyes of the world? The question came to mind twice this week. First, contemplating (but not actually ordering) a ‘Korean Crunch Burger’ on the room-service menu of a Premier Inn, I wondered how the austere industrial powerhouse of South Korea I knew in the 1980s became so fashionable in fast food, pop music and cinema that the prefix ‘K-’ will these days sell almost any gimmick. Next, enjoying pierogi and vodka at the Ognisko restaurant in South Kensington’s Polish Hearth Club, I recalled the downbeat post-communist Poland of the early 1990s, now a rising star of European diplomacy, tourism and even Wimbledon tennis.

In both cases, a generation-long release of creativity and animal spirits has wrought startling transformation. How do we get there from here? Certainly not by following the flickering torch of Reeves and our visionless Prime Minister. But still the question should be writ large on every Westminster whiteboard.

Comments