“7m caught in tax blunder,” trumpets the cover of this morning’s Daily Mail. “After a series of errors, six million will get an average £400 rebate,

while a million face demand to pay £600.”

“7m caught in tax blunder,” trumpets the cover of this morning’s Daily Mail. “After a series of errors, six million will get an average £400 rebate,

while a million face demand to pay £600.”

It’s a good story — but it’s also sadly, wearily familiar. Rewind the tape to last November, and the Telegraph was running with the headline, “New HMRC tax blunder means thousands face demands to repay”. Last September, the Guardian had an article about the 10 million people who might be owed rebates. Last August … oh, you get the point. Nary a month has passed without some tale of how HMRC has screwed up once again.

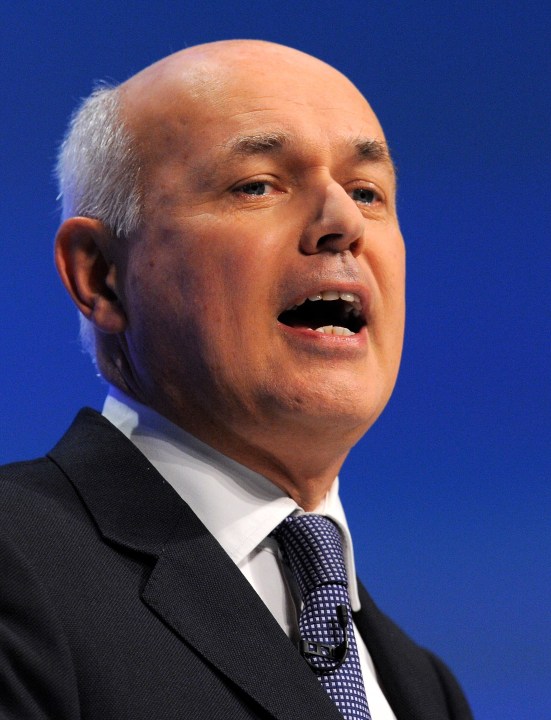

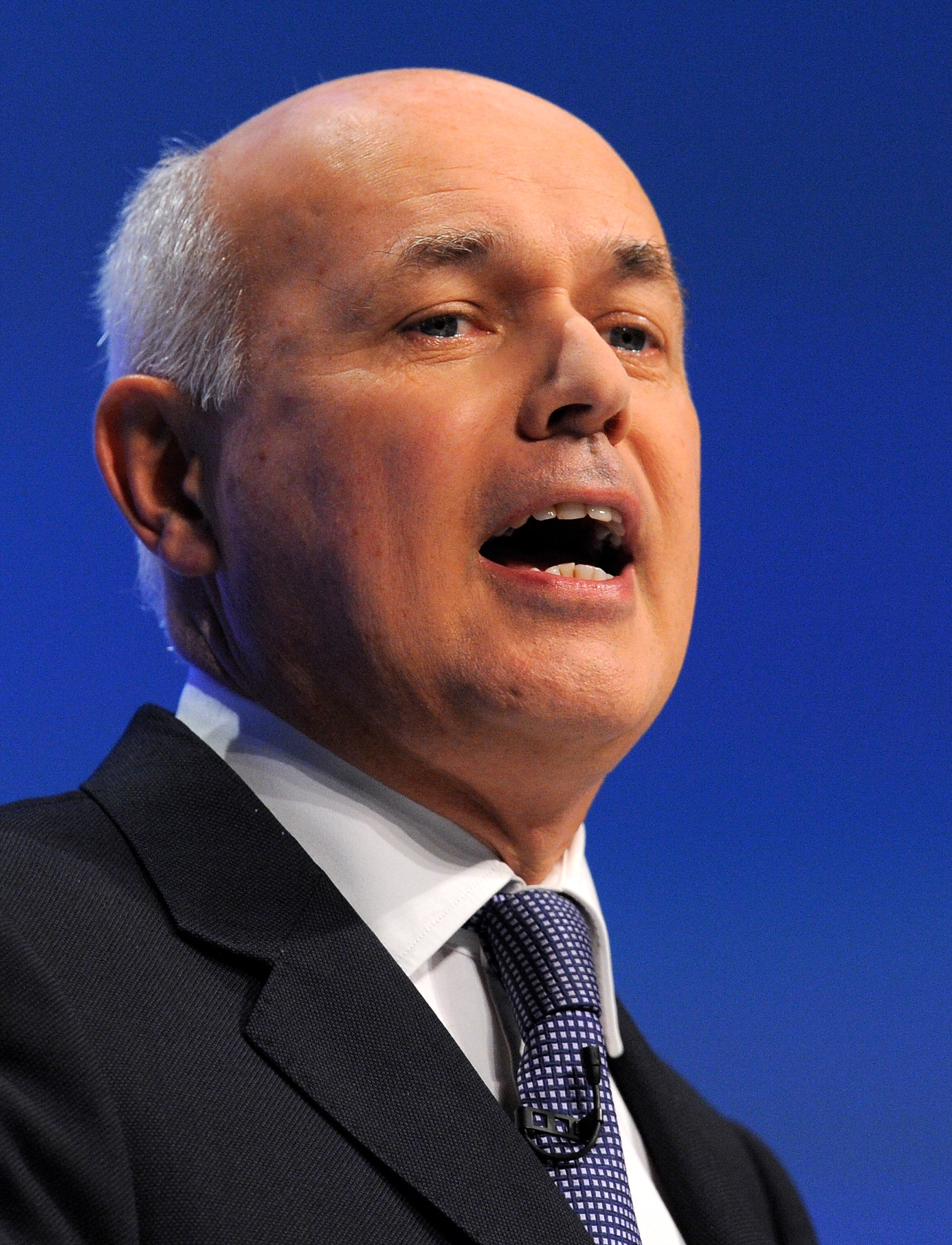

The persistent problem is the department’s Pay As You Earn (PAYE) computer system — which has never been up-to-standard, but which is slowly being fixed now. In fact, many of the miscalculations are emerging thanks to that process. The aim is to create a system that not only works, but that will be better suited to IDS’s universal credit. It is hoped that, eventually, people’s tax and benefit levels will be able to be worked out in “real-time,” with minimum fuss and form-filling.

While all this is progress of sorts, it does also suggest how Duncan Smith’s crucial reforms might be undermined. Whitehall and computers just don’t get on with one another, and there are already doubts that the new PAYE system will meet its April 2014 deadline. This, I’m told, would not be too much of a problem for the timing of the new benefit reforms, but it’s still not ideal. As dull as it sounds, this is one story about tax and computers that is worth paying attention to.

Comments