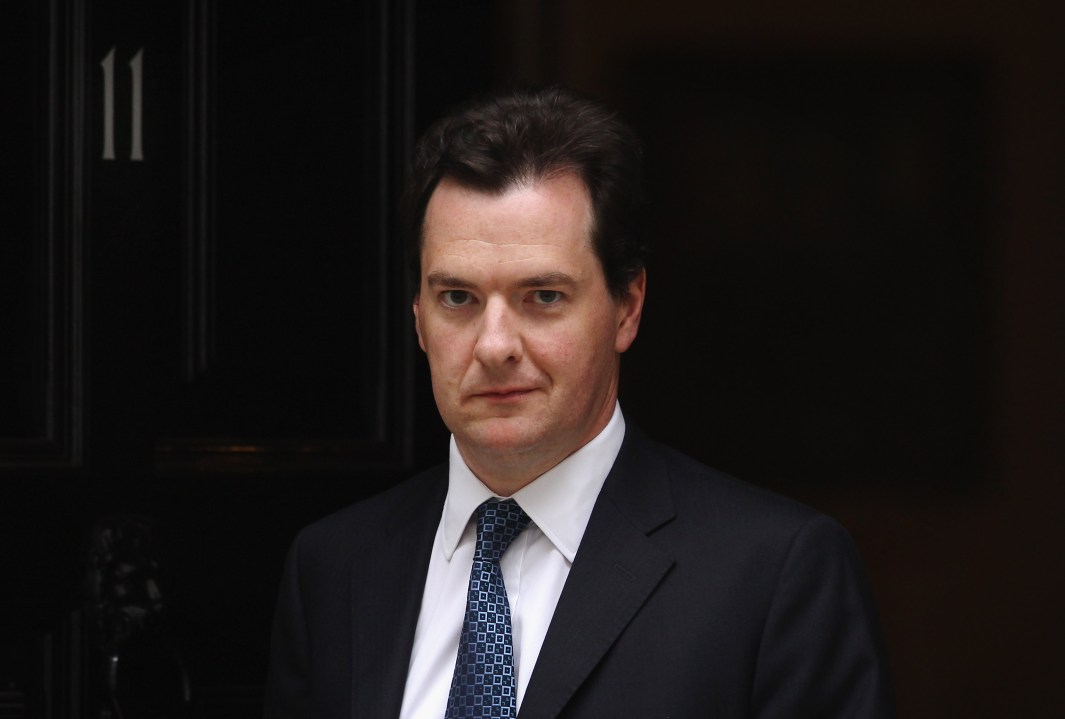

Try telling George Osborne that ‘tax doesn’t have to be taxing’ — I’m sure he’d laugh at the sentiment. The story this morning is that he has a grand, gritty choice to make ahead of the Budget: to tax income or to tax wealth. The Lib Dems have apparently agreed to relent on the 50p rate, but only if they get a mansion tax on properties worth over £2 million in return. The thinking is that, in the current political environment, the government must always be seen to be hitting the well-off in some way.

So, will Osborne accept the offer? He and other Tories will certainly be tempted to do so. For starters, there are fiscal as well as political arguments for replacing a cut in the 50p rate with a tax hike elsewhere, as Paul Goodman explains in the FT this morning. And then there’s what it would mean for growth. According to the OECD, property taxes are less harmful to the overall economy than personal income taxes:

But Osborne will also be acutely aware of the dangers of introducing a mansion tax. It could spark a wider revaluation of properties, which would hit a lot of natural Tory voters as well as, potentially, some that wouldn’t normally be classed as ‘wealthy’. And it would also aggravate many within the party, who would feel that, as Benedict Brogan puts it this morning, ‘there are some issues which should be off limits to political expediency because they touch on a party’s very being.’

There is one potential escape route for Osborne, though: the £10,000 tax threshhold. The Lib Dems always describe this popular policy as their ‘priority,’ and so it should be. But is reaching it ‘priority’ enough that it would compensate, by itself, for somehow diluting the 50p rate? And would that satisfy the public too? In any case, if Osborne does want to lower income taxes — particularly at the top end — then he’s going to have to put forward a more dynamic argument about what that means for the public finances and the general economy.

Comments