From rescue to recovery — that’s how George Osborne is selling his Budget ahead of its release tomorrow. But what might we see beyond the rhetoric? Here’s a five-point guide for CoffeeHousers:

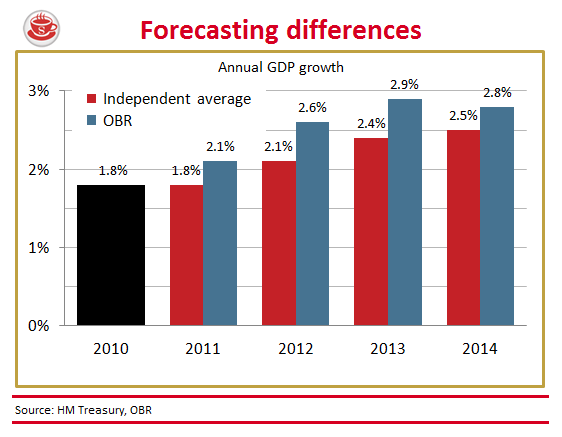

1) Growth. It almost feels like a tradition now: a new Budget, and a new set of forecasts from the Office for Budget Responsibility. Chief among them will be what the OBR says about growth. Its previous forecast for 2011, made last November, was for 2.1 per cent growth in 2011 — but that will almost certainly be downgraded after the mini-slump in the fourth quarter of last year. As this graph shows, the average of the 39 forecasts collected by the Treasury is now at 1.8 per cent; the OBR’s own forecast will likely shift towards that:

Of course, the usual health warning applies: the OBR doesn’t have superheroic powers of foresight. While

a downgrade would be discouraging, it does not spell disaster for the economy. But don’t expect Ed Balls to admit to that in his response to the Budget. He’s been priming an attack on growth for weeks now. Indeed, I wouldn’t be surprised he leads off tomorrow with

something like, “The Chancellor talks about recovery, and yet he’s just had to downgrade his first growth forecasts…”

2) Spending. The big spending decisions were, in truth, made in last November’s Comprehensive Spending Review. In which case, don’t expect much change to the overall picture that emerged

then. The cuts to total spending will still only take us back to 2008 levels, not much deeper than Alistair Darling would have managed:

Yet, when expressed as a percentage of GDP, that still means that the cuts are similar to those of the Thatcher years:

3) Borrowing. Osborne’s Prime Directive is simply this: to get the deficit — aka, public sector net borrowing — down. And he’s been doing fairly well so far. It’s likely that, thanks to higher-than-expected tax takes, borrowing will undershoot the OBR’s current £148.5 billion forecast for the fiscal year, which is already £7.9 billion down on last year. Yet the undershoot will probably not be as much as we expected previously. New figures have borrowing at £11.8 billion for February, well above the consensus forecast of £8.0 billion. So whereas Citi were, before today, predicting the deficit to be £138 billion, they now have it at £142 billion.

4) Debt. And here’s what I like to call The Scary Graph; one that we shouldn’t lose sight of during the blizzard of other metrics. Despite the spending and borrowing reductions, and whatever actions are taken tomorrow, the overall national debt will still creep upwards under this government:

Although it will start going down as a percentage of GDP:

If you want an even scarier graph, then the IFS’s projections for when debt will return to pre-crash levels are Grade A grim.

5) Policy. Those wonderful folk over at FT Westminster have already done a breakdown of the policy measures to look out for tomorrow, so do hasten to their post. Suffice to say, here, that the Big One will probably be George Osborne’s plan to merge National Insurance and income tax. For reasons we have gone into before, this is not a straightforward proposal, and will take some years to implement — but it would nonetheless be a totemic shift in how we are taxed. Aside from that, it would be extremely surprising if Osborne didn’t act on fuel prices, at least postponing the planned hike in fuel duty. And there will be a bundle of measures — such as new enterprise zones — designed to reduce the regulatory burden on business and nurture entrepreneurship.

Mr Osborne, over to you.

Comments