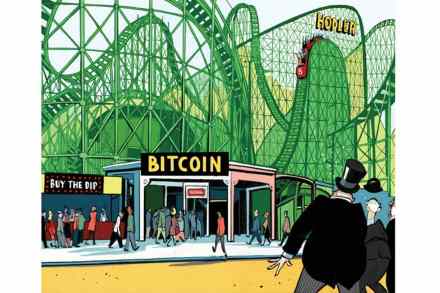

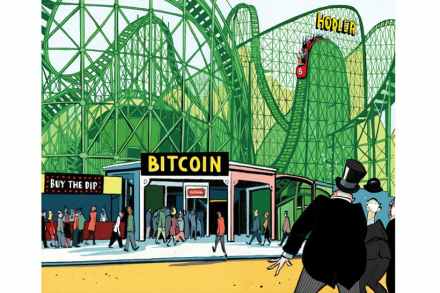

This time it’s crypto: now the Bank of England bows to Trump

The softening of the Bank of England’s stance on ‘stablecoins’ looks like another tugging of the British forelock towards the Trump regime. Stablecoins are virtual money akin to cryptocurrency, but theoretically safer because their value is pegged to the dollar or other conventional currencies. Often used by investors to buy into crypto, they’re claimed to offer a more efficient future for international payments – but also accused of facilitating crime. Two years ago, Governor Andrew Bailey decreed that stablecoins did not ‘meet the standards we expect of safe money’; other non-US regulators largely agreed. That well-known crypto player Donald Trump, however, called them ‘perhaps the greatest revolution in financial technology