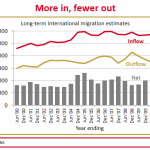

Right to reply: The impact of immigration on the labour market

Yesterday, we introduced our new “Right to reply” series, where outside writers take on some of the ideas and arguments raised on Coffee House. In that case, it was the IPPR’s Matt Cavanagh replying to Fraser’s recent post on immigration and the labour market. Here’s another reply to the same post, this time by Jonathan Portes of the National Institute of Economic and Social Research: Myths abound when it comes to the effect of immigration on the labour market — and the most damaging of these is that most or all “new jobs” go to migrants. Although I agree with Fraser Nelson’s general views on immigration, he is misleading on this one point.