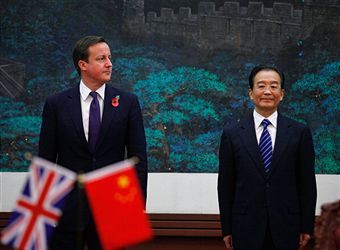

Nothing Miliband says can rain on Mr Confident’s parade

Back from Zurich, where he’s been helping FIFA determine the winner of the world’s greatest bribery festival, Cameron was in hearty form at PMQs today. He faced Ed Miliband who looks increasingly like the life and soul of the funeral. His party is riding high in the polls – but only when he’s away. As soon as he pops his head back around the door a groan of misery goes up and his rating collapses. Earlier this week the OBR gave an upbeat assessment of the economy so Ed sent his bad-news beavers to sift through it for signs of toxicity. They couldn’t find much. Jobless totals are to rise.