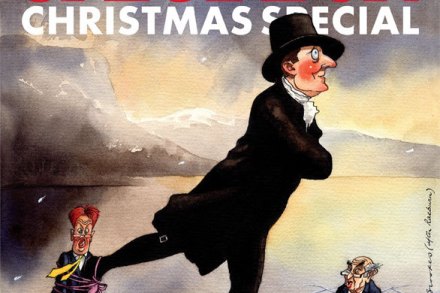

The right has little cause for alarm

It is to his credit that nuance is a word inimical to Lord Tebbitt. The unashamedly independent voice of the past has written a cutting piece about the coalition, the Lib Dems and the Oldham East by-election. He says: ‘A Lib Dem win would tilt the Coalition even farther Left and away from Conservative policies.’ Many Tory ministers joke that they thought themselves right wing until meeting their Liberal colleague. This is a radical government that many on the right can cheer. Iain Duncan Smith’s welfare reforms are intended to make work pay and break the cycle of dependency; Michael Gove’s education reforms are market orientated; Grant Shapps’ housing reform