The rookie gambler turns pro

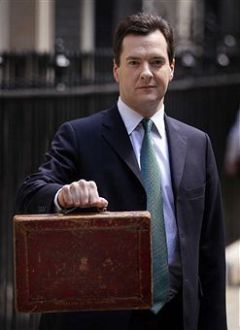

George Osborne is an enigma. For many, his politics and personality are defined by a photograph of him sneering in the Bullingdon’s clashing colours. The determined face that presented the Budget contradicted that stereotype; it suggested that Osborne was coming of age. Paul Goodman was part of Osborne’s Shadow Treasury team and one of the ‘Gang of Four’ who prepared IDS and Michael Howard for PMQs, along with Boris, Cameron and Osborne. He has written an extensive appraisal of Osborne the man and politician. Read the piece: it’s enthralling, a detailed account of Osborne’s political adolescence through the years of defeat and a candid analysis of his tactical expertise.