Portrait of the week | 21 May 2015

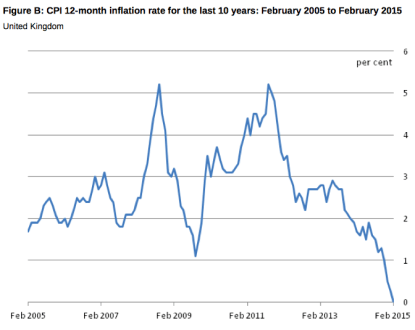

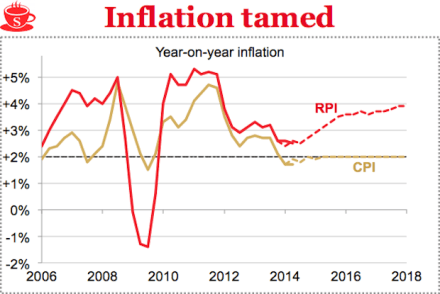

Home The annual rate of inflation turned negative in April, for the first time since 1960, with deflation of 0.1 per cent as measured by the Consumer Prices Index, so that a basket of goods and services that cost £100 in April 2014 would have cost £99.90 in April 2015. But, measured by the Retail Prices Index, inflation continued at a rate of 0.9 per cent. Marks & Spencer reported its first rise in annual profits for four years. Police trying to find the gang that broke into safe-deposit boxes in Hatton Garden last month arrested nine men. A botanist claimed unconvincingly that Shakespeare was depicted in the frontispiece of