What’s better than a tax cut?

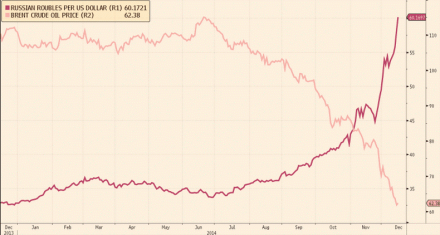

What’s the most important political development this year? The falling oil price. As of 2.30pm, Brent Crude was trading at $50.80 dollars a barrel—massively down on the $115 dollars a barrel it was trading at back in the middle of June. If the plunging price of crude is passed on to consumers, it’ll be the equivalent of a mega tax-cut and might just produce the feel-good factor that has been so lacking in this recovery so far. The Tory leadership is acutely aware of this. As Cameron did the rounds before Christmas, the falling oil price was often the first thing that he brought up. While Tory Ministers now are