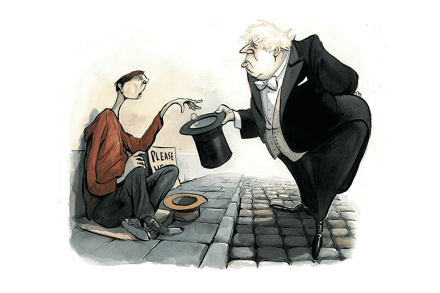

Your state pension is a socialist bribe

Every four weeks the government sends me my state pension. Those words have a socialist, almost Soviet, ring. The amount has recently risen to £11,973 a year – a preposterous sum to send a 67-year-old man still in paid employment. But from the state’s point of view, the money is not entirely wasted: it buys a kind of loyalty. Because I accept the money, and do so with a certain pleasure, I am bound into the system and am less likely to say it’s a bad one. I’ve allowed myself to become a dependent. I may criticise the way the welfare state is run and demand improvements in the administration