Why our national debt went up by £1,300 billion today

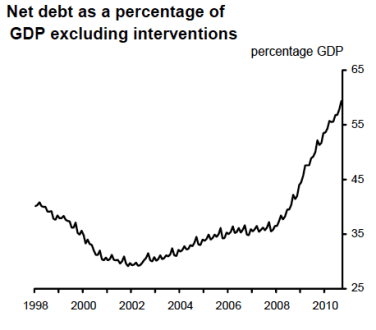

It’s not just the growth figures, you know. Today, the Office for National Statistics also released its latest estimates for the state of the public finances. Among the headline findings was a crumb of consolation for the Treasury: it is on track to meet its borrowing target for the financial year. But that’s by the by when compared to this other snippet from the ONS release: our national debt went up by £1,300 billion in December. Don’t worry, though – it’s not really as terrible as all that sounds. What’s happened is that the human calculators have finally worked out how to account for Lloyds and RBS on the public