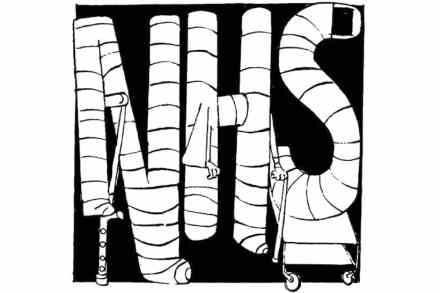

Get ready to start paying the cost of Covid

Forget the desirability (or lack thereof) of tax hikes: can Britain survive them? That’s the economic question that kicked off the new year in cabinet this week when Jacob Rees-Mogg was reported to have encouraged the Prime Minister and his colleagues to roll back plans to bring in the new National Insurance levy this April. A recap on the proposals: the 1.25 per cent National Insurance hike will be paid by both employers and employees, and will eventually be funnelled into social care, we’re told. But for the first few years, most of the tax revenue it raises (roughly £12 billion) will go to addressing the NHS backlog and the millions