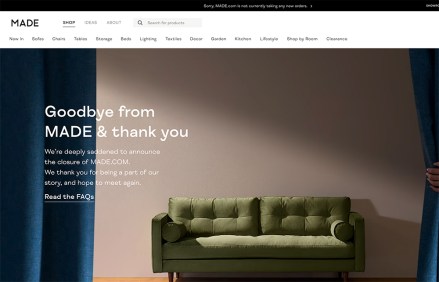

Made.com is a dotcom parable from an earlier era

‘Reparations’, much bandied about at Cop27, is a dangerous word. It speaks of an admission of historic guilt, which no one can deny has a place in public discourse. But its intention is to put a punitive price on guilt itself, rather than to advance collaborative work needed to rectify damage that can be traced