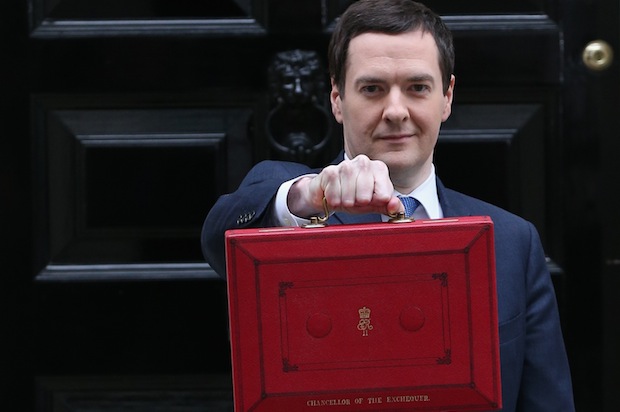

George Osborne has been in retail mode this morning, selling his pension reforms and explaining how pensioners can unlock their life’s savings. The Chancellor has said that the Treasury will work with the Citizen’s Advice Bureau, Age UK and other organisations to provide pensioners with the best possible impartial guidance to transform their retirement. Interested parties can consult the Treasury for more details.

Osborne, in the course of this effort, gave a politically pointed interview to the Today programme. His watchword was freedom:

“We have to get away from the patronising view that the state know best” – George Osborne on plans for free & impartial pensions guidance

— BBC Radio 4 Today (@BBCr4today) July 21, 2014

Osborne went on to add that this was what the pension reforms are ‘all about’.

More cynical voices might, however, refer to Allister Heath’s article in this morning’s Telegraph, which says:

‘Despite the stonkingly good economic growth, and the near-miraculous performance of the jobs market, the budget deficit remains horrifyingly large. The government is set to borrow another £95.5bn this financial year, a mere £11.9bn less than in 2013-14. Matters are improving far too slowly: with the economy booming and GDP likely to expand by at least 3pc this year, the public finances ought to be in a much better state than they are.’

Heath notes that tax receipts remain depressed because real wages are falling and consumer spending is sluggish while households retrench. The deficit is running at 6.6% in 2013-2014. The hope is that it will fall to 5.6% next year. Some 65% of cuts are still to be implemented.

When seen through the dark prism of the public finances, the pension reforms have a different appearance – more fiscal necessity than political principle. The reform will release a vast amount of cash for pensioners to spend – and they will spend it because there’s not much point in being the richest man in the graveyard. The Treasury anticipates that the reforms will raise £320m next year, rising to £1.2bn in 2018-2019. As Fraser noted on Budget Day, ‘Osborne is, quite literally, banking on a pensioner spending splurge.’

Elsewhere in the interview, Osborne spoke about sanctions relating to the MH17 outrage – and there is a lot of chatter about ‘Iran-style sanctions’ in the press this morning, notwithstanding the damage that this would do to the British economy and (ho, ho) pension funds that have invested in oil and gas companies that run joint ventures with Russian state companies. Osborne was clear on sanctions and the integrity of national borders:

G Osborne backs sanctions against Russia: “The economic impact of not acting in a situation like this could be very much worse.” #r4today

— PoliticsHome (@politicshome) July 21, 2014

It is less clear what those sanctions will be. The EU is reportedly divided on the subject, with Germany apparently favouring a less severe approach than other western countries, many of which happen to be less reliant on Gazprom. The split is further evidence of a fissure at the heart of the Commission over how to deal with Russia; with bitter rows over the identity of Cathy Ashton’s replacement as EU High Representative. Federica Mogherini, the Italian foreign minister, is deemed to be unacceptable due to her allegedly pro-Russian credentials. But, alternative candidates such as the Swedish foreign minister Carl Bildt might veer too far in the other direction. Once again, the EU appears to dither while events turn apace.

Comments