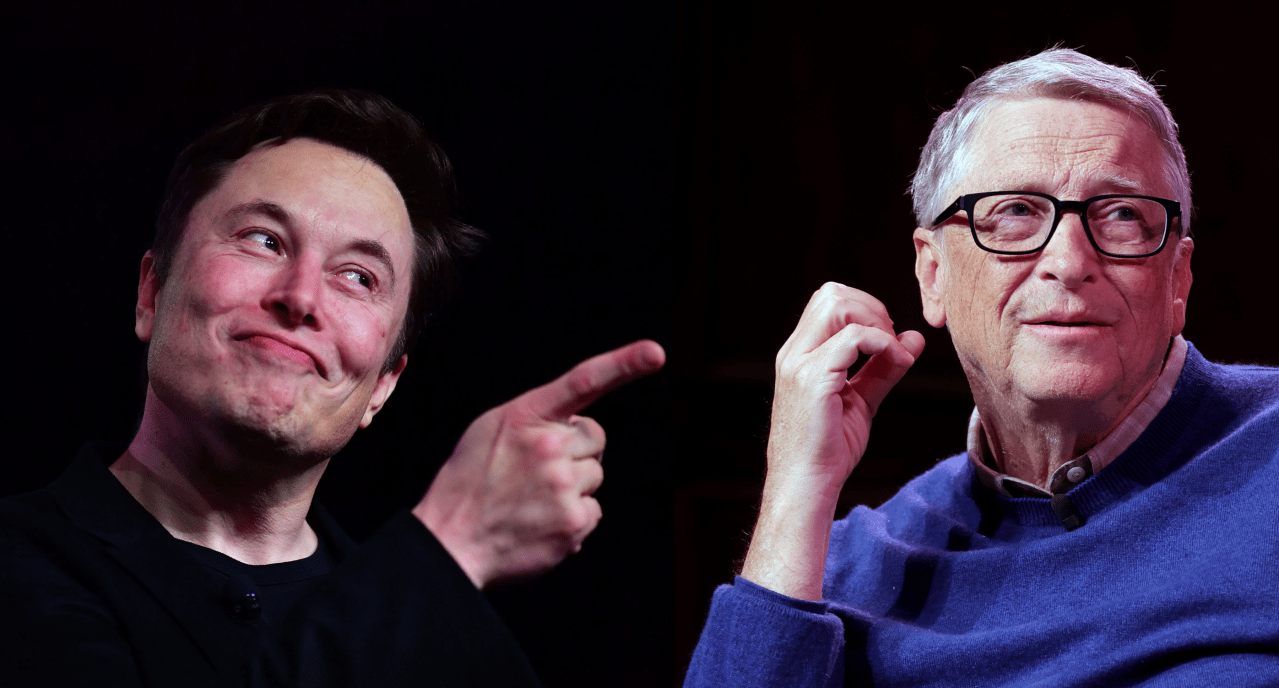

Is Bill Gates shorting Tesla? He certainly didn’t deny it in an interview with the Today programme. The suggestion is that he has upset Elon Musk, who has complained that he couldn’t take Gates’s philanthropy on climate change issues seriously if he was betting against the share price of the world’s biggest electric car-maker.

But Musk’s outburst rather evades the issue: is Tesla’s share price destined to fall? You could be the most ardent climate change campaigner, the biggest enthusiast for electric cars in the world – and still think that Tesla is overpriced. The trouble with Tesla’s market valuation is that not only does it assume that electric cars are the future – which is still not entirely certain, especially given the soaring prices of rare metals which are going to make it increasingly difficult to produce electric vehicles that achieve price parity with petrol and diesel models. The share price also seems to assume that Tesla is pretty much the only car company in the world which can make electric cars. How else to explain why Tesla, at $942 billion (£760 billion), is worth more than every other car manufacturer in the world? Toyota comes in at $280 billion (£220 billion), Volkswagen $84 billion (£70 billion), Ford and GM a mere $58 billion (£45 billion) apiece.

I can happily change my brand of car in an instant, but you just try easing Microsoft out of your life

You can argue that the established car-makers have been caught napping and failed to appreciate the marketing potential of electric cars. But what is it that Tesla owns that will prevent other manufacturers from catching up and taking a share of its lunch? Its own dedicated network of chargers? That might be an advantage now, but it is not going to last as the charging network becomes more developed. Is there any proprietary technology that Tesla owns which could prevent other entrants to the market? Absolutely not. Other car manufacturers already can and do make electric cars, even if their ranges are less well-developed than Tesla’s currently is.

Tesla’s vast market capitalisation is based on two factors: firstly the large profit margins it has found it can make on luxury electric cars; and secondly, the huge tax credits that are on offer to buyers of electric cars, especially in the US. Neither is going to last. As other luxury manufacturers refine their electric car ranges, Tesla is going to find it increasingly difficult to protect those profit margins. Electric cars attract a type of evangelist who is prepared to pay inflated prices for a vehicle, but there are only so many of them around, and most of them will already very likely be driving a Tesla. Secondly, the tax credits are not going to last. Their purpose was to grow the market for electric cars, but the larger it grows, the less governments will feel the need to offer bungs to the buyers of these cars. Indeed, when electric cars become commonplace, governments will not be able to afford to subsidise them.

Bill Gates’s bid for world domination makes for a far more convincing investment case than does Elon Musk’s. I can happily change my brand of car in an instant, but you just try easing Microsoft out of your life. The company’s products are embedded in virtually every business in the world, as well as in the lives of vast numbers of private citizens. Everything I have backed up is backed up in the form of a Microsoft product. Like or loathe Microsoft, we are all pretty much hooked on their services.

I am not going to short Tesla or any other share. The risks are too great. However much you correctly analyse the economic fundamentals, you can still get caught on the wrong side of investors’ emotions – especially in a company like Tesla which has a large number of private shareholders as well as institutional ones. But I suspect Gates is right: Tesla is a bubble waiting to burst, regardless of the future of electric cars.

Comments