The tax burden in the UK is nearing a 70-year high — but that’s not stopping ministers from mulling over plans to hike taxes further. According to reports this morning, Boris Johnson and Rishi Sunak are close to agreeing an increase to national insurance to help address the NHS backlog (five million patients in England, and counting). They also want to fill the long-standing black hole in the social care budget: something Johnson promised he’d address nearly two years ago to the day when he first entered Downing Street.

The rumours have immediately led to criticism of the government’s willingness to break its manifesto pledge, not to raise income tax, national insurance or VAT. Last week’s vote in the Commons to roll back the UK’s foreign aid spending laid the groundwork to further pivot away from the manifesto — but to break the ‘triple lock’ on taxes promised in 2019 would be seen as ripping up the manifesto completely.

But frankly, breaking another promise would just be the tip of the iceberg. Hypothecated taxes — designating a specific tax to fund a specific purpose — don’t work. They’re too volatile, especially for something as important as healthcare. If the government sticks to ring-fencing, then the thing that is being funded (in this case health and social care) will be subject to the ebbs and flows of the economy, which can see tax revenue go down as well as up.

Hypothecated taxes — designating a specific tax to fund a specific purpose — don’t work

Take the rumoured proposal: a 1 per cent increase on national insurance to plug holes in health and social care. The Resolution Foundation estimates that 1p on the pound would translate to £6 billion extra tax revenue a year to be spent on the NHS and care homes. What happens if there’s another lockdown (given the government’s language around so-called ‘freedom day’, nothing can be ruled out) that sends unemployment higher, or a recession triggered by something else, and NIC receipts fall? Would the government be comfortable with letting health and social care spending rise and fall with tax receipts?

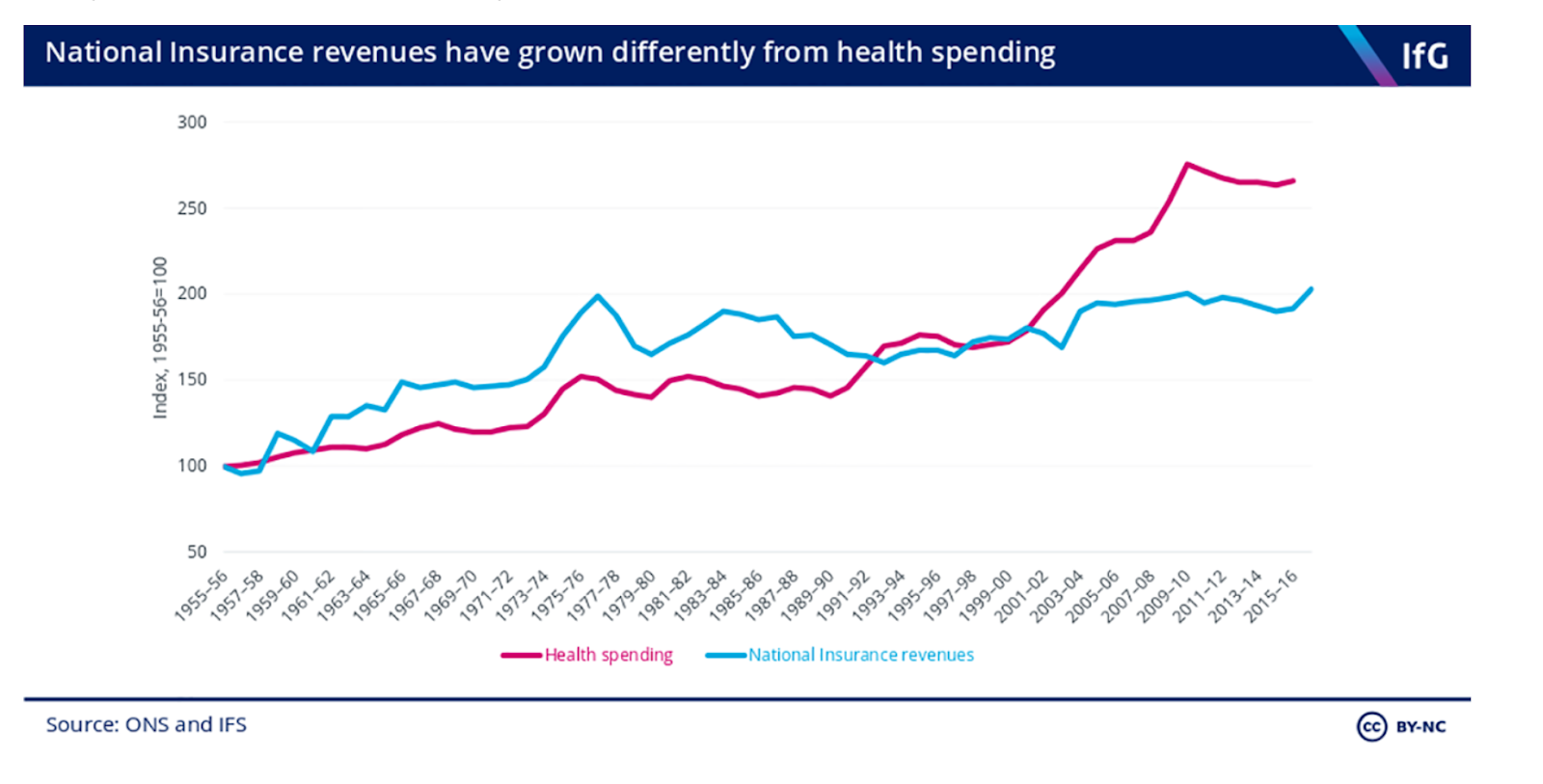

Almost certainly not. As the Institute for Government notes, back in 2002 when Gordon Brown introduced a 1p increase on both employers’ and employees’ NI to boost NHS spending, money for healthcare still far outpaced the tax rise. As it turns out, the government didn’t like having its hands tied when it came to prioritising where to spend. So in practice, the NI hike didn’t work as a tax linked directly to NHS spending: it was just more money for the overall pot. A stealth tax, that gave the government more resources to spend on whatever it saw fit.

There’s a good reason why the government would want to be able to reprioritise its spending plans on a whim. There’s perhaps no better example than the past 16 months, when Covid demanded a fast rethink of how resources were deployed. This makes it even more likely, however, that this NI tax hike won’t stay hypothecated for long: it’s yet another £6 billion into the Treasury’s coffers, which gets swallowed up by the state. Some of the cash might find its way to the health service, but as a decade’s worth of real-terms funding increases shows, this isn’t going to do much to improve waiting times or make a meaningful dent in the Covid backlog. Former health secretary Jeremy Hunt is selling the idea of a hypothecated tax today to ‘make our cancer survival rates as good as Denmark [and] Australia’ — with almost nothing in the way of evidence to show that it will. (Hunt is comparing the NHS to systems with far more market mechanisms, which even before Covid hit were shown to decrease waiting times and improve patient outcomes).

It’s no surprise that calls for tax rises are made in the name of the NHS. A soft spot for the British public at the best of times, and a lifeline at their worst, millions of people will be growing increasingly worried about the length of time they’re being asked to wait to receive treatment. But a hypothecated tax isn’t the answer, and this government should know better. In just the past few weeks, it has had to deal with the consequences of making ring-fenced spending promises: rolling back the foreign aid budget, facing the very real prospect of finding billions more pounds than expected to pay out on the pensions ‘triple lock’, which due to a statistical anomaly during Covid could see the state pension increase by a staggering 8 per cent.

Who will pay for this non-solution? As NI only applies to earned income, it will be working-age people, the younger generations, asked to shoulder the financial burden of supporting the older generations. Hardly a long-term, sustainable option — and certainly not one that finds a balance between the generations for who must foot our increasingly large bills.

That the government is considering a stealth tax to tackle the serious problems facing health and social care suggests we’re entering desperate times. Ministers aren’t simply running out of areas to tax, but they’re terrified of having a frank conversation with the public about the state of our finances. In truth, the government was going to struggle to meet its spending commitments long before the pandemic hit: now it most certainly can’t without tax rises, growing the economy or trimming back what they initially said was on offer. It appears this Tory government is opting for both the laziest and most painful option.

Comments