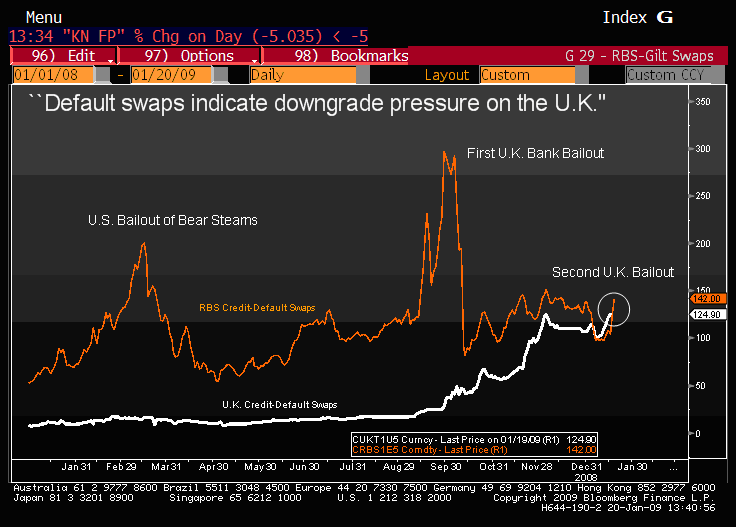

Britain is now as likely to go bust as RBS – this is the official verdict of the markets. At the bottom of this post is Bloomberg’s Graph of the Day, which shows how Britain’s dodgiest bank and Europe’s dodgiest government now have the same “credit default swap” rating – the yardstick the markets use to guage whether something’s about to go bust. No wonder, you may say, given that RBS is state-owned. But my point is that this has major implications for our ability to borrow – and borrowing is what both Cameron and Brown will be relying on to pay the bills. Spain lost its AAA rating yesterday, and the markets think Britain may be next. This would increase the cost of borrowing, our taxes, our mortgages – the works. I wish I could find a way of getting across, in plain, non-hyperbolic English, the sheer scale of what’s going on right now, and what this means to our country’s ability to finance itself. I just can’t: the size of our problems defies my powers of expression. Journalistic language can’t do it justice: we cried doom months ago, and we were right. Crying “double doom” now wont resonate. So I leave you with this recent, chilling analysis from Michael Saunders of Citi:

“The debt-fuelled boom in asset prices and spending in recent years was so huge that deleveraging and retrenchment will cast a shadow over the economy for many years. The combined debts of households and non-financial firms surged to 219% of GDP in Q3-2008 — the EU’s highest — from 128% of GDP at end-97 and 98% of GDP at end-87. Debts of leveraged non-bank financial firms (e.g. hedge funds, private equity, banks’ off-balance-sheet vehicles, wholesale mortgage lenders) rose even faster, to 172% of GDP in 2008-Q1 from 66% of GDP at end-97. In turn, total sterling and FX assets of UK banks surged from £188bn (240% of 1996 GDP) at end-96 to £754bn (521% of 2008 GDP) in early 2008. This debt boom relied heavily on short-term external funding. The UK’s external debts (i.e. debt owed by UK banks, non-bank companies, households and government to non-residents) ballooned from 129% of GDP in 1987, to 197% of GDP at end-1997 and 413% of GDP in 2008Q3. This is, by a long way, the G7’s highest. Moreover, roughly three-quarters of the UK’s external debts are short term, making the UK highly vulnerable when, as now, global banking flows dry up. Credit booms and asset booms are as old as capitalism. But, this one was especially big, both in the UK and overseas. Because inflation was capped by benign effects from globalization over recent years, this credit boom was allowed to run until it collapsed under the weight of worsening credit quality, high debt service burdens, high debt rollover, and extraordinarily high house prices. As a result, the UK now faces a savage mix of shrinking bank assets, widening lending spreads and falling asset prices. Although financial market conditions are improving a little, the process of retrenchment by banks, companies and households is far from over.

And, further ahead, if and when the recession eventually ends, there are uncertainties as to whether the authorities will be able to manage the withdrawal of massive policy stimulus at an appropriate pace to avoid both a massive upsurge in inflation and a renewed dive into recession. It will be a long journey — probably many years — back to economic stability.”

Comments