There was no economic growth in July, according to the Office for National Statistics. The latest GDP figures show that a boost in services output – 0.1 per cent – was offset by a tumble in production and construction output – 0.8 per cent and 0.4 per cent, respectively – leading to no overall growth in the month of the election.

It’s surprisingly bad news, as markets had expected a modest 0.2 per cent increase in July. Instead, Britain had two consecutive months of no growth.

There is also growing concern that the improvement in services output in July won’t necessarily carry into the latter half of the summer. The rebound in retail sales and the reduction in strike days could take a turn for the worse. GP walkouts could affect the data in August and the Confederation of British Industry reports that there are early signs that August and September will show another dip in sales. But as Capital Economics notes this morning, this ‘doesn’t mean the UK is on the cusp of another recession’ either: in the three months to July, the economy still grew by 0.5 per cent. So long as growth picks up, even very modestly, in the coming months, this isn’t dangerous territory – yet.

It’s rare that a government is bolstered by weaker growth figures, but this update couldn’t have landed at a better time for the new government, which just fought a politically hard battle to means-test the winter fuel allowance for pensioners. Their reasoning, ministers say, is to get the public finances in order and to protect the economy from a downward turn. This is just the first of many battles to come leading up to the October Budget, when substantial tax rises and more spending cuts are expected to be announced.

For Labour’s argument – that the economy is in a dire state and something bold must be done – to work it needs the figures to back it up. So far, things have been going in the other direction, with the economic data pointing towards a better autumn than expected at the start of the year.

Markets are predicting at least one more interest rate cut this year, if not two (despite the lacklustre growth in July, economists expect the Bank of England to hold steady in September and wait until November for another cut). The BoE’s last report substantially revised up its growth forecasts for the year: from 0.5 per cent in May’s report to 1.5 per cent in August’s report. Inflation is back to target. Unemployment is low, and still falling, and the labour market is finally showing signs of cooling down, with job vacancies starting to approach their pre-pandemic levels.

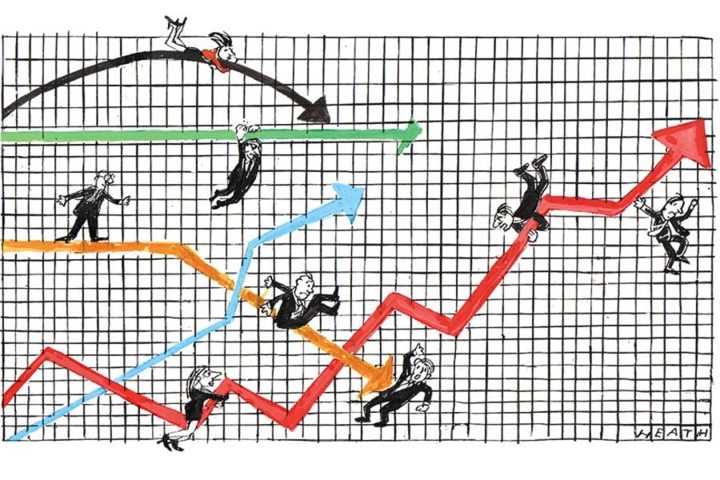

None of this really plays into the idea that the economy is on a knife-edge – nor does a single month of GDP data. But the fact that there has been no growth for two months feeds into the narrative of stagnation. Britain may not be at a risk of a major recession, but growth isn’t guaranteed and the economy is prone to stalling. July’s figures once again highlight this trend.

That helps Labour insist on the need for some radical change. Of course if those changes – red tape, tax hikes, and pay hikes without improved productivity – only make growth harder, they will find it increasingly difficult to keep blaming stagnation on the previous government.

Comments