No new year would be complete without the traditional Oxfam survey showing that a few of the richest people on the planet own more assets than the poorest 50 per cent of the world’s population combined. The figures change, but the gist is the same. January is usually a slow month, and it makes for startling headlines, intended to get us thinking about capitalism’s shortcomings.

It’s also been tradition, for those of us more positive about free markets, to offer a retort: before Covid, global poverty was falling at the fastest rate in history. Global inequality was narrowing because of capitalism, not despite it. Oxfam arrives at its figures by calculating, for example, that a recent Harvard graduate with $250,000 of student loans is worse-off than a rural Chinese rice farmer, because her ‘net wealth’ is technically lower. Such statistical stunts do little to assess — or help — the world’s poorest citizens. But they serve as a yearly reminder of the strange nature of wealth: how prosperity cannot be easily captured by crude figures, clumsily interpreted.

This year, though, Oxfam changed its approach. It abandoned its usual focus on wealth inequality and instead switched to an assessment of lockdown inequality. ‘The recession is over for the richest,’ it claimed this week, while the consequences of economic hibernation linger on for everyone else. The poorest are looking at an uphill recovery for the better part of the decade. And here, Oxfam has a point.

The pandemic has beenone of the biggest drivers of inequality in living memory

The pandemic — and subsequent measures to curb its spread — has been one of the biggest drivers of inequality in living memory. Lockdowns are, by nature, nationalistic: countries turn in on themselves and worry less about the outside world. We may furlough our own workers, but what about the millions outside of our borders forced out of work by the sharpest economic collapse in modern times? The poverty caused by Covid could kill more people than the virus itself, according to the United Nations. It’s estimated there could be as many as 400,000 excess deaths from tuberculosis alone due to missed diagnoses. The International Monetary Fund warns that more than a decade’s worth of closing the gap between developed and emerging economies could be wiped out.

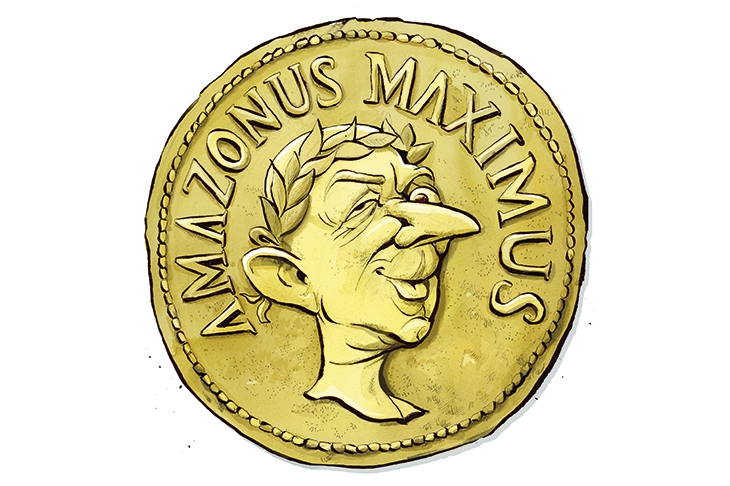

Meanwhile, the tech billionaires — already some of the richest people in the world — have seen the value of their companies surge as consumers became even more dependent on their services. The net worth of Jeff Bezos, founder of Amazon, rose by $90 billion last year. That’s more than the annual economic output of Afghanistan, Botswana and Mongolia put together.

We see this unequal recovery in the UK too. One in three families on high incomes managed to bulk up their savings in lockdown, compared with only one in five families on lower incomes. We have witnessed the bizarre spectacle of the stock market surging while the economy plunges. According to the Office for National Statistics this week, salary growth has returned to pre-pandemic levels. But there’s a catch. The data is skewed upwards because so many low-paid jobs have simply vanished. Redundancies reached a record high of nearly 400,000 in the three months to November.

It’s refreshing to see Oxfam for once use its vast resources to properly diagnose a problem. But its prescription is the same old solution as every year: tax wealth and high incomes. There is no evidence that a cash-grab from the rich directly translates to a top-up for the poor — a point that even organisations such as the High Pay Centre (which seeks to close income gaps) have conceded.

Oxfam’s claim that Europe’s 305 billionaires could use their Covid profits to ‘write a cheque of 11,092 euros to each one of the poorest 10 per cent of Europeans’ is, on the face of it, a standard raid-the-rich proposal that we tend to hear after economic crises. But variations of this argument are now heard in Britain, including a Wealth Tax Commission whose report got lots of attention late last year: what about a one-off wealth tax, to level things? We already tax income: the best-paid 1 per cent contribute 29 per cent of income tax collected. That’s anyone’s definition of a fair share. But what about wealth?

In 1990, 12 European countries had some form of a wealth tax. Most abandoned them. The taxes end up being ineffective, hard to police and often with too many unintended consequences (including issues of double taxation). Then comes the question of incentives: why save money if the government can raid your savings at any point? It would not only be to the detriment of the super-wealthy, but the aspiring working and middle classes as well, if all money were to be redefined as government money, a pot of gold for the state to dip into whenever it wishes.

Before the pandemic, global inequality had been on a downward path, thanks to a market economy that has allowed for wealth and prosperity to be spread and created. The vaccine race serves as a case in point. Oxfam notes that the combined wealth of the ten richest men could pay for universal Covid vaccines, oblivious to the role that the private sector, the market economy and the philanthropy of some of the world’s richest men — most notably Bill Gates — have played in delivering efficient vaccines in the first place.

Things have hurtled backwards. International trade has become hindered by borders and protectionism, progress on human rights has been trumped by temporary infringements on liberty. The best we can do is work towards getting the old show back on the road, and reject failed ideas dressed up as progressive policy.

spectator.co.uk/money - For more economic and financial news.

Comments