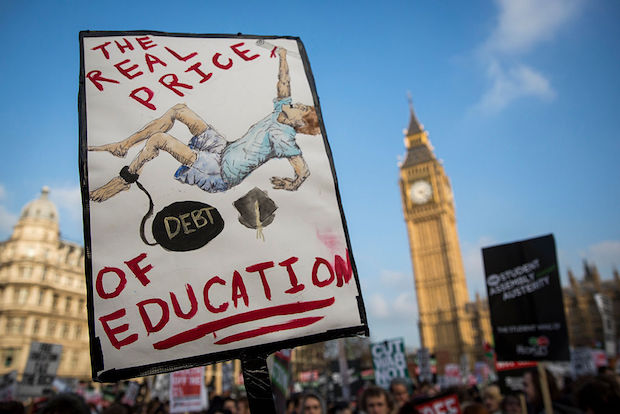

This weekend the papers mooted that Theresa May’s government is looking to cut the English and Welsh student loan interest rate – now at a 6.1% headline rate for those who began uni in or after 2012 – in order to appeal to the youth vote.

I find this frustrating. Not because I object; I’ve always believed on principle student loan interest shouldn’t be higher than inflation – charging students for their education is one thing, charging them for the financing of their education is a step too far.

Yet if the Exchequer has limited resources to finally shell out something to relieve student loan pressures, cutting the interest rate is far from a priority – in fact, it’s poorly targeted. Student loan interest rates change every September, based on the RPI rate of inflation the prior March. For this 2017/18 academic year the rates are as follows:

– While studying: Interest is charged at RPI + 3% (= 6.1% for this academic year) – From the April after leaving: Then the rate is RPI (3.1%) for those earning under £21,000 and RPI + 3% (6.1%) for those earning over £41,000. Those in between are charged on a sliding scale.

Yet do note I say students are charged – not students pay. That’s because student loan repayments solely depend on what you earn, not what you owe. Graduates repay 9% of everything earned above £21,000 for the shorter of 30yrs from the April after you graduate, or until you clear what you borrow (see my 5 things every student and parent should know blog).

So if someone earns, for easy maths, £31,000 (ie £10,000 above the threshold), they repay £900 a year regardless of whether you owe £10,000 or even if they (absurdly) owed £1,000,000. The same is true of the interest rate: at £31,000 earnings people repay £900 a year regardless of whether the interest is 3.1% or 500%.

In other words, what you borrow and the interest rate have no impact on annual repayments. Instead, all it changes is whether or not you’d clear the loan plus interest within the 30 years.

According to the Institute for Fiscal Studies, it’s currently only the highest-earning 23% of graduates that are likely to clear their debt within that time. So they would definitely save money from an interest rate cut (as would some who earn a little less than them as they’d now join the club of those who’d ‘clear within the 30yrs’.)

Yet those who earn less will feel no change whatsoever from a lower interest rate. In other words, cutting the interest rate only helps the highest-earning graduates. Lower/middle-earning graduates are unlikely to gain as they won’t clear much more than their actual borrowing – never mind the interest – within the 30yrs.

In fact, for a good percentage of lower-earning graduates, student loans are interest-free (full help in my Will you really pay 6.1% interest? guide). Contrast that to the government’s real student loan horror this year – the April 2017 freezing of the repayment threshold at £21,000 until at least 2021 – when it was supposed to rise with average earnings.

All students earning over the threshold will repay more each year than they would’ve done – a real hit especially for lower and middle-earning graduates. And in the long run that hurts almost every graduate except higher earners (see why high earners gain.)

The problem here is one of psychology. The interest rate seems scary so we hear loud cries – even though in practice it doesn’t affect most. Freezing the repayment threshold is complex so we hear little – but it affects millions. Reversing that is a far greater priority for graduates.

To make policy just to appease fundamental misunderstandings is wrong. The sooner student loans are renamed a ‘graduate contribution system‘ the sooner we can start to be rational and protect young people who need help, rather than illogically prioritising helping those who don’t.

So to summarise, cutting interest rates – while not bad – should be far from top of the priority tree. For graduates, unfreezing the repayment threshold is a priority. For current students, interest rates have no practical impact – what does is the fact that many don’t have enough money to live off. The priority there should be money to give bigger, fairer loans for living and to clear up the poorly-operating hidden parental contribution system.

Martin Lewis is the founder of MoneySavingExpert.com.

Comments