Remember George Osborne in his hi-viz jacket as he toured the nation’s metal-bashers and gromit-manufacturers in furtherance of his elusive ‘rebalancing of the economy’ away from services and consumers and towards manufacturing and exports? What a shame he is not still in office to witness his ‘march of the makers’ finally becoming a reality. This month’s Purchasing Managers’ Index (PMI) for manufacturing has come in at a healthy 55.1, comfortably exceeding expectations. Any figure above 50 suggests expansion. The index was boosted especially by a sharp rise in new export orders, which rose at their second fastest level in the 17 year history of the index.

As I wrote here last week, manufacturing statistics are not all pointing in the same direction – there is a little puzzle in that the Office of National Statistics estimate for economic growth, released last week, suggested that manufacturing shrank in the second quarter by 0.5 per cent. Orders, though, precede output, suggesting that the manufacturing growth ought to turn positive later in the year.

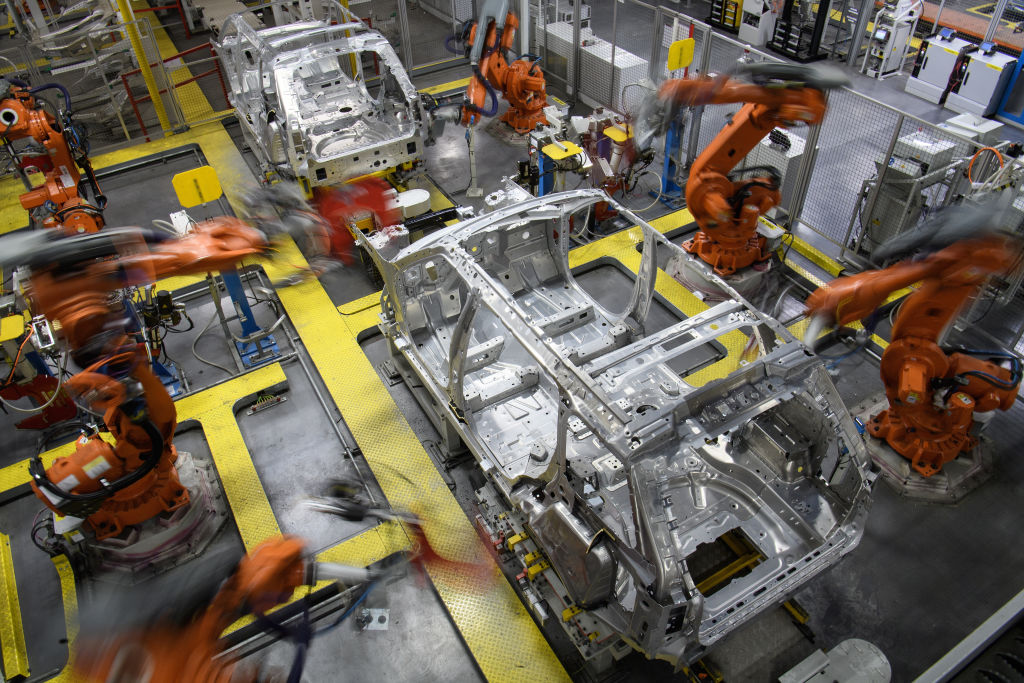

The growth in export orders challenges the assumption that Britain is destined to lose virtually all its manufacturing as production drains inexorably off to the Far East. That has been the story for so many decades that it is hard to imagine British factories staging a comeback – even though in one area, car-manufacturing, there has been a revival in progress for many years. Yet, as the old adage goes, a trend is only a trend until it stops. As Far Eastern countries become richer, through selling stuff to us, so they will lose their competitive edge in terms of low labour costs, and we ought to expect some manufacturing to come home.

The same is true of the trend towards a consumer-driven UK economy. There is only so much that UK consumers can drive the economy. As their borrowings start to reach worrying levels again there is an increasing danger of a collapse in consumer spending. Nor is the housing market likely to be driving the economy in the near future – this month’s Nationwide index shows that annual house price inflation, at 2.9 per cent, is now little above consumer price inflation.

George Osborne ought to be enjoying the turnaround in manufacturing exports, but his joy might just be tempered by the reason behind the change in fortunes. Exporters are doing well because of the lower pound, the fall having been triggered (which is different from having been caused) by last year’s referendum result. Brexit, as the former Chancellor keeps telling us through his new mouthpiece, the Evening Standard, will be a disaster – though maybe you won’t see it that way if you are a rubber gromit manufacturer somewhere in the Midlands and have seen a lower pound do for your business what Osborne’s visits never quite managed to achieve.

Comments