There are many ways to classify shares, including by sector and country or region. We think another useful way is to distinguish between two main types of investing styles: value and growth. From a global, top-down perspective (meaning, considering broad categories before choosing individual shares), knowing how sectors, countries and regions overlap with value and growth characteristics can be helpful for determining how to weight them in your portfolio.

To begin, what is value and growth investing? Whilst criteria differ, we find a common trait of value investors is seeking bargains amongst shares with low prices relative to valuation metrics—like comparing share price to per-share corporate profits, dividends or sales. In contrast, growth investing tends to disregard valuations and focuses on companies with faster expected-sales or profit-growth rates than the overall market.

But the two styles have deeper characteristics, too. Value-orientated shares tend to be economically sensitive and carry more debt, meaning the broader economy’s outlook heavily influences their prospects. Such companies also tend to try to reward shareholders by returning profits to them via dividends as opposed to reinvesting them into growing the business. In our experience, investors typically think of growth companies as taking advantage of earnings- or revenue-growth drivers that are less sensitive to economic conditions—their growth doesn’t depend primarily on the economic cycle, but, rather, on lasting trends within the economy and society. This would include things like the rise of online retailing or companies storing data offsite at high-tech computing storage locations. They also commonly feature strong product pipelines, higher profit margins and growing market share driven by innovation in the areas where they compete.

Value and growth companies tend to be found in certain sectors. Value shares traditionally concentrate in Financials, Industrials and Energy. Information Technology and Health Care classically demonstrate growth characteristics. But this isn’t clearly delineated. For example, the Communication Services sector contains the value-orientated Diversified Telecommunication industry group, which features many old-line telephone companies. Yet it also includes the Internet Media & Services industry group, which is comprised of growth-orientated search engines and social media companies that, until recently, were categorised as Technology shares. Or, consider Consumer Discretionary. Most shares in this sector are economically sensitive—cyclical value companies. But its largest industry group is Internet Retail, which has many growth qualities.

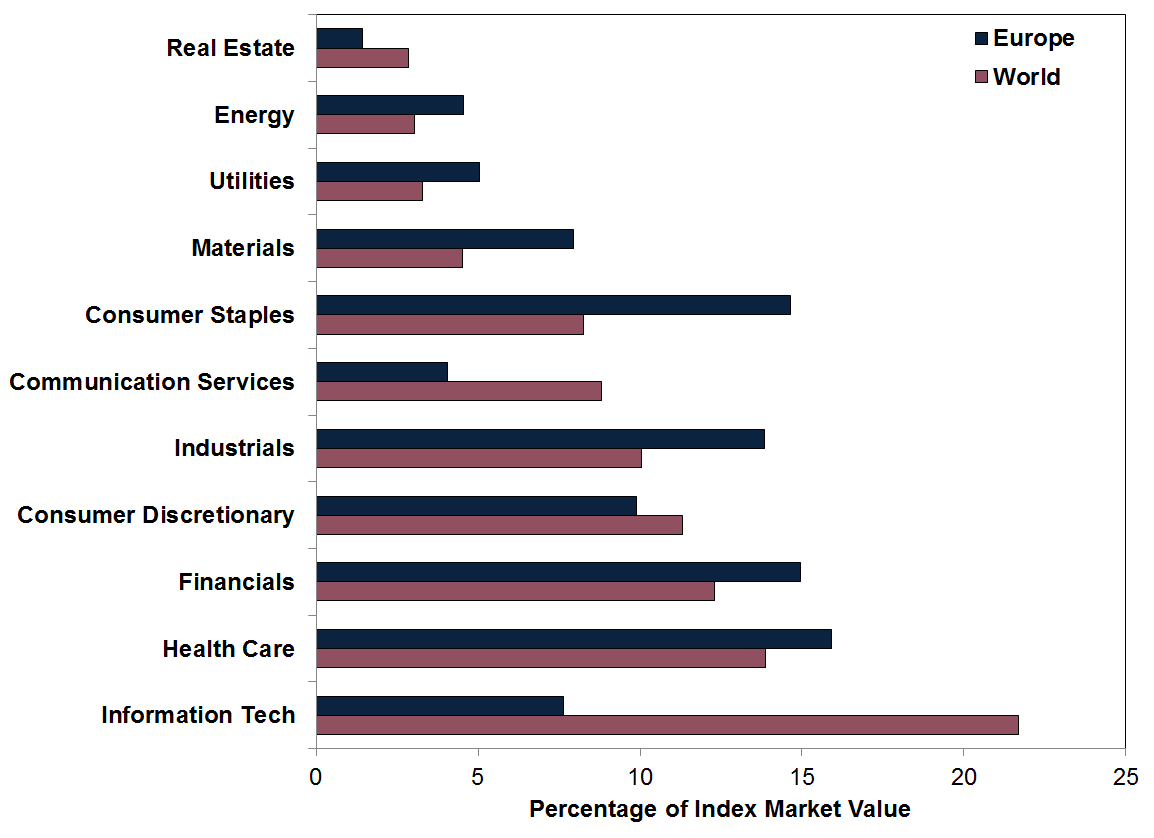

Now, to see how you can utilise this value and growth investing approach, look at Europe. As the exhibit below shows, the biggest difference between the MSCI Europe Index and the MSCI World Index is the former’s relative lack of Information Technology. European Tech’s weighting in the Index, as a percentage of market capitalisation, is nearly one-third the size of Tech’s weighting in the World Index. Next, Europe’s Communication Services sector is less than half the World’s weight. Moreover, its weight slants toward Diversified Telecommunication companies—a value bias. Meanwhile, the MSCI Europe also carries a much larger share of Financials, Industrials and Energy.

Exhibit: MSCI Europe and World Index Sector Weights

Source: FactSet, as of 06/08/2020. Market capitalisation of each sector divided by market capitalisation of the relevant index, displayed as a percentage.

In short, Europe tilts heavily toward value. We think the key, then, for investors is to know when value and growth are usually in favour when determining how much to allocate to Europe in global portfolios. Our research shows value shares often—but not always—outperform when bull markets (prolonged periods of generally rising equity markets) begin. This happens for two main reasons, in our view. Firstly, at the trough of a bear market—a fundamentally driven broad equity market downturn exceeding -20%—our research indicates many investors fear value-type companies won’t survive the typical decline in economic activity (known as a recession) that bear markets often precede. During the panic typical at bear markets’ depths, sentiment usually becomes overly pessimistic, and shares in value-orientated companies trade at extremely low valuations. This panic forces markets to reflect exceedingly dour expectations. We find bull markets typically begin when signs start to emerge that reality won’t be as bad as feared. Secondly, a typical trait of recessions and bear markets is many smaller, value firms have a difficult time getting credit, as banks and lenders fear they won’t be able to repay. But as panic wanes, credit becomes more plentiful, helping boost these firms’ viability. We think this is important to value’s typical early leadership.

Growth-style investing is typically in favour as bull markets mature into their later stages—when our research shows investors who abandoned equities in the prior bear market generally begin to return. It tends to persist as more investors, questioning economic expansion’s sustainability, favour companies with a perceived ability to grow and profit through thick and thin.

Unusually, this year, growth shares led before, during and after the downturn that began in February.[i] Whilst uncommon, this is also understandable given 2020’s unique circumstances. In our view, the sudden onset of coronavirus-induced government lockdowns caused the record-fast bear market.[ii] Value investors never gave up on them, which normally takes place long into a bear market, according to our research. Markets rebounded in late March before the worst economic data hit.[iii] Increasing prospects for a normally drawn-out recession could yet sink value shares to levels well below ones justified by reality. That might drive a rotation into them. But we don’t think conditions currently favour that scenario. Rather, global economic recovery seems likelier to us as countries gradually reopen—even amidst occasional COVID-19 upticks.

In this way, knowing where we are approximately in the business cycle—and when it favours value and growth—can help you make portfolio decisions on a sector, country and regional level.

Get exclusive stock market knowledge in your free Markets Commentary guide as the first of our ongoing insights.

Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[i] Source: FactSet, as of 12/08/2020. Statement based on MSCI World Value Index and MSCI World Growth Index returns with net dividends, 31/12/2019–11/08/2020.

[ii] Ibid. Statement based on MSCI World Index return with net dividends, 31/12/1969–23/03/2020.

[iii] Ibid. Statement based on MSCI World Index return with net dividends, 23/03/2020–11/08/2020.

Comments