The Sunday Times Rich List is out today – and it says a lot about Britain. Mainly: what type of country are we? One that reads that supplement with admiration, or with outrage? I’d argue that the former, but this runs contrary to the bovine populism being encouraged by Labour.

Ed Miliband wants to raise the top rate of tax to 52 per cent which, as he knows, will raise next to no money. The real purpose of that tax rise is to perform a basic populist manoeuvre: identify an enemy (the highly-paid) and then promise to hurt them. Today, it’s landlords: rent would be capped by the government. Like all left-wing populists, he is out to draw dividing lines: tenant vs landlord, worker vs employer, rich vs poor. His government is all about thwacking the bad guys (including the rich) in the name of fairness.

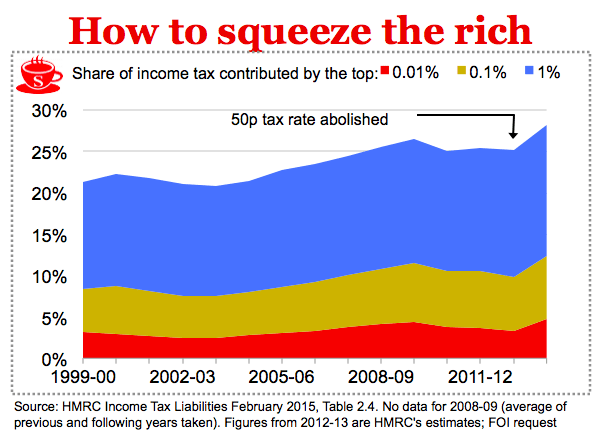

But here’s one statistic Miliband will never repeat: the best-paid 1pc already contribute 27pc of the income tax. (They earn about 12pc of salaries). The best-paid 3,000 contribute, on average, £2.6 million in tax per year. To listen to the hype, you’d be forgiven for thinking the richest pay not a penny in tax. The truth is that the UK income tax system is reliant upon a very small number of highly mobile rich people. I’m not saying they pay too much; I’d like it to be even more. I’m just saying that it’s untrue to insinuate, as Miliband does, that the rich are not paying their fair share.

As today’s Sunday Times Rich List shows, the richest are rich not because they are gaming the system but – by and large – because they’re very talented, took risks and worked their guts out. It includes many immigrants, who made their fortunes abroad but come here to pay tax. And who would not welcome that?

The nature of wealth is changing, and not in an attractive way. JK Rowling is far richer than was – say – John Buchan, a far more prolific and far more talented. Why? Because today’s stars – from the world of business, literature and sport – are able to leverage their talents on a global scale. If Ms Rowling’s books are read as voraciously in Tokyo as they are in Telford, then the money will follow. The same is true for architects, software programmers and – yes – for bankers: it’s a global market. The Harvard Economist Greg Mankiw recently conducted a study recently most of the very wealthy got that way showing that the pay of the 1% was justified by global forces. Or, as he put it, “by making substantial economic contributions, not by gaming the system or taking advantage of some market failure”

Now, I can’t say I welcome this global trend. I’m not wild about the fact that David Beckham earned vastly more than Bobby Moore, but it’s a sign of the times. Let’s look at the Sunday Times Rich List. The people in the top 1000 are not those who inherited a fortune – most of the billionaires are self-made. Philip Beresford, the list’s complier, says that some about four in five of those on his list made their own fortune. We have:

- James Dyson – whose his eponymous vacuum cleaners, hand dryers and fans have sucked in a £3bn fortune

- Chris Dawson, who left school at 15 and says that he can read what he needs to but he can barely write. But he built a chain of discount gardens centres – and a £1.28bn fortune.

- Paul Sykes, the son of a miner, who left school with no qualifications before setting up a company to sell scrap from busses to the far east, then moving into property he built Sheffield’s Meadowhall shopping centre, then moved into technology building what was once Britain’s largest internet service provider. Worth: £650m.

- Mark Dixon, a former sandwich salesman who has made £820m providing people with places to work in his serviced office business Regus

And Jamie Oliver – his cookbooks and restaurants have netted him £240 million.

I’m all for getting the richest to pay a fair share. But I’m up for doing it with intelligence, a sense of fairness – and a sense of purpose. Some 44 of the 104 billionaires at the top of the Sunday Times Rich List are from overseas. These are people who can (and do) decided to go anywhere, to make and declare tax. And they spend an estimated £16bn here a year.

Not to mention £45 billion of income tax. But it wasn’t always this way. The last time that Labour was going through an Ed Miliband phase and went swinging for the very richest, with a top rate of an eye-watering 83% per cent, did it work?

The top 1% paid just 11% of all income tax: a pathetic figure. So Thatcher dropped the top rate to 60%. And in 1987, the top 1% were paying 14% per cent of all income tax: a far healthier figure. But then Nigel Lawson came along with his 1988 Budget that cut the top rate to 40%. That infuriated the left: tax cuts for millionaires! But Lawson grasped what John F Kennedy called the “paradoxical truth”: that lower tax rates lead to higher tax yields.

Because the conservatives were deadly serious about having the richest shoulder a greater burden. Shaking you fist at the rich, calling them names, does not work. Encouraging wealth creation, and asking fair tax rates – in Britain it’s 47 per cent of top earnings – does work.

I’d like to close with two final facts. When George Osborne cut the top rate of tax, he milked them better than Dennis Healey ever did. We had the top 3,000 earners paying an average £2.6 million each in tax. So the top 3,000 paid more tax than the bottom 7.5 million. That’s what I call a fair share.

And my vision of fairness is a Britain that rejects the politics of envy, where success is celebrated – and the tax system makes works because it shares the success.

Inequality is a big problem in our society. But the difference between the Conservative policies and Labour ones is that the Conservatives want to tackle it – not just talk about it. I accept that the Tories have not made this point (or others) very well, but this will be the next challenge for Conservatism. The only question is whether they’ll do this in government or opposition.

Comments