Starbucks had a go at David Cameron on Sunday for his ‘cheap shots’ at the coffee chain’s tax arrangements in the UK. The company felt it was being unfairly singled out in comments about companies legally avoiding tax needing to ‘wake up and smell the coffee’. So what about other firms known to be avoiding tax?

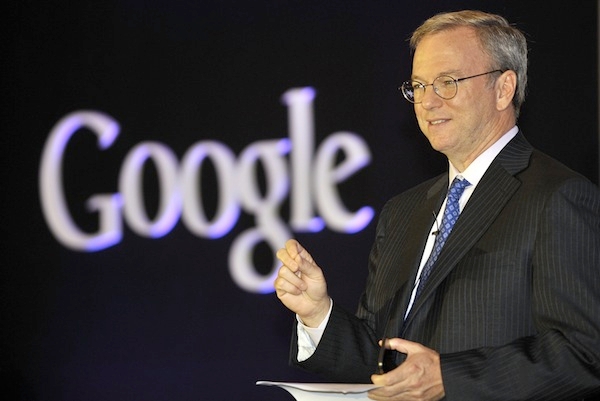

Coffee House has learned that the former Lib Dem Treasury spokesman Lord Oakeshott is writing a rather scathing pair of letters to David Cameron and George Osborne about the government’s dealings with Google, which paid only £6 million in corporation tax in the UK in 2012 by funnelling £6 billion worth of transactions through the tax haven of Bermuda. Google’s executive chairman, Eric Schmidt, currently sits on the government’s Business Advisory Group.

Oakeshott’s letter says that while he strongly supports Osborne’s condemnation in last year’s Budget of aggressive tax avoidance as ‘morally repugnant’, the government is undermining its own campaign by retaining Schmidt on the advisory panel. He argues that Cameron and Osborne are leaving themselves ‘wide open to a charge of selective indignation on tax dodging’ and that every meeting with Schmidt ‘sends the worst possible message that aggressive tax avoidance is acceptable in high places’. His letter to the Chancellor adds:

‘Will you also ensure that before Google are considered for any government contracts, they prove that full British tax will be payable on the money they receive from British taxpayers?’

This is not dissimilar to the campaigns from MPs on the Conservative and Labour benches, particularly Charlie Elphicke and Jim Sheridan, as reported on Coffee House earlier this month.

The problem with singling out certain firms as the Prime Minister has done is that name-calling is a weak way of doing politics, whether you’re talking about multinational companies or benefit claimants. Starbucks were grumpy about being the focus of the Prime Minister’s comments because they felt they were already doing their bit with a voluntary agreement to pay more tax. But it is far more convenient to make villains out of those in a system who aren’t even breaking its rules than it is to make clear that the real villain is the system itself.

Comments