For a decade or so, GERS Day has been something of an annual gloatfest for opponents of Scottish independence. The fiscal data dump would reliably show just how dependent Scotland is on cash transfers from the Treasury to fund the embryonic state created by devolution and its sizeable estate of public service provision. As a result, GERS, which stands for Government Expenditure and Revenue Scotland, has become central to Scottish constitutional politics.

Anti-nationalists say it proves that independence would be financially devastating for Scotland. Nationalists dispute this. Some say independence is a matter of constitutional principle and fiscal considerations shouldn’t come into it. Some say GERS fails to take into account the new economic opportunities that would come with independence. Some say GERS is a conspiracy orchestrated by Westminster to make Scotland look poorer than it is. (GERS is compiled by the Scottish government.)

The latest GERS figures, released on Wednesday and covering the fiscal year 2022-23, record Scotland’s net fiscal balance as £19.1 billion, or 9 per cent of GDP. This is down from the pandemic-era highs of £37.9 billion (23.4 per cent) in 2020-21 and £24.9 billion (12.8 per cent) in 2021-22, but remains larger than the pre-pandemic deficit of £15.1 billion, or 8.6 per cent of GDP.

Critics of independence use the GERS figures to demonstrate how Scotland’s notional deficit is financed by the Barnett Formula, a Treasury calculation that allocates Scotland higher per-head public spending than England and Wales. This is known as the ‘Union dividend’ and, based on the new GERS figures, was worth £1,521 per head last year. Independence opponents point out that an independent Scotland would lose the Barnett formula and the Union dividend. The new state would have to find a way to manage its own deficit and maintain the higher levels of spending that have come to be expected north of the border.

Nationalist responses to GERS vary but are typically asinine and contradictory. The figures are said to show that Scotland’s public finances are improving more quickly than those in England. They are also said to show that Scotland is suffering the fiscal and economic consequences of being part of the UK. This is in line with a well-established principle of devolved politics: anything that goes right in Scotland, the Scottish government gets the credit; anything that goes wrong, the UK government gets the blame.

Still, there are three points I want to make about the latest figures.

First, they show how shallow is the SNP’s position on North Sea energy and net zero. Since 2021, the SNP government has opposed all new oil fields because of the impact on the climate. However, GERS estimates that, without a geographical share of oil revenue included, Scotland’s deficit would balloon to £28.5 billion. And so it was that, responding to the figures, the Scottish government’s wellbeing economy secretary Neil Gray pivoted to oppose only ‘unlimited extraction’ and to state that fossil fuels ‘will be with us for some time to come’. If you want to understand the Scottish government’s position on the climate emergency, imagine Greta Thunberg filling up an SUV at a diesel pump while tweeting ‘#JustStopOil’.

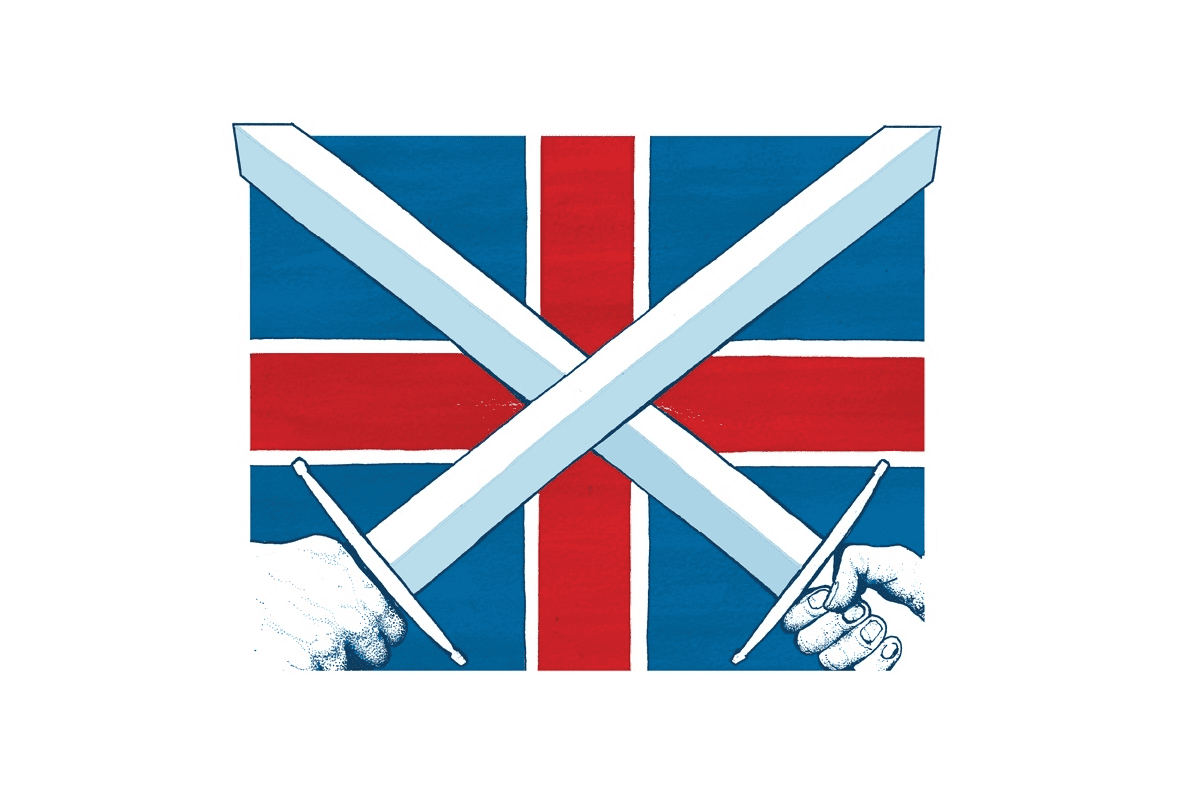

Second, by continuing to tie the case for Scotland remaining part of the UK to GERS, the SNP’s opponents are giving a hefty hostage to fortune. If GERS proves that independence is economically unviable, what happens if the notional deficit continues to fall? If Scots should stick with the UK for the Barnett formula and the Union dividend, what happens if a future government ditches the former and the UK’s continuing economic decline swallows up much of the latter? Both Tories and Labour think they’re terribly clever waving GERS in the faces of nationalists, not realising they are flaunting their own weakness. The SNP would like GERS to support their (highly imaginative) prospectus for an independent Scotland but they aren’t pinning everything on it. Nationalists don’t need spreadsheets to win, they can rely on all the emotive, cultural and jingoistic impulses that nationalism is in communion with.

Third, who will speak for England? As I’ve pointed out before, what is a Union dividend from Scotland’s perspective might look an awful lot like a Scottish subsidy to English eyes. An English voter might ask why his taxes must subsidise higher public spending in Scotland, a country with its own parliament with the tax-raising powers to generate more income from its own people. While most Scots would bridle at the mere asking of the question, it is not an unreasonable query and it underscores just how asymmetric is the devolution experiment the UK embarked on a quarter-century ago. The SNP’s opponents at Westminster and Holyrood have no answer to the question but, sooner or later, someone is going to figure out there’s a political platform to be found in asking it.

Maybe it’s time to drop the gloatfest.

Comments