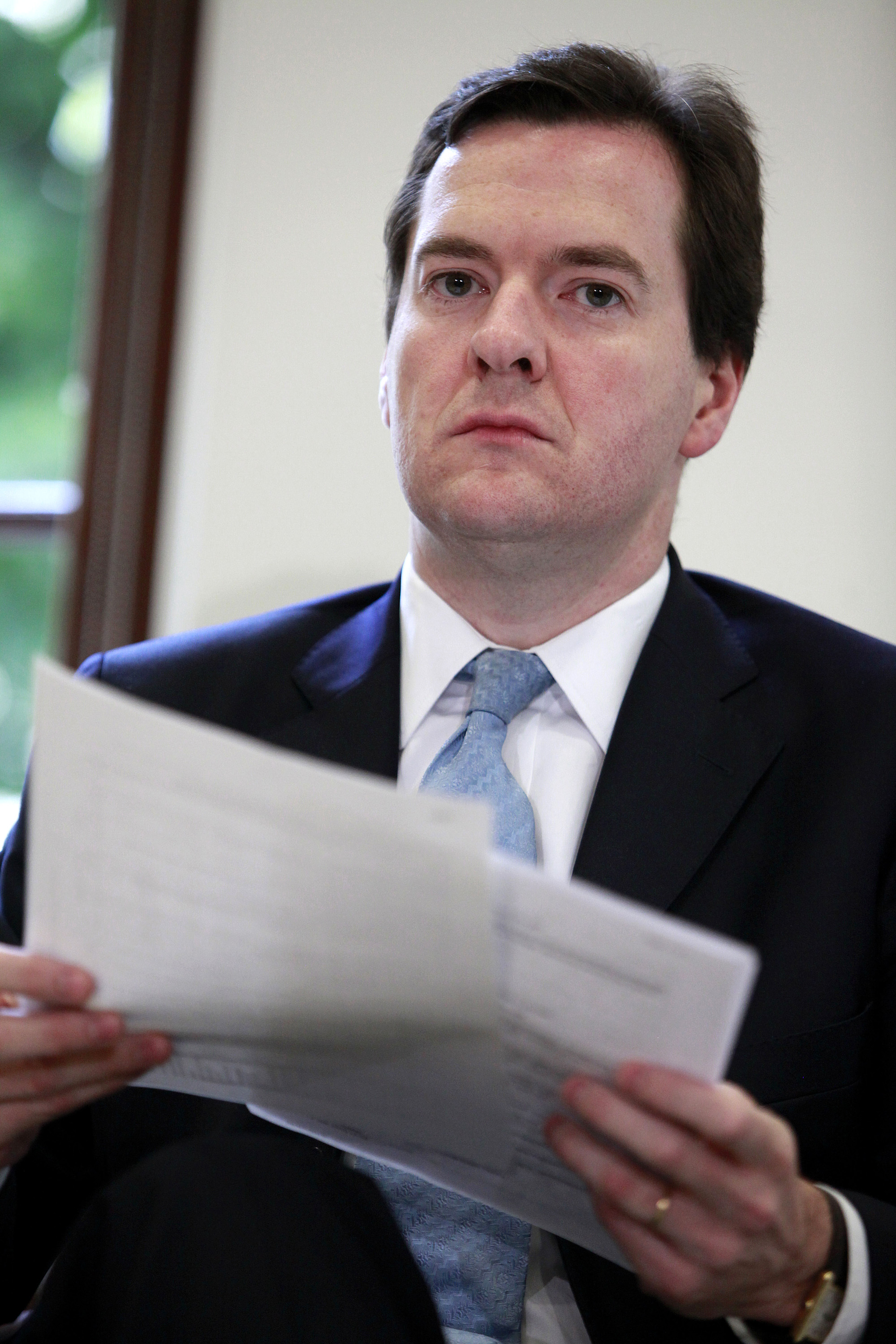

In interview with the Sunday Telegraph today, George Osborne stresses that

the banks have got to start lending again – and he’s right to do so. The easy availability of cheap credit may have done much to get us into this mess, but now we face a converse problem. As

a recent Bank of England report shows, net lending from the banks to businesses remains negative –

or, in other words, more is being paid back than given out – and the situation is getting worse. With small and medium businesses so reliant on credit to get themselves off the ground, this

doesn’t augur well for a powerful recovery.

In interview with the Sunday Telegraph today, George Osborne stresses that

the banks have got to start lending again – and he’s right to do so. The easy availability of cheap credit may have done much to get us into this mess, but now we face a converse problem. As

a recent Bank of England report shows, net lending from the banks to businesses remains negative –

or, in other words, more is being paid back than given out – and the situation is getting worse. With small and medium businesses so reliant on credit to get themselves off the ground, this

doesn’t augur well for a powerful recovery.

But what can the government do to rectify the situation? As the FT’s Kiran Stacey pointed out in a snappy post last week, their recent Green Paper on the matter was a little uncertain. Unlike, say, the police and benefits reform consultation papers, it leaves you with no clear sense of where its authors might like to head. The main reason for this, I suspect, is that there are no easy levers for manipulating the balance between bonuses, liquidity, lending and everything else. I mean, take George Osborne’s suggestion that the banks might face lending targets: this has already been tried with RBS and Lloyds, with negligible success.

This leaves Osborne armed with little more than rhetoric at the moment – his interview is littered with phrases like “we will not tolerate” and “they have an … obligation”. But with the banks starting to make hefty profits again, the Chancellor will soon face public, as well as economic, demand for action. Whether this means a firmer hand in managing the state-owned banks or, more likely, a range of industry-wide policies in a few months time, we shall see. But, in the end, much of the solution rests with the banks: when they feel like lending again, then will.

Comments