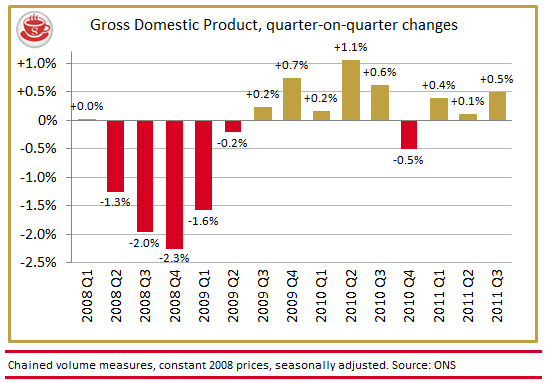

The growth number for the third quarter of this year is out, and it’s a little bit better than expected: 0.5 per cent. Many economists were saying that we’d have to hit around 0.4 per cent to recoup the growth lost to the Royal Wedding and Japanese Tsunami in Q2, so we’ve managed that. But, that aside, this is not the time for party poppers and champagne corks. It may not be Econopocalypse, but it’s not Mega Growth either. We are still living in a bleak, borderline stagflationary environment.

Besides, I still reckon that we oughtn’t get especially worked up about these quarterly figures anyway. For starters, the obsession over micro-percentage points can obscure the fact that many parts of the country are already in effective recession — and have been for decades. And then there’s the inconvenience that, looking back over recent history, these figures are so often revised. What we have today is effectively one organisation’s preliminary stab at the mark. As this recent graph from Citi shows, the ONS does tend to recalibrate its aim afterwards:

But, that said, today’s figure does have some significance. It will, of course, fuel the political firestorm around growth and all that. George Osborne, starting with Treasury Questions later today, will claim that we are headed in the right direction, while pointing nervously towards the eurozone, and with some cause: there is no doubt that the Greek tragedy is splashing blood all over Europe and across the Channel. His Labour counterparts will prefer to highlight the spending cuts that, in truth, have not properly kicked in. Neither side, despite what Polly Toynbee thinks, can feel properly vindicated quite yet.

But more important, as I suggested last night, is what this means for the annual growth forecasts on which Osborne’s deficit reduction plan is constructed. If they go down, as they now surely must, then it will have ramifications for everything from tax receipts to social security spending to the depth of our austerity. All eyes, then, on the Pre-Budget Report at the end the month.

UPDATE: Jonathan has more on today’s figures over at the Business Blog.

Comments