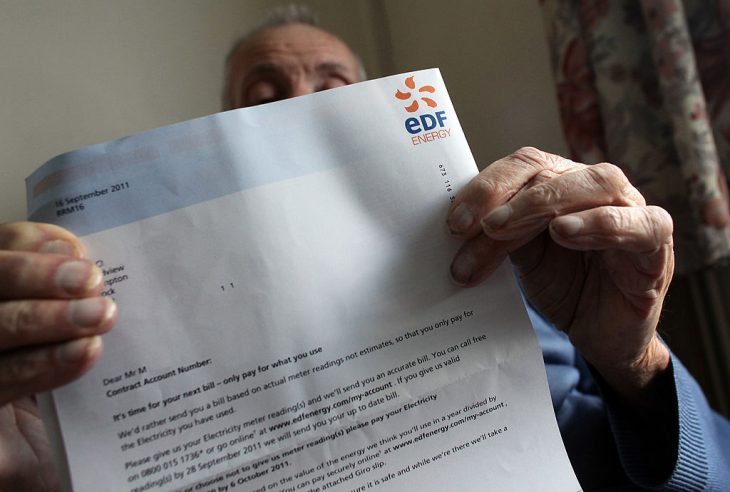

With the winter chill showing no sign of letting up any time soon, it’s even more depressing that some of the big energy suppliers are hiking their prices yet again. Scottish Power customers will see their gas and electricity costs rise 7.8 per cent on average from the end of March, adding £86 on to bills. EDF Energy and Npower have announced similar rises.

The good news, however, is that it’s perfectly possible to slash your own bill. Of course, the best way to reduce the cost of energy is simply to use less of it by becoming more energy efficient – for example, by making sure your home is adequately insulated or turning the thermostat down by just a single degree. But if you want to save big bucks fast, all you need do is shop around for a better energy deal. The most convenient way to do so is by using a comparison site. Here’s a mini-guide to the process.

What information will I need?

Knowledge is power, to quote Francis Bacon, and certainly in this case, the more information you can provide, the better. At the very least you’ll need your postcode – because energy deals are region specific – and an idea of your monthly or annual spend. But if you can provide the exact details of your current tariff and annual spend or usage, as well as details about how you pay your bills (e.g. monthly by direct debit) you’ll get much more accurate comparisons.

I’ve found a cheaper deal, how do I switch?

Once you’ve flicked through the comparison site’s search results and picked a suitable deal, you have two main options. You can either contact the provider directly and get them to move you onto your chosen tariff and away from your old energy customer, or you can switch directly through the comparison site. Either way, all you need do is make sure to cancel direct debits to your old supplier after your final bill.

The benefits of the comparison site route usually include a speedy online transaction, requiring just a few clicks and the input of some personal details. But some comparison sites offer added extras, such as Comparethemarket’s 2-for-1 cinema tickets for a year with certain tariffs.

Should I always go with the lowest cost deal?

This totally depends on what your priority is. If it’s to save the maximum amount of cash possible, then it would seem sensible. However, you might also want to consider the provider’s customer service record before you sign up.

A lot of the comparison sites helpfully display customer ratings. So if the cheapest deal comes with the lowest rating, you may want to compromise and choose a deal that may save you a bit less money but that gives you peace of mind from a higher customer rating.

Are there other ways to save?

Yes! While switching to a more competitive tariff through a comparison site or contacting a new provider directly should in theory save you the same amount of money whichever route you choose, you could save even more by using a cashback site. For example, switch to the SSE 1 Year Fixed v9 tariff through topcashback.co.uk, and you’ll get £53.56 too.

You simply create an account (or log on if you already have one) and follow the links provided to your deal. Once it’s gone through, your cashback account will be credited accordingly and it’s up to you whether you transfer it to your bank account or use it to take up other deals on the site.

And don’t forget, it’s possible to make savings on your utility bills through some bank accounts. For example, the £3 a month NatWest Reward Current Account pays 3 per cent on utility bills, including energy, paid by direct debit from the account. And the £5 a month Santander 123 Current Account rewards customers with 2 per cent of their monthly energy spend.

What about smart meters?

These can save you money too. Energy companies mostly install these in your home at no cost to you. The hi-tech energy meters automatically relay your energy usage data back to the provider, meaning they should be able to bill you much more accurately than is the case with traditional meters that require readings or usage estimates. The display on the smart meter handily shows up-to-date information on your daily usage and energy costs that can serve as a warning and help lessen bills.

Laura Whitcombe is an editor at Thisismoney.co.uk

Comments