Deflation terrifies economists because once it starts, they have no idea what to do about it. When demand in an economy shrinks, companies cut jobs, and with fewer employed demand shrinks even more. The deflationary spiral is self-reinforcing. Central banks can cut interest rates to near zero and slosh money around like drunken lottery winners, but once hope flickers and dies, there is nothing they can do to persuade anyone to invest in the economy. Deflation took hold in Japan in the early 1990s and despite the government straining every sinew, its economy is still ailing 20 years on.

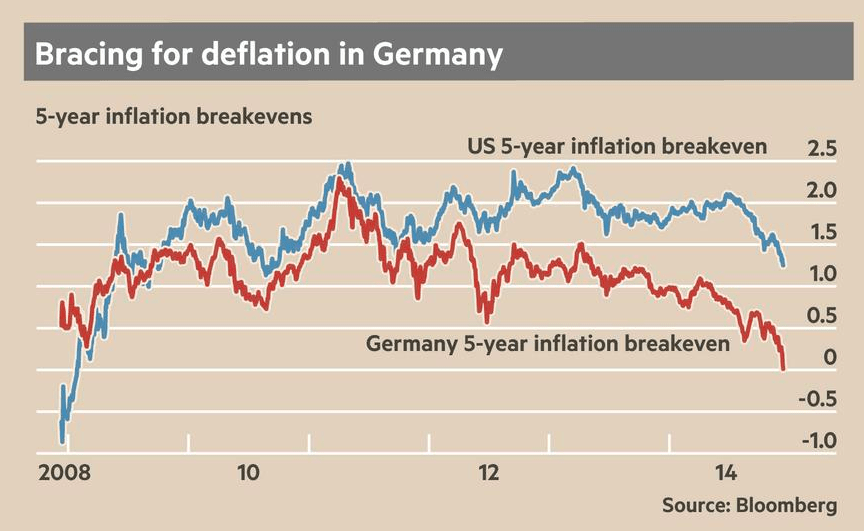

Europe is right, then, to be in a panic. Inflation across the eurozone is just 0.4 per cent and over the past year eight of its economies, including Greece, Hungary, Sweden and Poland, have recorded annualised rates of negative inflation, falls in wages and prices of a kind Britain has not seen since 1960. If these rates persist, we may well be in ‘last-chance Europe’, as Jean-Claude Juncker described it last month before becoming President of the European Commission. A great chunk of the eurozone risks the Japanese curse, an economic malaise which lasts a generation. Britain’s economy and inflation rate may seem the healthiest in Europe, but that could easily change if its neighbours tip into persistent deflation.

Mario Draghi, President of the European Central Bank, said last year that he had studied Japan’s experience of deflation and decided that the EU was not at risk of suffering a similar fate. Recent months have changed his mind. The ECB said this week that it was ready to fire a trillion euros into the EU’s financial system, by buying both government and private bonds. Or was it a gazillion? After so much quantitative easing around the world in recent years, it is hard to keep count.

The Germans are sweating, as they tend to, caught between their prim attitude to credit and a need to keep the eurozone together. They have the ECB just where they wanted it, in terms of geography — in Frankfurt — but that has not meant control. The notion of unleashing a fire-hose of ECB cash -horrifies Berlin: a German lawsuit opposing the ECB’s bond-buying programme is still rumbling through the European Court of Justice. But they may have no choice. An uneasy consensus is forming that preventing deflation is far easier than trying to cure it.

There is another way of thinking about the problem. In 1981, as the Conservative government prepared to give the economy a hard pruning, Lord Hailsham spooked Margaret Thatcher by comparing her plans to those used by Herbert Hoover after the 1929 Wall Street Crash. Hoover’s austerity, Hailsham said, sparked the Great Depression. Franklin Roosevelt’s spending pulled America out of it. Hailsham turned out to be wrong: the 1981 budget cleared the underbrush and made way for the Thatcher boom. But he was right to say that political economics is above all ‘applied psychology’. Give people a strong sense of a sunny future and they will follow you. Dither or depress them and you’re toast.

The underlying problem with Europe’s stalled economy is not German intransigence or Greek profligacy or Portuguese cluelessness, or even a shortage in the money supply. There is plenty of money around, it is just stuck in banks which have been required to tighten their lending standards and improve their capital structures. The larger problem is demographics. Since the crash of 2008, a wartime mentality has taken hold in much of Europe. Even interest rates of near zero cannot persuade people to spend or borrow, for fear that tomorrow something worse will happen. Those with money, who tend to be older, are hoarding what they have and depriving the young of jobs and hope, just as they have done for years in Japan. In terms of ‘applied psychology’, inflation and deflation are superficially equivalent to optimism and pessimism in an economy. But the reason economists hold these forces in such awe is that they redistribute wealth between generations more powerfully than any tax.

The economist and writer Felix Martin likes to explain this with a story about his mother and her sisters. When they gather, they will often ask the question ‘what happened to our father’s money?’ He had retired in 1970, after an accomplished career in New Zealand, with what appeared to be a handsome pile of pension and other savings. For the next decade, he lived fairly modestly, but by 1980 he was anything but well off. The Bernie Madoff character who cleared out his savings was an inflation rate which veered between 10 and 20 per cent. Meanwhile, Martin’s parents had been able to take a teacher’s salary, borrow from the bank, buy a house in Oxford and watch inflation quickly erase their mortgage while their house soared in value. The 1970s robbed creditors and savers and rewarded borrowers. It redistributed wealth from the old to the young, which is precisely what now needs to happen across Europe and why one generation craves it and another fears it.

Europe’s savers, its cash-rich, its Germans, would much rather a brush with deflation than see what they have eroded by inflation. They dress up their fear in dubious virtue, and slap the bottoms of debtors. But if structural reforms mean growth, and growth means inflation, they would rather keep the status quo. The young, those trying to buy a house, the Greeks, want to load up on debts to get their lives under way, helped along by an inflationary economy. But they cannot catch a break.

There is a generational war breaking out in Europe, as well as a political war between countries. You can see it in the many young people supporting Beppe Grillo in Italy and Greece’s Syriza party. In that single, desultory number, 0.4 per cent inflation, lies proof that the continent is socially, psychologically, politically and economically stuck. When that number turns negative, it will further ram home the point.

The answer is more likely to lie in Hailsham’s applied psychology than in the ECB’s coffers. The countries which have been beaten up for the past six years need fresh leadership capable of cheering them up, of seeing the problem in terms of human beings, not just as economic. Someone needs to relieve Spain and Portugal of their tight German-made corsets, dress them in baggy linen trousers, give them a cheap cigar and tell them they are marvellous and that everything will be okay. There are alternatives to this one-way ticket to deflation hell. Before the euro, the baggy linen trousers and cigar route was called devaluation. That’s not an option now, but give a fracturing Europe many more months of this misery and it soon could be.

Comments