Gordon Brown loves hiding behind numbers. He does it almost every PMQs – when he reels off the usual tractor production statistics – and he has done it in every Budget he’s been involved in, either as Chancellor or Prime Minister. My guess is that he hopes to cover up not only how bad things are, but also the human dimension of the fiscal and economic crisis. £billions, £trillions of debt, what does it matter? So long as he can continue to talk abstractly about “investing in growth”.

Gordon Brown loves hiding behind numbers. He does it almost every PMQs – when he reels off the usual tractor production statistics – and he has done it in every Budget he’s been involved in, either as Chancellor or Prime Minister. My guess is that he hopes to cover up not only how bad things are, but also the human dimension of the fiscal and economic crisis. £billions, £trillions of debt, what does it matter? So long as he can continue to talk abstractly about “investing in growth”.

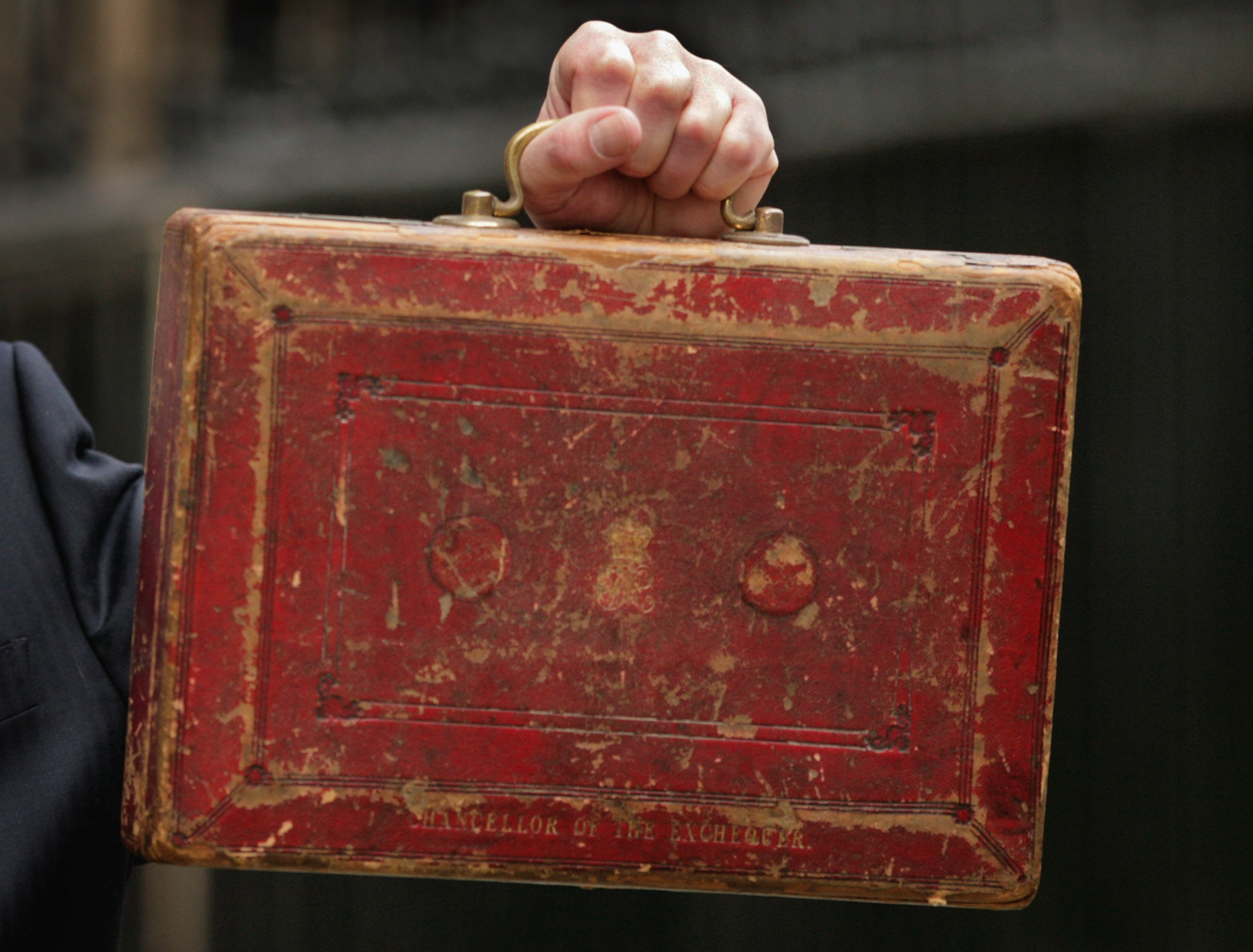

Of course, revealing the debt crisis for what it is – an aberration which will burden the British public for decades – is an important cause. It’s one of the reasons why we introduced our own debt counter – which shows each family’s share of the UK debt – on the right-hand side of the Coffee House home page. And it’s why the latest figures from the National Institute for Economic and Social Research are so striking. They set out, in stark terms, just how we could be left paying for Brown’s borrowing binge:

“The institute said the Government had three options to bring the balance sheet back to good health. The first was to raise the state pension age, from 60 for women and 65 for men, to 70 between 2013 and 2023.

Under existing plans, the state pension age is due to increase to 68 for both men and women between 2024 and 2046. The rise will generate additional tax revenues and reduce pension payment obligations.

The second option was to raise the basic rate of income tax by 15p in the pound. Taxes would have to rise by as much as 8p in the pound even if the retirement age was increased, NIESR said.

The final option was to cut government spending by a tenth, which would hit the NHS, education and other front-line services.” The Tories should both dread and welcome numbers like this. Dealing with Brown’s debt crisis will be one of the most difficult tasks ever put before a government. But the more the public understands about its scale, the more forgiving they will be of the measures needed to solve it.

Comments