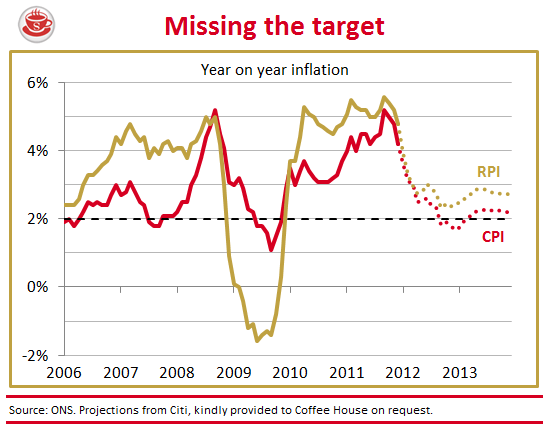

Are today’s inflation figures cause for celebration? The Consumer Price Index rose a mere 4.2 per cent in the year to December, down from 4.8 per cent in November. So, yes, a sharp drop — but only a statistical boffin could describe this as good news. Sure, a similar drop can be expected when the VAT rise drops out of the comparison figures next month. But the prices confronting British shoppers are still rising at twice the supposed inflation target, and will keep rising above this target for months to come. The following graph shows the trajectory we can expect for CPI and RPI over the next few years:

The misery that inflation inflicts on the public is, of course, mitigated by pay rises. The two must be regarded together, and the fact that pay is failing to keep pace with inflation means the nation is midway through the sharpest contraction in living standards in 80 years — which is certainly is nothing to boast about. The below chart shows how the Office for Budget Responsibility sees inflation and pay in the years ahead:

For as long as prices are rising faster than salaries, and standards of living are falling, the British public are becoming poorer. Whatever else the government is doing, people are becoming worse off. To raise a cheer midway through this appalling process, as some in the Westminster Village are doing, could be seen as grossly insensitive.

And let’s look at the least fashionable topic of all, the real value of housing:

Homeowners are seeing the value of their net assets decimated by British inflation, still the worst in Western Europe. And the process is ongoing. Pensioners feel the same pain and ordinary workers

are facing a de facto pay cut year after year — all because the Bank of England has proven woefully unable to meet its 2 per cent inflation target. It hard to see how the Bank’s control

of monetary policy can be described as anything other than a failure when you consider how frequently it has missed its target.

The cost of living is still, by some margin, the biggest problem in Britain today — albeit one not felt by people who shop using Ocado and without a second thought about the price of margarine (up 27 per cent, since you ask). The Bank’s massive gamble with Quantitative Easing also means that inflation could explode at any point, as it has so often in the past when governments printed banknotes to pay for its consumption.

Ronald Reagan won in 1984 with the simple question, ‘are you better off than you were four years ago?’ In 2015 the answer to that question, for most Brits, will be ‘no’. If I were a Tory in government, I would not be happy about the rising cost of living. I’d be more worried about this than anything else.

Comments