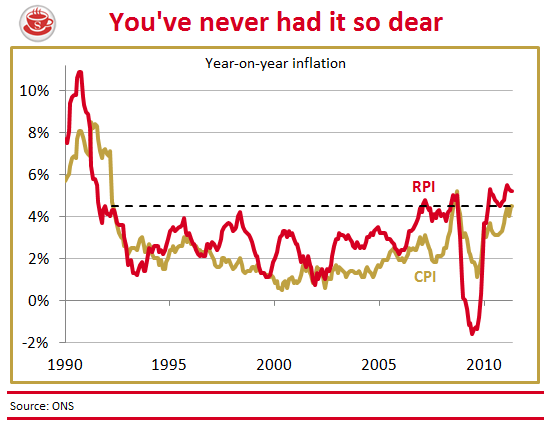

Britain has the worst inflation in Western Europe; this is today’s story. CPI is 4.5 per cent and RPI is 5.2 per cent. This masks even worse rises which, as the IFS says today, hit the poor hardest. The price of a cauliflower is up 38 per cent to £1.26, potatoes are up 13 per cent to £1.54 a kilo. For millions, these are the most important metrics. Historically, it’s pretty bad.

You’d think a Bank of England legally mandated to keep CPI inflation at 2 per cent would be horrified at this, and start vowing to tame the cost of living. After all, this isn’t just a statistic: it means everyone’s savings and salary is worth 4.5 per cent less than it was a year ago. Inflation is, as Reagan said, as deadly as a hit man and as violent as a mugger. It helps indebted governments because the real value of the debt falls. Even if almost a quarter of all gilts are inflation-linked, three-quarters aren’t and Britain can, by turning a blind eye to inflation, or feigning constant surprise and dismissing it as a blip, shaft its creditors. The old inflationary default is the oldest trick in the book. Look at the graph below:

But this looks more like a cock up than a conspiracy. The Bank of England just doesn’t understand British inflationary pressures, as its laughably poor forecasting record demonstrates. The CPS has published some good research on the Bank’s failure and where inflation is heading. Even more striking is Citi research (see graph below) showing that the Bank has the worst forecasting record of any European central bank.

Mervyn King’s job is to keep the cost of living down, not sate a national debt addiction. That’s why I don’t take the Bank’s sanguine assurances seriously. British inflation is being policed by what is, demonstrably, the most hapless central bank of any major industrialised nation. Adam Fergusson’s book about Weimar Germany, When Money Dies, has been in much demand of late. Little wonder. Money may not be dying in Britain, but the value of what we’re all paid and of what our pensioners save is falling at the fastest rate in Western Europe.

And no one – the Chancellor, the Governor or MPs – seem to be alarmed.

Comments