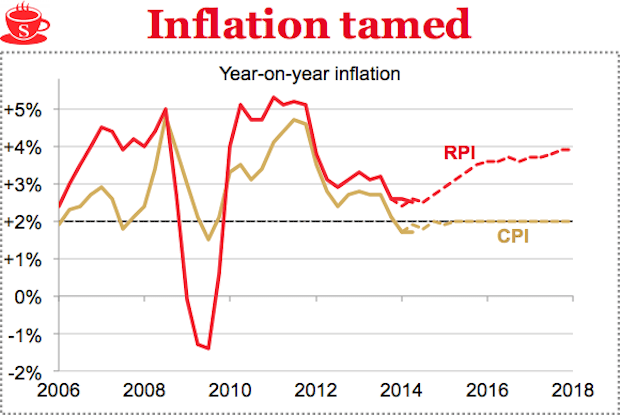

David Cameron is back on holidays again, this time to Cornwall. He missed a trick. His economic recovery is making the pound strong and, ergo, the continent cheap for British holidaymakers. This also makes imports cheaper which has, in turn, cut UK inflation to 1.6 per cent in July – down from 1.9 per cent in June. This will be deeply annoying for Ed Miliband, as it interferes with his ‘cost of living crisis’ narrative. This had more potency when inflation was high (see the graph above) but it becomes that much harder to push the line now. Especially when inflation is expected to trot along near the target of 2 per cent until the election.

Of course, the measure that most of us grew up with calling ‘inflation’ – the RPI index – is almost a full percentage point higher. But at 2.5 per cent even that is at the target set by the last government. Encouragingly, rail fares are linked to today’s RPI index so it has come down just in time.

Michael Saunders at Citi expects CPI to average 1.7 per cent this year, but RPI to be higher at 3.3 per cent – his take here (pdf). If the Labour Party was functioning properly, it would today argue that inflation, on its own, doesn’t decide much: happiness or misery depends on whether the average wage is rising faster or slower than that inflation. If you adjust the official earnings by CPI and RPI, you see that it will be 2020 before the average salary is back to its pre-crash levels (below).

And if HM Treasury was functioning properly, it would counter that this doesn’t tell the full story. If you factor in the tax threshold increases, then disposable income looks better. Also, as Julian Harris pointed out in an excellent City AM piece, the new rules forcing employers to enrol staff into pensions will mean a greater chunk of their remuneration is being paid as pension, thereby depressing the earnings figures. As he put it:-

‘Analysis by the Treasury last year also suggested that total compensation – which includes all employee benefits, National Insurance contributions, and so on – has been rising at a much faster rate than just wages alone, helping to explain sluggish growth in regular pay.’

So, a complex picture with a simple upshot: the economy is recovering, there are jobs galore and the momentum is with Osborne and Cameron, rather than with Miliband and Balls.

Comments