Each month, inflation numbers come out and seem to surprise everyone – except the chosen few who have access to the forecasts. So I thought we’d share with CoffeeHousers what is all too seldom put on public record: forecasts for inflation and base interest rates. It might be useful to anyone thinking of taking out a fixed rate mortgage deal. These forecasts are from Michael Saunders at CitiGroup, whom I regard as one of the best in the business. Pretty much every analyst thinks that interest rates will soon start a relentless march back to 5 per cent, so these 3 per cent fixed rate deals we’re getting right now will soon be a distant memory.

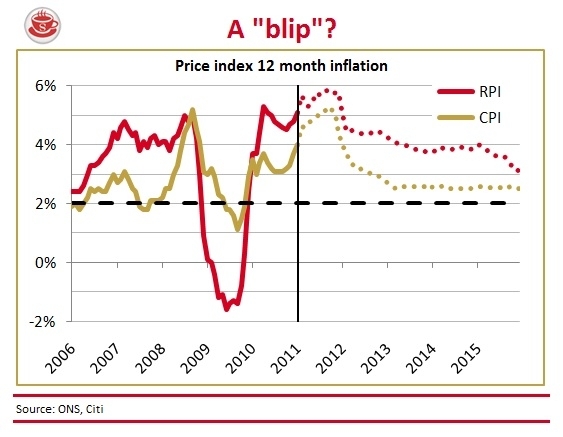

He envisages CPI hitting 5 per cent, more than double its target, but not quite getting back to target. And as Mervyn King knows only too well, events can get in the way – his original plan was that inflation would be back on target by now. Instead he’s looking at 5 per cent CPI. And there’s plenty that can exacerbate the already daunting course that Saunders lays out in the graph.

As CoffeeHousers know, I have plenty problems with the inflation targetting system. Even if it does return to 2 per cent in 2014, we will still be stuck with the high inflation that we’re experiencing now – you’d have thought that after a period of sustained overshoot, we’d tolerate a little undershoot by way of an apology. With no signs of wages catching up, the cost of living is set to be horribly squeezed for some time to come. I still believe that inflation, not jobs, will be the killer of 2011. At this rate, the same may be true for 2012 too.

Comments