“Inflation destroys nations and societies as surely as invading nations do. Inflation is the parent of unemployment. It is the unseen robber of those who have saved. No policy which puts

at risk the defeat of inflation – however great the short-term attraction – can be justified”.

That was Margaret Thatcher, speaking in 1980 when inflation was much higher but British politicians actually cared about it.

You won’t even hear the Governor of the Bank of England denounce today’s figures: CPI at 4.4 per cent and the traditional measure of inflation, RPI, at 5.0 per cent. It is seen as just another

statistic. The government has also chosen to announce that rail fares will be rising by 8 per cent.

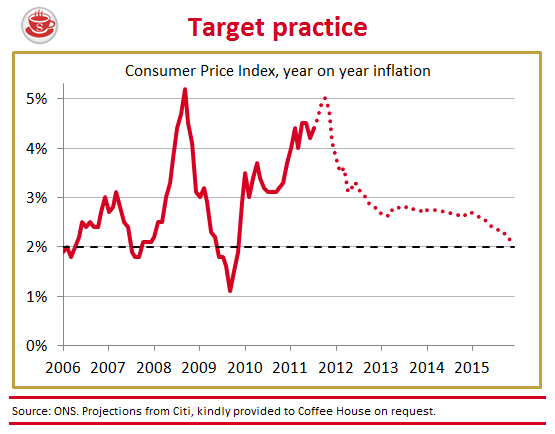

George Osborne is in charge of getting inflation right. He has subcontracted the task to the Bank of England, whose ability to keep CPI at the 2 per cent target can be summed up as follows:

We use Citi’s projections at Coffee House because the official forecasts – from the Bank and the Treasury forecasting division (now the OBR) – have proved wrong so regularly. Thatcher could have

gone on. Inflation is the assassin of consumer confidence, and makes millions poorer. Let’s compare CPI and RPI inflation with pay rises:

It also costs Osborne insofar as a quarter of UK government debt is inflation-linked. But overall, I suspect that the chancellor has been seduced by the short-term attraction of inflation. By

lowering real wage costs, it helps employment numbers allowing him to boast – as he did last week – that Britain has the second-best growth rate in the G7. This is short-term, because the damage

done by eroding business confidence is greater. Companies shelve expansion plans.

Crucially, inflation also reduces the real value of both household and government debt. Remember, there is more household debt in the UK than any other G7 country, ever.

So yes, inflation hurts savers. It decimates the spending power of British workers. As Merryn Somerset Webb tweeted earlier, 40 per cent of taxpayers need 7.6 per cent interest to stop the value of

their money shrinking.

But perhaps most deplorably, it whacks pensioners. Those who worked all their life to build a nest-egg can only watch its value dwindle. Inflation transfers wealth from savers to borrowers, and is

the most amoral tax because everyone makes out like it’s accidental, some kind of force of nature. Unconnected to QE or base rates.

The Bank of England says now what it’s always said: that this is a blip and that inflation will be back on target next year. Even if they are correct, immense and avoidable damage has been done to

British economy meanwhile.

This time last year, they predicted we’d be looking at 2.6 per cent CPI now. No European central bank has made such a horlicks of inflation forecasts. King may be using consensus datasets to reach

these forecasts, but it is obvious that the consensus keeps underestimating the impact of the weak pound. Inflation has overshot the consensus in 26 of the last 40 months, according to Citi. Its

economist, Michael Saunders, has a horribly good record. He is now predicting CPI inflation will rise to 5 per cent in October, just in time for the Tory conference.

PS: Many CoffeeHousers ask what I’d do. I accept in the blog that the inflation is largely the result of a plunging pound. But most of all, I’d like to see inflation discussed as a

problem, given that it means so much misery for so many millions. I’m concerned that our policymakers (many of whom have no idea how much a pint of milk costs) have forgotten the effect of

inflation across society, especially on pensioners who are trying to live off their savings. The inflationary beast hits the poor far harder than any cuts the government is imposing right now, and

yet no one discusses inflation because it’s not seen as a political football. There is a feeling that, unless you can blame a politician for it, there’s no point in mentioning it. Our inflation is

bad, getting worse and will have consequences for the low-paid. If I were Osborne, I’d be thinking of some tax cuts to give these people some form or relief.

Comments